A few weeks ago, we had a little snafu. A promotional email said the energy transition is failing. That hit a nerve with one state government official. This week, I’ll present some facts, and you can decide.

Cobalt

First, we have the issue of diversity, equity, and inclusion in the energy transition. The following video from France’s AFP News describes the toil in Congo for cobalt, a key ingredient of lithium-ion batteries for electric vehicles and grid-scale storage. The video states the scene shows “almost biblical toil.” No. It’s biblical.

Seventy-two percent of the world’s cobalt comes from the Democratic Republic of Congo, where on a good week, these modern-day serfs might make $200. This is not equity. It is also not the intent of the word inclusion.

Seventy-two percent of the world’s cobalt comes from the Democratic Republic of Congo, where on a good week, these modern-day serfs might make $200. This is not equity. It is also not the intent of the word inclusion.

Who is the primary buyer? The world leader in lithium-ion battery production is China. The genocidal Chinese Communist Party (CCP) doesn’t care about slave and child labor. It’s their business strategy and model. The China-Congo slave mining alliance began under Mao Zedong, “the most evil dictator in history.”

Carbon-based fuels have long been criticized for externalities of CO2 and other emissions – costs producers of those emissions foist onto others via climate change, asthma, and acid rain. I would categorize these cobalt-mining miseries as more diabolical externalities. While not everyone may be hit by the impacts of emissions equally, the outsourced misery is laser-focused on impoverished people of color on the other side of the planet. This is inequity at the highest imaginable plateau.

Coal

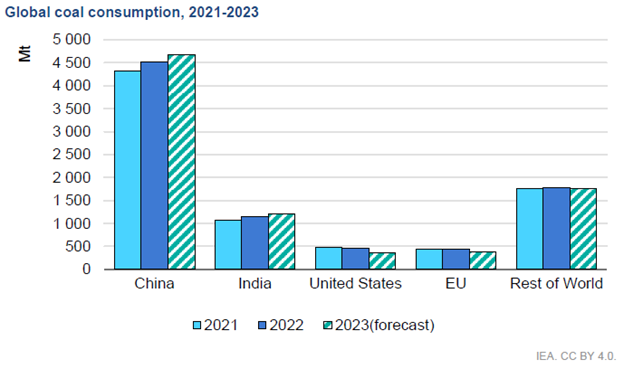

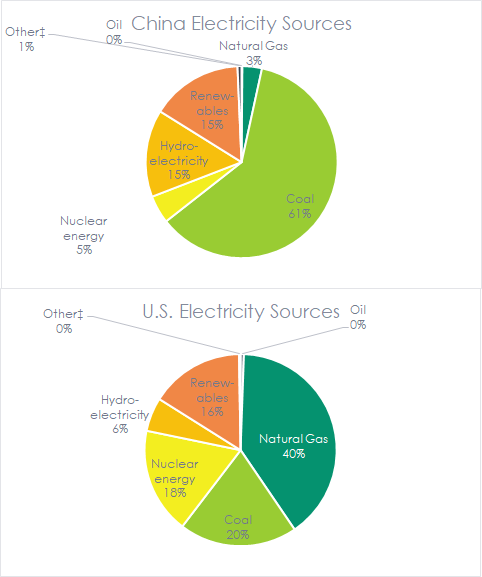

Speaking of China, worldwide coal consumption continues to rise behind the leadership of the CCP. China burns more coal than the rest of the world combined. While total coal consumption for the rest of the world, including growing India, is declining, China’s consumption is increasing rapidly.

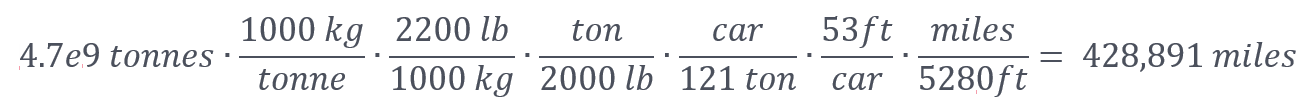

China is the world’s leading producer of solar panels and wind turbine components, manufactured mainly with coal-fired electricity. Per my calculation, 4.7 billion tonnes of coal would fill 429,000 miles of rail cars[1] – about 17 laps around the planet every year. I cannot believe this number.

China is the world’s leading producer of solar panels and wind turbine components, manufactured mainly with coal-fired electricity. Per my calculation, 4.7 billion tonnes of coal would fill 429,000 miles of rail cars[1] – about 17 laps around the planet every year. I cannot believe this number.

Nickel

Nickel

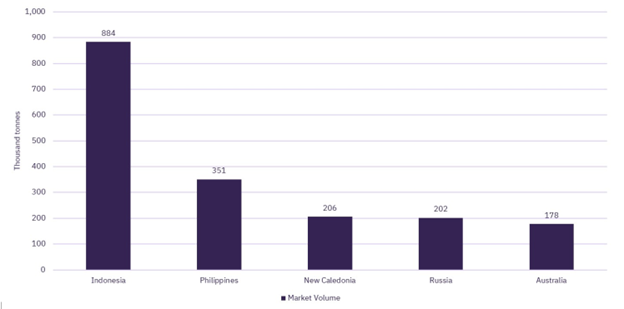

Nickel is another critical ingredient in lithium-ion batteries. Indonesia is the world leader in nickel mining and production[2] in something The Wall Street Journal calls the “nickel pickle” – a cute term for an ugly reality. “Reaching the nickel means cutting down swaths of rainforest. Refining it is a carbon-intensive process that involves extreme heat and high pressure, producing waste slurry that’s hard to dispose of.”

