This blog features dozens of posts regarding the nuances, obscurities, and upside down world of the public utility industry. To wit, every other industry provides things people need or want at the lowest possible price in competition with dozens or even hundreds of competitors or alternatives. Conversely, electric utilities with transmission and distribution systems are fully regulated with an obligation to serve all customers. Those customers have no other choice. The show must go on. To financially destroy a utility serves no one but attorneys. This post is about the bankruptcy and viability of the nation’s largest investor-owned utility, Pacific Gas and Electric (PG&E).

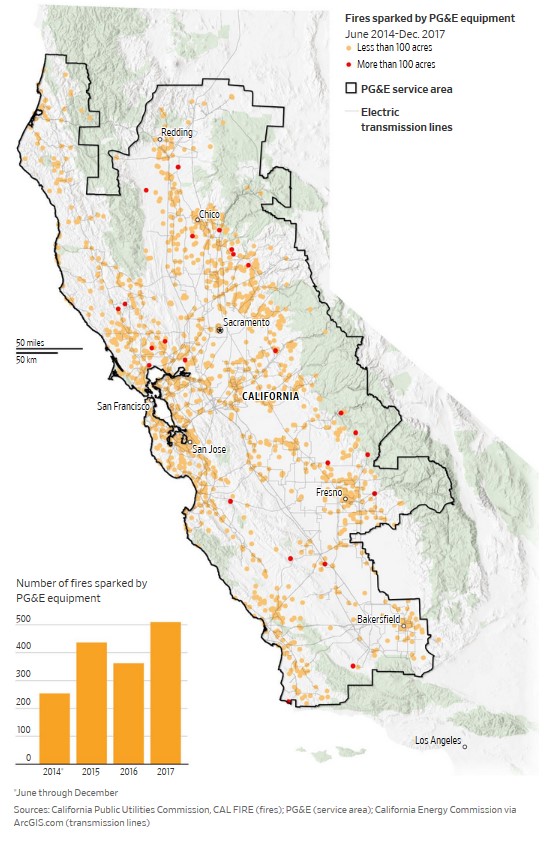

Per last week’s post, casual observers are often wrong, this appears to be the case with the PG&E bankruptcy, which is, pun alert, scorched earth. This story begins with the devastating and deadly wildfires that raged through portions of California last year. The Paradise fire killed 85 people and destroyed 14,000 homes, more than 5,000 businesses, and 4,300 other buildings. The Wall Street Journal reported that on November 8, 2018, a wire snapped free from a transmission line, made contact with the metal tower to create “an electric arc that scorched the metal tower supporting it.” Minutes later, a PG&E worker spotted a fire under the line. The article states the cause of the fire is still unknown.

As I type this post, a search of the world wide web for information on superhighways does not provide a definitive answer, yet PG&E, its shareholders, customers, vendors, employees, and others are paying a heavy price for PG&E’s bankruptcy.

Risky Behavior from Risky Policy

Part of the problem, as Holman Jenkins with The Wall Street Journal wrote, is that California policy promotes wide-scale building in tinder-dry forests. He says policy to block urban sprawl and protect urban homeowners causes affordable housing shortages, which drives all but the wealthiest families to build in or move to the combustible backcountry sticks. He writes that when housing costs are factored into the equation, California has the highest poverty rate in the nation. Even the Los Angeles Times makes similar claims that poor decisions and policies are to blame, and that climate change is an insignificant factor with these fires.

Wildfires in California are about as natural as mushrooms and photosynthesis. It rains in the winter to grow fuel, and for eight months, the fuel is desiccated to anhydrous, combustive cellulose. It is so combustible, a rancher with a hammer and fencepost can set it off.

Scorched Earth

Utilities need a lot of capital in the form of equity and debt. Utility investors expect a nice dividend and asset preservation. Actually, in one of my favorite articles, Steve Huntoon, writing for Public Utilities Fortnightly, explains how utilities are, what I would argue, the best investments available. Now, when a mob runs a utility into bankruptcy, the casual observer may think investors get what they deserve. Not so much. Yes, their investments are largely destroyed (equity first, followed by preferred stock and bonds). But somebody must pick up the pieces and recapitalize the remains so the utility can serve customers again. Who wants to do that when the last round of investors lost everything?

Result: the cost of capital soars. Who pays? Captive customers. Who else? This is not a competitive, take-my-business-elsewhere situation. Only captive customers pay for energy, delivery, and what the market requires to draw capital from investors to operate the company. Sticking it to the shareholders doesn’t work. Therefore, bankrupting a utility is dumb. I am not saying there should be no accountability. When a warship or submarine collides with another, the Commanding Officer loses his job, at a minimum. There should be similar accountability with utilities and not just the CEO. But there is more to it than this.

Renewables

California’s extremely aggressive mandates for renewable energy drive up prices. Again, the mandates are driven by policies created by casual observers who know nothing about the utility industry and what is required to keep the lights on four nines (99.99%) of the time. See my recent posts, Rooftop Solar’s Tiger by the Tail, and last week’s Battery Storage post.

Why do these things matter? I guarantee the cost to accommodate these mandates puts pressure on prices. The utility has tens of thousands of tiny DERs connected to the grid. The cost to connect and maintain all that safely must be immense. Why wouldn’t PG&E keep ahead of maintenance, brush clearing, and ensuring distribution integrity is maintained when all these things are pass-through costs? Could it be they are tasked with the impossible? Could it be they are being clobbered for rising costs?

Over the Limit

For the thousandth time, there are physical and economic realities of policy. These realities not only sharply increase prices, they also put lives in danger. I believe California policy – zoning laws and renewable mandates to name a couple – are posing imminent risks to its citizens, and eventually its industries. Ooo, do you think that’s bold? The San Francisco Chronicle reports that the fires could cause rates to “skyrocket 50% and threaten the state’s ability to execute some of its top clean energy initiatives according to new analysis prepared for Governor Newsom.”

I think some pie-in-the-sky-high-hopes policy should be reexamined. I’m simply connecting dots.