I was going to skip predictions for 2024, but due to popular demand, I’ll throw some chicken bones at the tarot card enthusiasts. Like other things in my life, I don’t make safe bets or set goals of high probability. If my guesses aren’t 50% wrong, I’m not sufficiently aggressive.

Clean Energy Investment Curtailment

Inflation will continue to chop block the economy, including clean energy investment. I have a saying that many have heard in recent months: inflation is no problem for those of us who don’t need food or shelter.

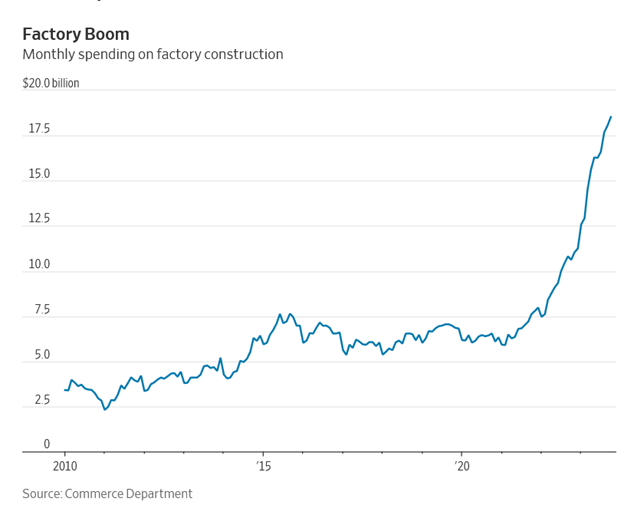

The Wall Street Journal recently reported that manufacturing in the U.S. is experiencing a “renaissance.” Still, there is a problem: no demand, the result of high-interest rates and financing costs.

