One of my obsessions is understanding how people make choices and what they truly value. Regarding climate change mitigation and everything else, the quest for more dollars or dollar efficiency, i.e., bang for the buck, rules.

Migration to Danger

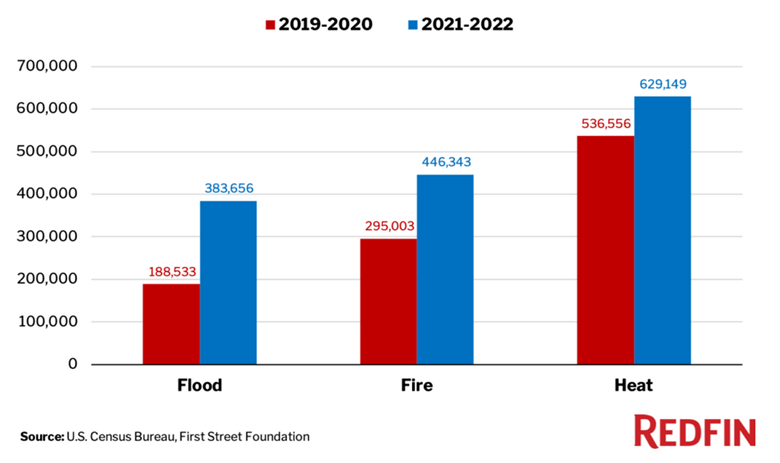

A recent article from Bloomberg, Americans are Moving Toward Climate Danger in Search of Cheaper Homes, lays it out for us. That is Bloomberg’s headline, but do people believe climate change is a threat? Don’t bother asking. Watch what people do. Actions don’t lie. “Americans are actually choosing to move to Zip codes with a high risk of experiencing wildfire, heat, drought, and flood, according to a new study on domestic migration by Redfin.”

I’m not one of the millions and millions of people who love heat. People joke about sizzling heat but moan and howl about cold weather. One speaker at the NARUC conference in Austin joked that he had a nice time checking out Austin on a little walking tour, followed by sitting down by the fire in the hotel to cool off.

I’m not one of the millions and millions of people who love heat. People joke about sizzling heat but moan and howl about cold weather. One speaker at the NARUC conference in Austin joked that he had a nice time checking out Austin on a little walking tour, followed by sitting down by the fire in the hotel to cool off.

Impacts of Migration

Property Loss

Migration to heat, fire, and hurricane centers is the primary cause of record property damage due to storms, fires, and power outages. When I hear or read about climate-induced property damage, I think it’s mostly because people willfully move into the danger.

Water Crises

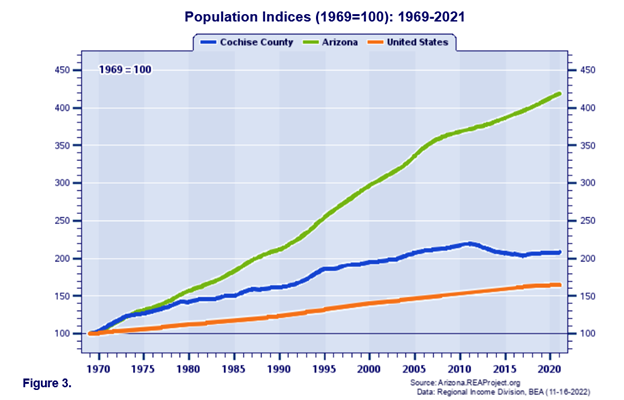

And then we have water shortages in the Southwest. As early as last week, I heard that even though we had the massive atmospheric river, rain, and record snowfall, the water supply is still in shortage due to climate change.

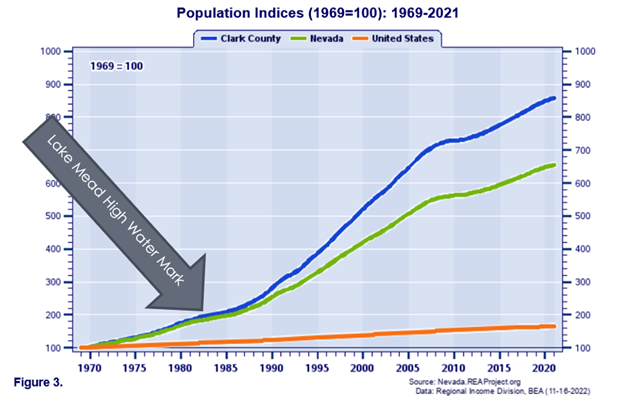

Not moved. See the charts below showing the massive 30-year influx of people into the desert. I don’t get it but to each their own. Vegas has tripled in size since I visited and saw Lake Mead full back in the 80s. How is the Colorado River supposed to keep up with this massive inrush of people and accompanying golf courses in the desert? Reducing CO2 emissions will do nothing to solve this issue.

