It seems like someone coined the line, “what others are saying,” but I can’t find it. So, maybe I’ll coin “what others are saying” with that; here is what others are saying: lawmakers and policymakers should read the Rant. Here is why, starting with this PR Newswire:

“Recent studies indicate that as of this year, 99% of all coal plants in the U.S. were more expensive just to operate compared to building new wind and solar. This is especially true for Iowa, where all coal used in power plants must be imported, costing ratepayers both the cost of coal and its transport. Battery storage technology is now widely available and can balance wind and solar generation cost-effectively.

Additionally, the cost of wind energy dropped by 63% between 2009 and 2023 and utility-scale solar by 83%. Battery storage prices have dropped over 70% since 2015. For both the sustainability of the environment and the security of ratepayers’ bank accounts, the transition to renewables is inevitable and necessary.”

Cue the second law of thermodynamics. Water will not flow uphill. Heat produced by brakes cannot be converted back to equivalent kinetic energy. The refrigerator won’t work if you don’t plug it in. The ball will not rebound to the same level from which it was dropped. A thrown baseball cannot rise.

The two quoted paragraphs would seem to violate the second law of thermodynamics. Everything in those paragraphs points toward plummeting electricity prices, except they are on the rise. The gap is in the storytelling with misleading and incomplete information. Intentional? I can’t say, but my guess is advocates don’t want to know the whole picture, like clear-cutting rain forests and surface mining for nickel in Indonesia for electric vehicle batteries. The missing information in the Newswire quote above is the price required to make kWh available around the clock 365 days a year – i.e., the total cost of electricity explained here.

Once the missing pieces are included in the model, prices rise despite the claim that “99% of all coal plants in the U.S. were more expensive just to operate compared to building new wind and solar.”

The energy transition is hitting a rough patch as utilities are being directed directly or indirectly to prioritize affordability over decarbonization. My conversations and meetings in recent weeks include regulatory pricing pressures in Colorado, Michigan, and Maryland.

The Iowa Case

Iowa is another state where utilities are under scrutiny. EnergyCentral.com reports, “This [ratemaking study and legislative review] process stemmed from the passage this year of House File 617, which required the IUB (Iowa Utilities Board) to undertake this review with a focus on ‘ensuring safe, adequate, reliable, and affordable utility services provided at rates that are nondiscriminatory, just, reasonable, and based on the utility’s cost of providing service to its customers within Iowa.’”

Note the word “clean” is not part of the objective. As renewable penetration increases, there is upward pressure on prices, despite the opening comments from the PR Newswire. For example, Alliant Energy recently filed for a rate increase of 13-20%, depending on sector, over two years. I investigated.

Iowa Data

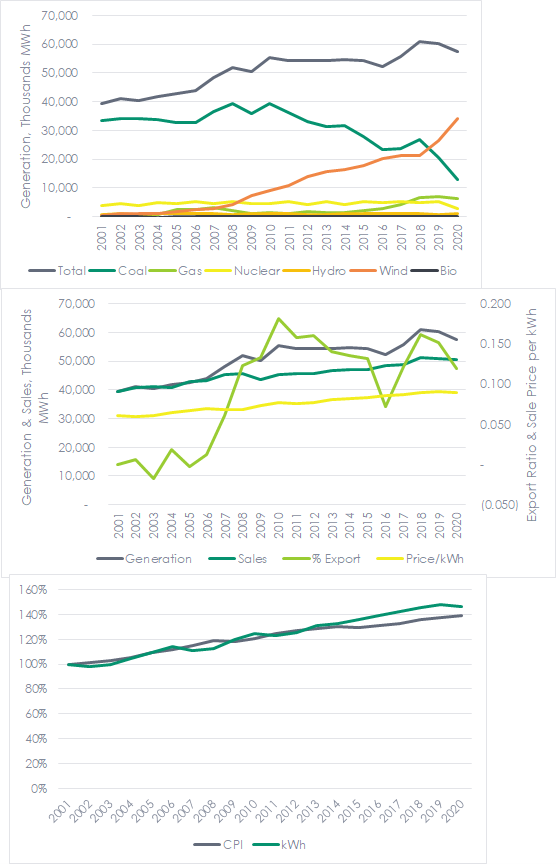

I pulled electric generation and sales data from the Energy Information Administration. Unfortunately, the most recent data are from 2020-2021, but it provides pricing versus renewable penetration over a decade-plus. I found several interesting things discussed below these charts.

Analysis

Analysis

Iowa has massively cut CO2 emissions, with coal consumption dropping nearly 75% with a minor increase in natural gas consumption. Combined cycle natural gas plants produce electricity with 70% less emissions than coal. It’s legit to say carbon emissions have fallen 70%, which is monumental.

Iowa consumes about 53,000 GWh of electricity and generates 34,000 GWh with wind resources – about 65% of the total. As wind generation increased, exports increased to 10-15%.

In the third chart, I looked at electricity prices versus the Midwest’s consumer price index. Iowa’s electricity prices have opened a small gap compared to the CPI. The gap likely closed to some extent as the CPI has soared in the last few years.

Finally, except for the “great recession” in 2008-2009 and COVID-19 in 2020, electricity sales increased steadily as lighting technology underwent an efficiency transformation from 2.0 Watts per square foot[1] to less than 0.71 Watts per square foot[2]. A sampling of our 1990s reports shows that lighting represented half the energy consumed by schools! Electrical loads, especially if transportation and HVAC electrification take off, will grow like it’s the 1950s.

Competitiveness

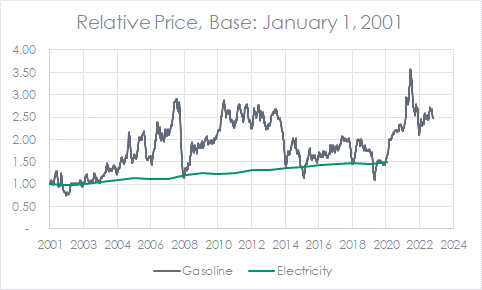

Based on my conversations and readings in recent years, I estimate the driver behind HF 617 is as much economic competitiveness with other states as it is affordability for consumers. Thus far, prices have been stable. Despite this page, which notes Iowa’s commercial customers experienced a 10% price advantage over Illinois customers in 2010 and then a 14% disadvantage in 2020, that is only true for commercial rates. Residential and industrial rates did not flip. Conclusion: electricity prices don’t move around at all compared to, say, gasoline.

Conclusions

Conclusions

Utilities seek a rate of return through the least path of resistance, and over the last 20 years in Iowa, that means building out wind resources. Let’s hope the consultant hired by the IUB proposes performance-based ratemaking and rate reform to financially reward utilities for load management to pair with intermittent renewable electricity supply.

[1] ASHRAE/IESNA 90.1 – 1989, Energy Efficient Design of New Buildings Except Low-Rise Residential Buildings – Classroom Lighting Power Density

[2] ANSI/ASHRAE/IES 90.1 – 2019, Energy Efficient Design of New Buildings Except Low-Rise Residential Buildings – Classroom Lighting Power Density

Analysis

Analysis Conclusions

Conclusions