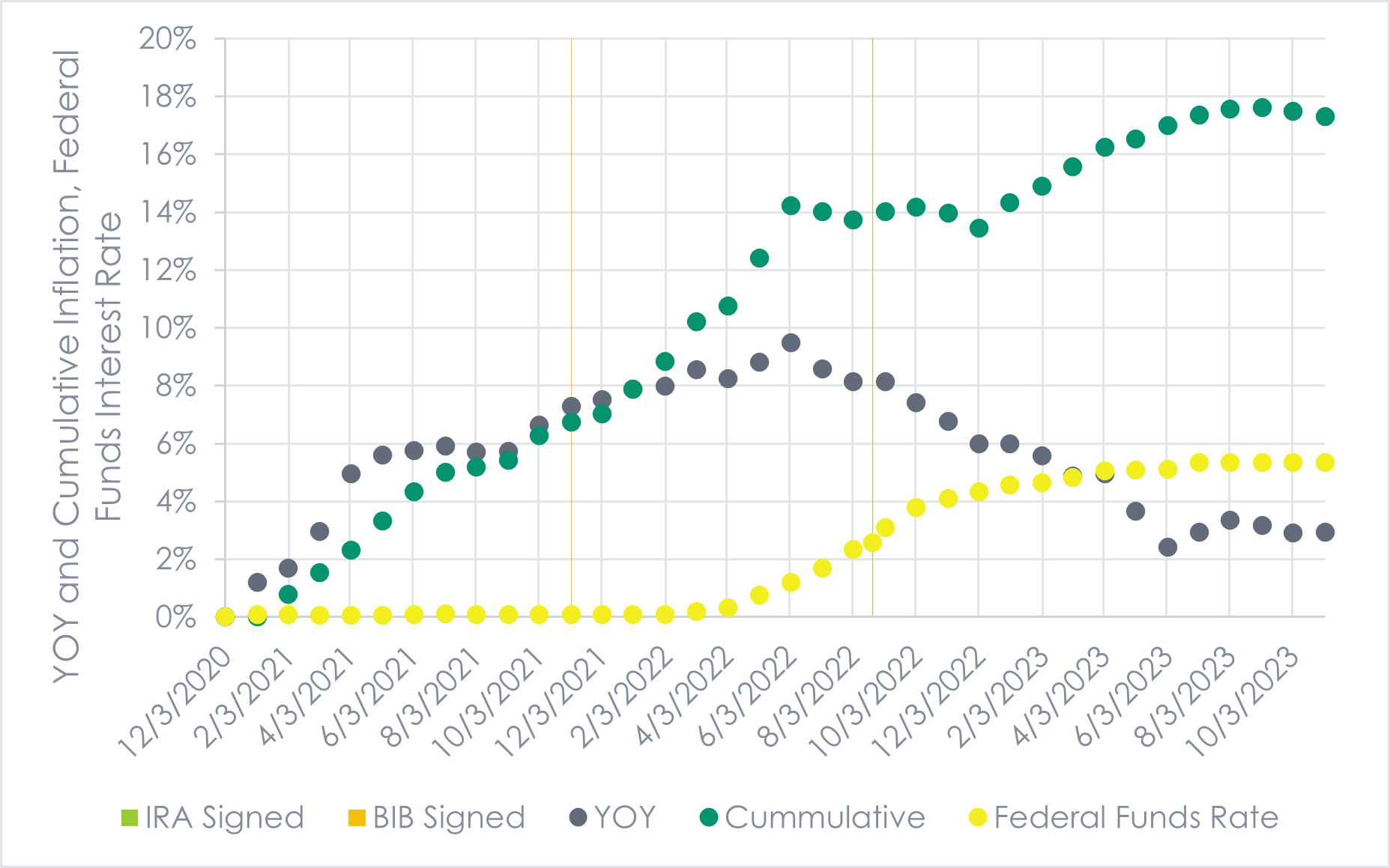

The seeds for inflation began to be planted in 2020. Remember all the free COVID money, employee retention tax credits, and the like? Not free: 20% erosion in dollar purchasing power.

I pulled data from the Bureau of Labor Statistics and the St. Louis Federal Reserve for the federal funds rate. I also added dates for signing the Bipartisan Infrastructure Bill and Inflation Reduction Act (skull-scraping eye roll here) and plopped that all onto the following chart. Judge for yourselves.

Despite manufacturing investment soaring, “activity has weakened” for 13 straight months, the longest stretch since 2002 (post-dot-com bubble). This is also the result of central planning: build something, and we’ll figure out consumer demand later. Electric vehicle battery factories, anyone? Ford, for example, reduced the size of its planned Michigan EV battery plant by 40%.

Despite manufacturing investment soaring, “activity has weakened” for 13 straight months, the longest stretch since 2002 (post-dot-com bubble). This is also the result of central planning: build something, and we’ll figure out consumer demand later. Electric vehicle battery factories, anyone? Ford, for example, reduced the size of its planned Michigan EV battery plant by 40%.

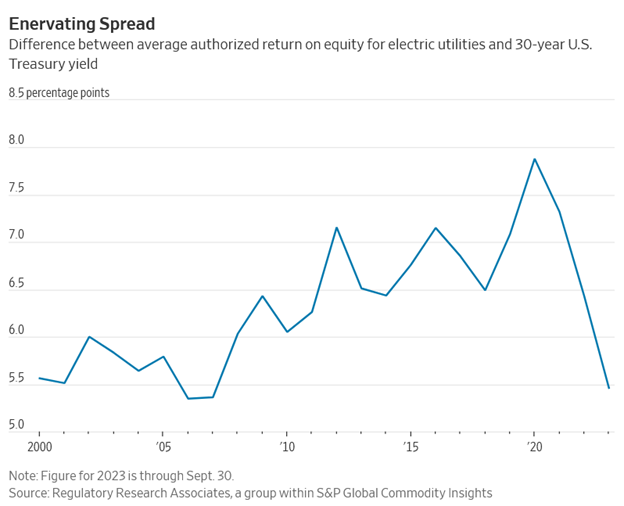

Inflation is hitting utility stocks hard. Utilities can pass through inflated fuel costs. Of course, that raises prices for customers; therefore, the headroom to get rate increases approved is smaller. Utilities are getting less in their rate cases. What will that do to the transition? Chop block[1].

