This post features a lot of refined hydrogen content you can’t find online. But before I get to hydrogen, here’s an update: I always get a little excited to lead news cycles. After publishing Electricity Shortages and What to Do About It last Tuesday evening, The Wall Street Journal published The Coming Electricity Crisis on Thursday, including the following common threads:

- I wrote, “In one year (2023 v 2022), the forecast peak load growth for 2028 doubled…” The WSJ wrote, “Projections for U.S. electricity demand growth over the next five years have doubled from a year ago.”

- I wrote, “Growth projections in Georgia, for example, jumped 17X…” The WSJ wrote, “Georgia Power recently increased 17-fold its winter power demand forecast.”

- I wrote, “The timeline from need realization to power transmission is easily 15 years.” The WSJ wrote, “Building transmission lines to connect distant renewables to the grid typically takes 10 to 12 years.”

The Wall Street Journal Digital Subscription: $534.69 per year.

The Energy Rant: $0.00 per year and two days ahead of the curve. ????

The WSJ reports, “Meantime, the Inflation Reduction Act’s huge renewable subsidies make it harder for fossil-fuel and nuclear plants to compete in wholesale power markets.” That’s about 5% true because subsidies go back a couple of decades. They also write, “Baseload plants can’t turn a profit operating only when needed to back up renewables, so they are closing.” The combination is correct and a big problem for wholesale, or for that matter, any form of competition in electricity markets.

The result is less reserve margin and grid operators appropriately tagging intermittent renewable sources with low capacity factors. The Midcontinent Independent System Operator’s Market Monitor, David Patton, is quoted, “Establishing accreditation that is accurately aligned with reliability will ensure that the capacity market provides efficient incentives to invest in and maintain a portfolio of resources that meet the reliability needs of the MISO system. Intermittent generation — such as wind and solar — provides MISO with less and less reliability as more comes online because it lacks key attributes provided by dispatchable resources.”

The bottom line is this thing I’ve been writing about for years, including Tiger by the Tail, Planes, Bikes and Automobiles, Scorched Earth, Decarb Warriors, Skateboard Curve, Blistering Wind and Solar, and Wild Ride, is getting attention. We’re headed for reliability issues, coincident with growing loads from computing centers (artificial intelligence, crypto, and conventional needs). As noted last week, this presents an excellent opportunity for our efficiency and load management industries to finally be leveraged as resources. Let’s deliver!

Hydrogen

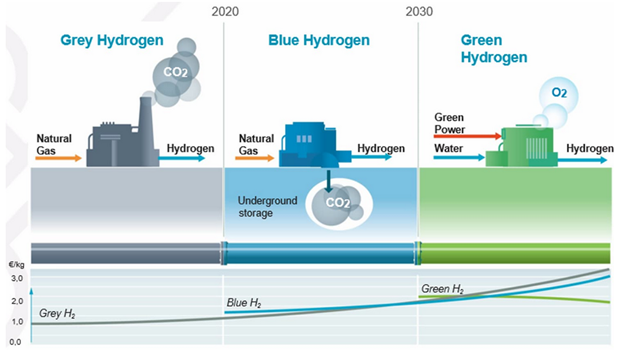

I recently read a Utility Dive opinion piece, “Don’t Give Up on Green Hydrogen,” which prompted this blog. First, I’ll explain the three colors of hydrogen: gray, blue, and green, using the following handy cartoon from Brunel.

Gray hydrogen is produced in an energy-intensive process using natural gas as the source of hydrogen and energy to catalyze the reaction. High-pressure, high-temperature[1] steam, methane, and a catalyst produce hydrogen, carbon monoxide, and carbon dioxide. Brown hydrogen uses coal as the heat source for this stupendously intensive and counterproductive way of producing gaseous energy.

Gray hydrogen is produced in an energy-intensive process using natural gas as the source of hydrogen and energy to catalyze the reaction. High-pressure, high-temperature[1] steam, methane, and a catalyst produce hydrogen, carbon monoxide, and carbon dioxide. Brown hydrogen uses coal as the heat source for this stupendously intensive and counterproductive way of producing gaseous energy.

Blue hydrogen is the same as gray and brown, except the undesirable carbon is captured and stored, adding cost and complexity.

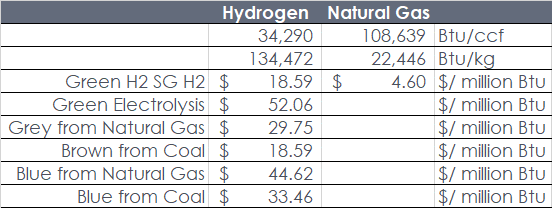

Green hydrogen, which Brunel calls a “utopian vision of the future,” is produced by electricity from emission-free (solar, wind) sources. The following cost chart is from SG H2 Energy, a hydrogen fuel production technology leader.