Step one in solving a problem is realizing there is one. Step two is an objective assessment to identify and define the problem. For this, keep your emotions in an old Dutch Masters box in the hallway closet upstairs as I do.

Step one in solving a problem is realizing there is one. Step two is an objective assessment to identify and define the problem. For this, keep your emotions in an old Dutch Masters box in the hallway closet upstairs as I do.

Investment Priorities – Duh

Investors also follow the money. Warren Buffett rides above the ESG fray and invests purely for return on investment. The chairman of Berkshire Hathaway and its subsidiary, Berkshire Hathaway Energy, and sub-subsidiary utilities, including MidAmerican Energy, PacifiCorp, and NV Energy, said plainly (from US News):

“I will do anything that is basically covered by the law to reduce Berkshire’s tax rate. For example, on wind energy, we get a tax credit if we build a lot of wind farms. That’s the only reason to build them. They don’t make sense without the tax credit.”

How does Larry Fink score that?

The trip wire for mentioning this is Berkshire Hathaway pouring into big oil – Occidental Petroleum, to the tune of 25% outstanding shares. Buffett’s big stake in Occidental, a CO2 Scrubbing Grifter, was announced right after we posted that to the Rant. In another case, a Wall Street Journal article, Warren Buffett Bets on the Fossil Fuel Highway, describes his purchase of Pilot and Flying J truck stops. Why? To make money, of course. I have no problem with that, except for the greenie virtue signaling by subsidiary companies.

Public Opinion: Someone Else Should Do It, Pay It, Thank You

In April, Pew released the results of a poll reflecting consumer views on climate change policy. Surprise – people support carbon neutrality. In another poll somewhere, people also support safe cities.

As usual, Pew results show that people support climate change mitigation as long as someone else pays for it with magic. Subsidies? Yes. Governments, businesses, and corporations need to do more? Yes.

Interestingly, concern that climate change is a “major threat to the country” dropped by about five percentage points since 2020. Three-quarters want the U.S. to participate in global efforts to reduce the effects of climate change. I suggest two words to bring international efforts to heal: Chi Na.

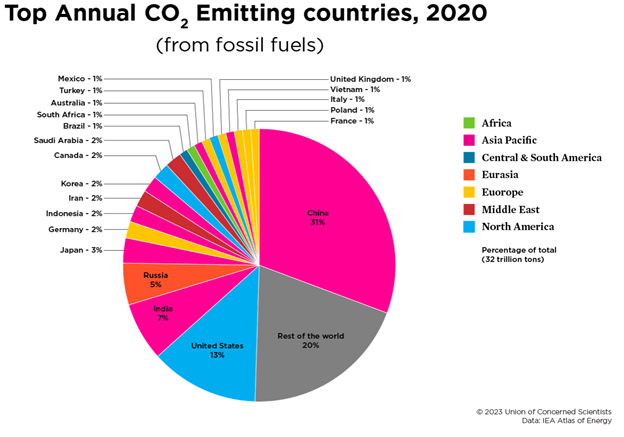

The following chart is the most recent I can find from the Union of Concerned Scientists. To my surprise, the U.S. isn’t even in the top ten for emissions per capita. Canadians emit more CO2 per capita than the U.S. What? They have all the hydro! But that is not where the exploding emission growth is. Emissions are soaring yearly from developing nations with low per-capita rates – as with India and China.

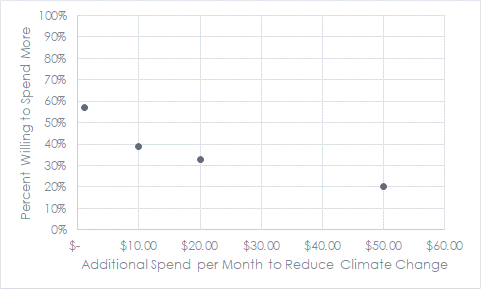

Next, we have a 2016 poll by CBS News that demonstrates America’s lack of responsibility for climate change. Forty percent are willing to pay nothing to mitigate climate change, and from there, they report the following results showing that the average American would not trade a candy bar for climate change mitigation.

Next, we have a 2016 poll by CBS News that demonstrates America’s lack of responsibility for climate change. Forty percent are willing to pay nothing to mitigate climate change, and from there, they report the following results showing that the average American would not trade a candy bar for climate change mitigation.

Finally, a year ago, Rasmussen reported that 52% of Americans wanted more gas and oil drilling to reduce energy prices versus 34% who wanted greenhouse gas reductions.

Finally, a year ago, Rasmussen reported that 52% of Americans wanted more gas and oil drilling to reduce energy prices versus 34% who wanted greenhouse gas reductions.

