When I first heard the term “value proposition” years ago, I thought, what the heck does this obtuse phrase mean? In this context, value is a measure of desirability, and proposition means proposal. Google tells us that value proposition is “an innovation, service, or feature intended to make a company or product attractive to customers.” Oh, you mean selling point: “a feature of a product for sale that makes it attractive to customers.” Wikipedia adds another term, “In marketing, the unique selling proposition, also called the unique selling point or the unique value proposition in the business model canvas, is the marketing strategy of informing customers about how one’s own brand or product is superior to its competitors.”

My job is to develop, evaluate, assess, and critique value propositions, which boil down to what’s in it for the parties involved? Why do they care? Why do they want this? Or maybe I say, “Ok, I know why you want this, but this is what it will cost,” or more bluntly, “Your business model is incompatible with your desired outcome.”

DEI v P4P

Michaels Energy hired the great Quinn Parker to provide a series of webinars to learn about diversity, equity, and inclusion(DEI). It’s an interesting and eye-opening experience, and it got me thinking: Utilities and program administrators want more equity in their programs – to reach markets and communities experiencing little program activity. That’s wonderful, but the critic in me pounces on utility and program administrator value-prop models and concludes they are incompatible with equity. I.e., pay for performance (P4P) – acquire energy and energy-demand savings at the lowest possible price. Where do I go for low-cost efficiency acquisition? Repeat customers familiar with programs and maybe those with deeper pockets and greater access to capital.

Simply put, P4P fosters inequity. So, what value do you wish to achieve, administrator? P4P or equity? Yes, there are other metrics in P4P, but they are a distant second to cost per unit saved – like afterthoughts that are hard or impossible to quantify.

Incentives

Another hot topic in the industry that relates to equity is incentive design. I am not an expert on this topic, but I can say that incentives should be targeted to the appropriate parties, whether they are customers or market actors, and an optimal dollar amount that moves people to act without excessively overpaying.

Most jurisdictions consider customer-specific services to be incentives along with cash incentives. Whether it is services or cash, the cost is likely to be higher to engage and penetrate these new markets.

Marketing and Outreach

But before we get to the point of striking a deal, we need to connect with the hard-to-reach and disadvantaged communities. As Quinn brought to our attention, the usual email and internet channels may not work. Different approaches will cost extra money to research, develop, A-B test, and so on. Tweaking, fine-tuning, and calibration will be required. Program implementation contractors may also need to expand the pool of trade allies that serve these communities.

Value Stacks

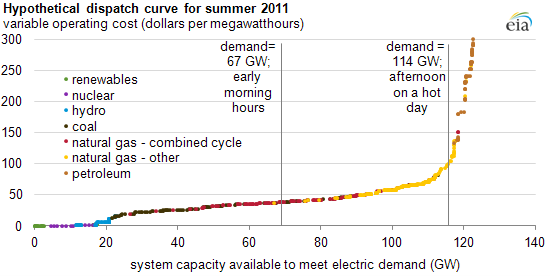

In a way, resource acquisition through efficiency programs, which include traditional incentive (rebate) programs, may compare with the resource stack of supply-side resources. In day-ahead wholesales auctions, the cheapest supply is purchased first. The balancing authority (grid operators, such as regional transmission organizations) keeps reserving and ultimately acquiring more expensive supply until demand is met.

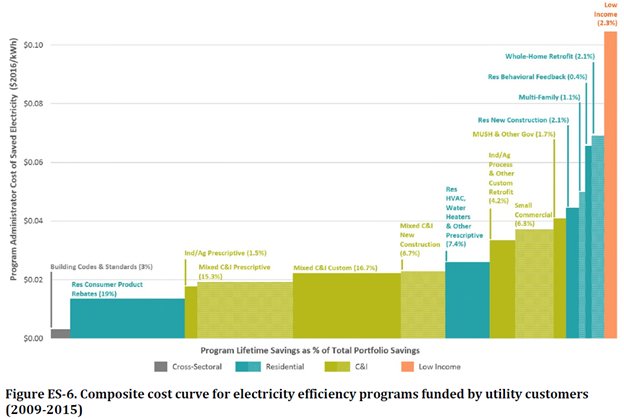

The next chart shows efficiency resource acquisition costs from a report by the Berkeley Lab. It looks just like the supply curve.

The next chart shows efficiency resource acquisition costs from a report by the Berkeley Lab. It looks just like the supply curve.

Note that efficiency resource acquisition and electricity supply stacks are not static. For example, as natural gas prices soared this year, supply from coal plants regained a lot of their cost-competitive leads. As supply cost falls, boom – the resource moves to the left. As supply cost rises, those resources move to the right and are called on less frequently.

Note that efficiency resource acquisition and electricity supply stacks are not static. For example, as natural gas prices soared this year, supply from coal plants regained a lot of their cost-competitive leads. As supply cost falls, boom – the resource moves to the left. As supply cost rises, those resources move to the right and are called on less frequently.

Similarly, efficiency acquisition costs can move, particularly for hard-to-reach and disadvantaged communities. They are likely to have higher percent-savings potential but capturing that potential will be higher initially and drop as those markets are penetrated, and the community becomes more familiar with and trusting of the program and utility.

The big difference in the supply and efficiency stacks is that there are tens or hundreds of thousands of efficiency resources out there while there are merely dozens to a few hundred electricity suppliers, although that’s changing with distributed generation. Each class of efficiency has its own acquisition curve.

The Bottom Line

To achieve equity, utilities and program administrators must accept higher costs to capture savings from low-income, hard-to-reach, and disadvantaged communities. I found many definitions of equity in this context, and I like the following as one of the betters: “Equity = impartiality and fairly providing access to resources and support, including investment capital and development opportunities, for minorities and underrepresented populations.” The italicized portion costs extra.