Production Cost Comparisons

Production Cost Comparisons

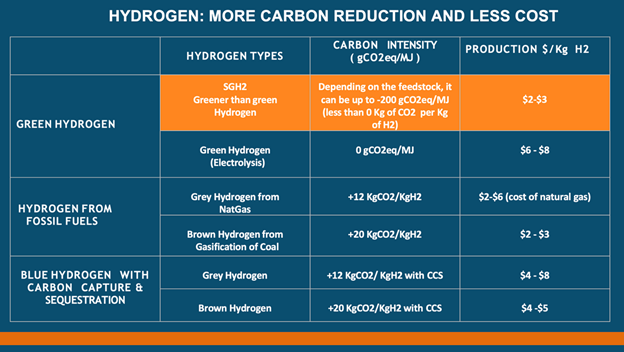

For reference, a kilogram (kg) of hydrogen has roughly the same energy content as 1.3 therms of natural gas. Bulk natural gas purchases for power production, per the chart last week, have averaged around $5 per thousand cubic feet or roughly $0.50 per therm. Therefore, hydrogen is 3-5 times more expensive per Btu than natural gas using SG H2’s technology and 10-13 times more expensive per Btu than natural gas using electrolysis from renewable electricity.

I cut to the chase, and using the mid-point of the pricing ranges from the table above, I calculated values in the following table for energy density and price per million Btu[2]. For reference, in the table, ccf is 100 cubic feet.

Table 1 Hydrogen and Natural Gas Production Costs

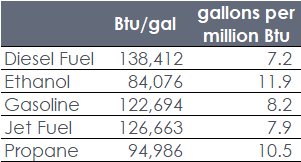

For comparison, here are some energy densities and gallons per million Btu of various liquid fuels. Readers can do a little math with posted prices as the local convenience store for energy pricing comparisons. A million Btu of diesel fuel can easily cost $40 retail, while a million Btu of retail natural gas might only cost $8.

For comparison, here are some energy densities and gallons per million Btu of various liquid fuels. Readers can do a little math with posted prices as the local convenience store for energy pricing comparisons. A million Btu of diesel fuel can easily cost $40 retail, while a million Btu of retail natural gas might only cost $8.

Table 2 Liquid Fuel Gallons per Million Btu

Retail Cost Comparisons

Retail Cost Comparisons

Note, however, that the above prices are like wholesale prices. For example, retail natural gas at my home in February was almost double the above cost. Similarly, the DOE says hydrogen runs $13-$16 per kg – about double shown in the SG H2 chart (per kg) above.

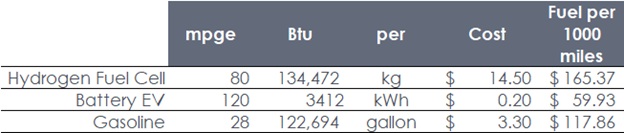

The DOE says the fuel cost for hydrogen is about the same as for gasoline. Per my math, it could be in sight of cost-effectiveness per mile but not per unit of energy. DOE claims hydrogen fuel cell cars get about 80 mpge, with the e meaning equivalent. Miles per gallon equivalent is essentially miles per Btu of fuel going into the vehicle (kWh electricity, kg of hydrogen, or gallons of gasoline), with gasoline being the baseline.

Table 3 Retail Fuel Comparisons for Automobiles[3][4][5]

Conclusions

Conclusions

As an energy source, nothing is close to natural gas for cost-effectiveness because it requires no processing and related massive energy input. Natural gas is also a low-carbon fuel, in my opinion.

The source fuel for electrolysis is electricity, which is flexible but expensive – roughly four times the price per Btu compared to natural gas. Therefore, electrolysis is a costly path to generate hydrogen.

SG H2’s technology is impressive but complex, expensive, and energy-intensive compared to almost nothing to produce natural gas.

[1] Pressures and temperatures higher than those entering a steam turbine in a thermal power plant – coal, nuclear, natural gas.

[2] https://www.engineeringtoolbox.com/fuels-higher-calorific-values-d_169.html

[3] Hydrogen data: https://www.energy.gov/energysaver/hydrogen-fuel-cell-vehicles

[4] EV data: https://www.fueleconomy.gov/feg/bymodel/2021_Tesla_Model_3.shtml

[5] Retail electricity and gasoline prices: typical nationwide estimates from Jeff’s lived experience

Production Cost Comparisons

Production Cost Comparisons Retail Cost Comparisons

Retail Cost Comparisons Conclusions

Conclusions