One recent Indonesian mine expansion cleared a rainforest to cause greenhouse gas emissions equivalent to 56,000 tons of carbon dioxide – equal to the annual emissions of 12,000 gasoline vehicles. That was merely the size of Central Park. Tesla claims EVs overcome mineral extraction and manufacturing emission deficit within two years, to which I would reply, yeah, because much of that extraction and production is on the backs of low-carbon slave labor. Moreover, here are a couple of photos of Indonesian nickel mines from The Wall Street Journal article – rainforest no more.

One recent Indonesian mine expansion cleared a rainforest to cause greenhouse gas emissions equivalent to 56,000 tons of carbon dioxide – equal to the annual emissions of 12,000 gasoline vehicles. That was merely the size of Central Park. Tesla claims EVs overcome mineral extraction and manufacturing emission deficit within two years, to which I would reply, yeah, because much of that extraction and production is on the backs of low-carbon slave labor. Moreover, here are a couple of photos of Indonesian nickel mines from The Wall Street Journal article – rainforest no more.

It doesn’t look very green.

It doesn’t look very green.

How Did This Happen?

The CCP

The Chinese Communist Party plays the long game – decades, and they have infiltrated universities, Hollywood, big sports, big business, and big investors for leverage.

A reader of this blog criticized my lambasting of ESG[3]. My focus was on powerful, uber-wealthy investors like Larry Fink of Blackrock. He is now under bipartisan congressional investigation for ”sending massive amounts of American money to companies linked to the Chinese military and human right abuses, the letter [from Congress]said, BlackRock and MSCI are ‘exacerbating an already significant national security threat and undermining American values.’” This is worse than the “scam” I called ESG last year.

The Center for Strategic & International Studies provides a concise but comprehensive picture of the ESG-CCP con. However, it comes to a naïve ambition near the end: “Now is the time for companies, their investors, and the CCP to disclose these costs and begin to deal in an open and transparent way with managing them.” The CCP is in no way transparent.

American Ignorance

This Wall Street Journal article describes how American mining companies can’t find enough workers and professionals because recruiters are chased off campus. “Most mining companies in the U.S., Australia, and Europe say their expansion and growth plans could come under pressure if current hiring trends continue, especially for high-skilled roles such as engineers, exploration geologists, and data analysts.”

How ignorant is this? Don’t mine in the first world where it will be transparent and regulated six ways to Sunday. Instead, mine the other side of the planet without human rights or environmental oversight. This ignorance has 70% of young folks in first-world countries shunning the mining industry. This is what our universities teach. Who has infiltrated the universities again? See how it works?

I spy a problem!

Solutions

These are enormous problems, and it will take years to turn this Titanic around. We need:

- Diversified supply chains away from the CCP

- Supply chain transparency and labeling

- Extraction, production, and manufacturing in Western nations

- Stationary storage that is not lithium ion

- Campaigns to debunk malformed protest and shaming of critical energy-transition professions

[1] https://bnsf.com/ship-with-bnsf/ways-of-shipping/equipment/coal-cars.html

[2] https://www.globaldata.com/data-insights/mining/the-top-five-nickel-producing-countries-thousand-tonnes-2021/

[3] Big ESG as in oligarchic institutional investors, and not small ESG at local levels

I would say most EV manufacturers, at least in the U.S. and Europe, do not shy away from the fact that relying on Nickel and especially Cobalt from developing countries is problematic. Tesla has been begging for more mines to open in North America for Nickel and Lithium and has been buying all of the regional material supply they can. Further, Cobalt is making up less and less of most lithium ion batteries as a % of total weight, as manufacturers find ways to get by with less of it. Lithium iron phosphate (LFP) batteries are cheaper and don’t use nickel or cobalt. They don’t have the energy density of nickel-manganese-cobalt batteries, but for applications like storage or lower-cost vehicles, they make sense.

Canada has significant nickel sources and lithium is available in many countries including the U.S. and Australia.

There is also a lot of cobalt available on the floor of the Pacific. Remote-operated subs are used to “mine” it off the ocean floor. Because it is in a remote location hundreds of miles west of Mexico, there is still easily accessible ore that can simply be picked up off the sea floor without much digging. The point is there are technological solutions to these issues that are receiving investment and electric vehicles of the future will likely avoid many of these issues, to say nothing of novel chemistries in the R&D phase like sodium solid state batteries, which offer decreased risk of fires along with better-sourced materials. I would also point out that laptops and cell phones have been using the same lithium ion chemistries for years without receiving much concern about these same issues.

Extraction and refinement of fossil fuels are hardly free of environmental damage and destruction, so comparisons between batteries and fossil fuels from the perspective of harm to the environment and communities nearby are not one-sided.

I will acknowledge that China does not face any of the same pressures the Western world does regarding acting in ways that benefit human rights, so I certainly agree that moving away from reliance on their labor and materials would be ideal for everyone. Finally, the labor shortage for Western mining is certainly an issue that would hold back efforts to on-shore these materials.