Inflation is hitting utility stocks hard. Utilities can pass through inflated fuel costs. Of course, that raises prices for customers; therefore, the headroom to get rate increases approved is smaller. Utilities are getting less in their rate cases. What will that do to the transition? Chop block[1].

Anyway, I need a SMART prediction so I’ll say this: five clean energy curtailments of $100 million or more reported in 2024. Odds 1:1.

Anyway, I need a SMART prediction so I’ll say this: five clean energy curtailments of $100 million or more reported in 2024. Odds 1:1.

$100 Million Dumpster Fire

Remember Solyndra and the American Recovery and Reinvestment Act? Solyndra was a $570 million dumpster fire financed by the DOE in one of the first “investments” from the ARRA. Look for, oh, maybe a half dozen Solyndras and dozens of smaller dumpster fires unfolding over the next few years. For 2024, I’ll project one debacle of $100 million in wasted taxpayer “investment.” Odds 3:1.

Electric Vehicle Sales Growth

EV sales growth will continue to decelerate, I’ll say to less than 25% through Q3, 2024, compared to the first three quarters of 2023. I have an extensive assessment of the industry to report next week. Odds 2:1.

Interest Rate Cut Before 05NOV24

The (cough) “independent” Federal Reserve will cut interest rates before the election. Odds 1:1.

No Debates

There will be no debates between Biden and Trump this fall. Odds 2:1.

China, United Nations, COP29

Do not tell me China is doing anything regarding the clean energy transition. It’s all crap. Yes, they lead in electric vehicle sales (27% EV new sales in China versus 8% in the U.S.), which will result in enormous demand for its coal-fired electricity. In 2022, China permitted two coal-fired power plants per week, each averaging nearly one gigawatt in capacity. The capacity of coal plants announced through those under construction in China is a staggering 392 gigawatts. For scale, the peak load of the entire lower 48 of the United States is a measly 720 gigawatts.

Although the Chinese Communist Party is sinister, they are smart and leverage every resource they have. They are developing technology to scale ethanol production using their abundant energy resource, coal, as a feedstock. Why? To save millions of tonnes of grain for food. China is the world leader in coal production. They consume 55% of global coal consumption, and in 2024, they will represent 95% of all coal plant additions.

Hear me now. Regarding climate change and CO2, it doesn’t matter what the rest of the world does because of China. At COP28, John Kerry and other delusional elites from ~196 countries declared we shall transition away from fossil fuels in an “orderly and equitable manner” by 2050. Even the IPCC was wise enough not to comment on such baseless claims.

SMART prediction: COP29 will produce more fantasia, meaningless targets, while fossil giant China stays home to build more coal-fired power plants that will burn at full capacity through the COP’s arbitrary deadlines – 2050. I do not, however, expect them to make a more absurd declaration than the UN’s agreement to end plastic pollution. Gutsy. War was outlawed between the two world wars in 1928. That one has already been spoken for, John. Odds 1:4.

Chevron

The United States Supreme Court will hear arguments on two cases that seek to overturn or gut the forty-year-old Chevron Deference case. In that case, deference refers to the federal bureaucracy of choice. The deference goes like this: if the law doesn’t say the government can’t do something, it can. What could possibly go wrong?

In one of the two cases, Loper Bright Enterprises v. Raimondo, the Department of Commerce’s National Marine Fisheries cyclops declared owners of commercial fishing vessels shall pay the salaries of bureaucrats while they ride along to make sure fishing laws are being followed. Initially, vessel owners were only required to take the bureaucrats, but the agency’s greed to make them pay their salary resulted in the case.

I predict the Alito/Thomas/Gorsuch wing of the court will take down Chevron and force Congress to legislate to the whims of the political process. Why does this matter? There will be hundreds, maybe thousands, of practices like the one described above that will end, and a lot of it will hit energy, and especially, the EPA. Odds: 1:1

[1] A chop block is when an offensive lineman has engaged a defensive player up high and another blocker comes in low to take out, and injure, the knees of the defenseman.