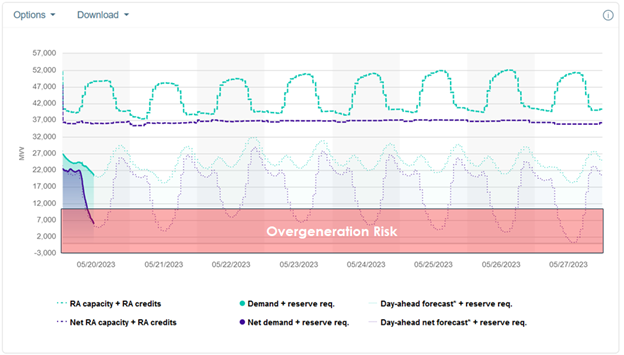

A year ago, I introduced the mantle curve to illustrate California’s overgeneration of solar power and the resulting need for curtailment. In 2022, California’s scoping study set a target for an additional 60 gigawatts (GW) or 60,000 megawatts (MW) of solar generation to be deployed by 2030. Below are the forecast curves from last year’s post in May. The system was penetrating the overgeneration region, but the net load was above zero MW.

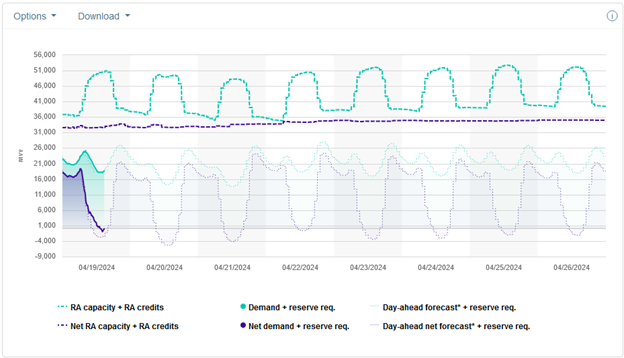

Similar forecast loads from last week are provided below. We see the net load digs below zero MW, into the mantle.

Similar forecast loads from last week are provided below. We see the net load digs below zero MW, into the mantle.

Granted, the first chart represents a week in May last year, while the second represents a week in April this year. Comparing the same week last year to this year, net demand decreased from an average of about 3.0 GW to an average of minus 0.4 GW. The solar excavation toward the mantle continues.

Granted, the first chart represents a week in May last year, while the second represents a week in April this year. Comparing the same week last year to this year, net demand decreased from an average of about 3.0 GW to an average of minus 0.4 GW. The solar excavation toward the mantle continues.

Implications for Solar’s Continuation

One result is that solar buildout in California has slammed to a halt. The Wall Street Journal reported that even though the nation has high ambitions toward the energy transition, “the market for rooftop solar is shrinking, pummeled by high interest rates, tight credit, and cuts to solar incentives.”

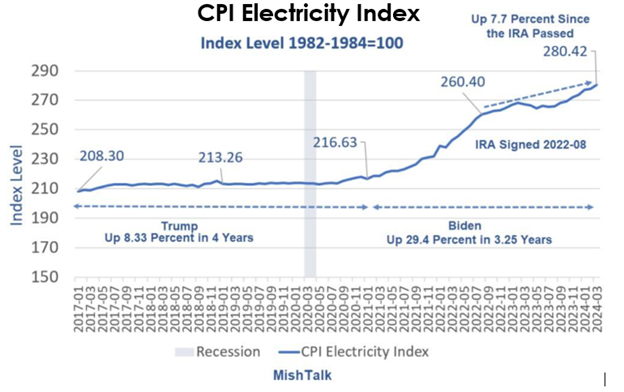

It’s instructive that they mention high interest rates—a result of persistent inflation that is not going away. Chicken bone number one is in the can: “Inflation will continue to chop block the economy, including clean energy investment.”

In a related story, Bloomberg reported last summer that the President wishes his signature climate law was called something else (rather than the Inflation Reduction Act). It reminds me of Orwell’s 1984 Ministries of Truth, Plenty, Peace, and Love – tending to be the opposite of the name. Orwell was as accurate at predicting the future as Hanna Barbera was with the Jetsons. Anyway, the chart below from Zerohedge demonstrates why the President regrets the misnomer.

The Journal reports rooftop solar installations could decline 13% this year, while 100 installation contractors lost their businesses last year nationwide. California utilities have chopped their payments to home-generated electricity by 75% because of the glut demonstrated by the mantle curve above.

The Journal reports rooftop solar installations could decline 13% this year, while 100 installation contractors lost their businesses last year nationwide. California utilities have chopped their payments to home-generated electricity by 75% because of the glut demonstrated by the mantle curve above.

Ten years ago, I explained how wholesale/retail pricing works for electricity, like tomato farming—a timeless tale and concept. Per the Journal, in line with my 10-year-old tomato tale, “The state’s [California] utility companies are increasing rates fast as they seek money to bulk up the power grid and bolster it against wildfires. Rooftop solar owners weren’t paying enough toward such costs [to deliver their electricity to other customers], the companies claim.”

The bright side? Solar owners are saving as much money as five years ago because electricity prices have soared. But it’s free. How can this be? The full cost of electricitEE.

Last week, Reuters reported California utilities are applying for $2 billion in federal grant dollars for added transmission capacity. They may also need distribution-level upgrades to move all the local solar generation to the bulk electricity superhighways.

New Legislation

So, what are California legislators proposing? Reinstating the overpriced net-metering policies that have caused electricity rates in California to surge. I don’t expect the average homeowner to understand that ratepayers largely fund the excessive payments to distributed solar generators/homeowners, which are disproportionally owned by higher-income folks because they are the ones who have the dollars and can use the tax benefits to finance projects. But wait, it’s silly of me to expect legislators to understand that. They are asking all customers to pay retail rates to solar generators for dumping their electricity onto the grid when net demand and prices are negative – makes perfect sense.

California’s investor-owned utilities are the primary opponents of restoring the net metering policy per Canary Media. Well, yeah, because they will be hammered by these legislators and customers for necessarily passing through these payouts via higher rates.

How much money is changing hands? Canary links to an assessment by the California Public Advocate’s Office, and their analysis headlines, “Rooftop solar incentive to cost customers without solar an estimated $6.5 billion in 2024.” For perspective, annual revenue from California’s largest utility, Pacific Gas & Electric was $24 billion in 2023. So, $6.5 billion is a huge transfer of wealth from the have-nots to the haves. I came to know the state consumer advocates through last summer’s National Association of State Utility Consumer Advocates conference in Austin. They are passionate about mitigating energy poverty among the “choice“ communities – and so am I!

To be clear, I’m not anti-solar. I’m pro-reality. It needs to be feathered in and not force-fed. This oversupply could be fantastic for load management and maybe even drive demand-side resources as an alternative to supply-side resources—out of necessity. Electricity loads are growing 5-6% per year, 10X the rate of the past decade, per Utility Dive. The lights will go out before contracts to study environmental impact statements for new baseload power plants are executed. Therefore, load management is the only solution for the next five years and beyond.

I’ll add a prediction for 2025 here: heavy doses of renewable energy investments will be blamed for future rate increases.