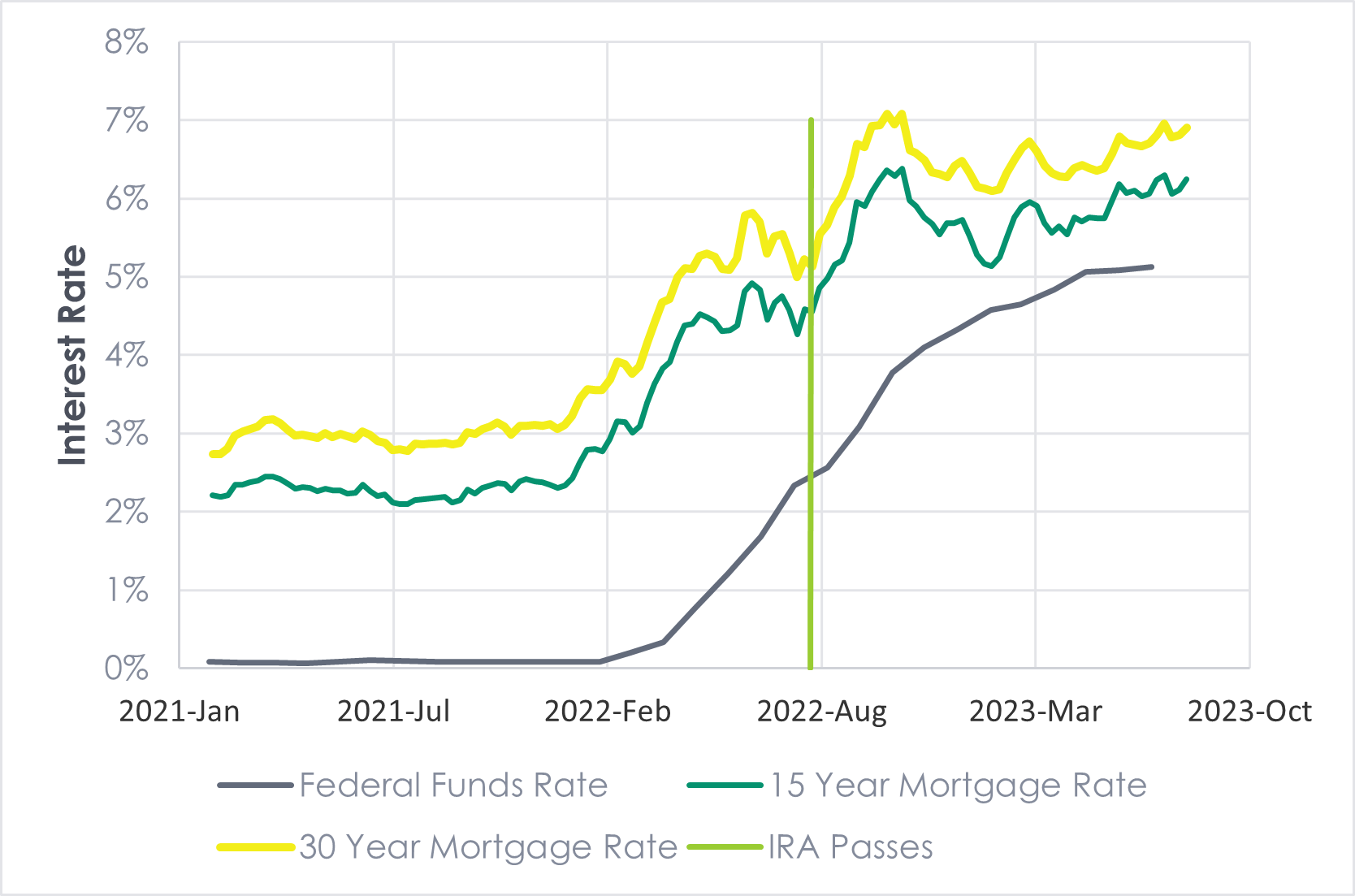

Consequences of Spending and Deficits

Soaring mortgage rates are another exacerbating factor in the quest for affordable housing and migration into the heat. I alluded to inflation pressure spurred by federal spending and deficits a few weeks ago in the Deceptive LCOE. Home financing costs have increased by about 50% since February 2021[1]. Yeow! That’s only the financing cost. On top of that, home prices have soared 43% for a combined cost of home ownership increase of 110% in barely two years!

Takeaways

Takeaways

- Check your emotions and biases at the Dutch Masters repository when identifying the root causes of problems.

- Words lie. Actions do not.

- The quest for the dollar has and always will rule.

- People are most supportive of someone else paying and doing.

- Subsidies are easy, but they cause problems – homebuying and grid instability

- Most survey findings are useless because of social desirability bias

Takeaways

Takeaways