Last week I couldn’t resist responding to the ISO New England’s report, 2021 Economic Study: Future Grid Reliability Study Phase 1 because it paralleled what I wrote a couple of weeks earlier in Electrification At Scale. This week, we’re back to better than best practices in efficiency programs.

Last time I described how downstream rebates are often wealth transfers because they are downstream of key decision points and barriers. As I replied to a job candidate who asked me how I would approach a utility to try to persuade them of this, I described how our purpose for being in business is to minimize waste and maximize value. Then I described the labyrinth of barriers project concepts must clear to make it to completion. Minimizing waste and maximizing value apply to program design. Giving money away when it has little to no impact is a waste. Applying it where it can make a big difference would accomplish both things more effectively.

Precision Bombing Barriers

To complete my response, I said I often write that impact evaluations year after year on the same programs are a waste of money. Instead, why not survey the chain of actors and influencers that poke, prod, beat, and sometimes kill efficiency on a project’s way from conception to completion? This survey would be a hell of a lot better use of research and evaluation dollars than finding that the realization rate dropped two points last year compared to the year before after it rose three points the year before that. Yawn!

With decent findings in hand, program dollars could bomb program barriers with great precision. For instance, dollars rule, and therefore, designers and contractors tend to do what they always do because that’s safe; they maintain their margins and move on to the next project without any feedback from disgruntled customers. However, the customer is stuck with a system that wastes energy and money year after year and no one knows it.

Risk mitigation costs money. Think insurance, safety checks, maintenance, training, and so forth. It’s no different when trying something new in the design and construction of projects, whether it’s a chilled water system upgrade, adding compressed air capacity, a new production line, or an entirely new building.

Who cares if the program dollars aren’t returned directly to customers? The reality is the impact is 15-20x that because the customer gets savings year after year for the life of the project (15-20 years) rather than an incentive that is roughly equal to one year’s savings.

Leverage

Efficiency is frequently value-engineered out of projects, especially for new construction and major projects. $50,000 cash doesn’t do much for a million-dollar project. But what if you took the $50,000 cash and leveraged it into a lot of free money via low or no interest financing? This is how performance contracting works, although they need significant markups to overcome all the overhead associated with the many projects that don’t pan out. Utilities don’t have, or at least don’t need to have, such massive overhead. They could buy down financing and add it to the bill, but the energy and demand charges will decrease by more than the upgrade payment. Genius!

Regulatory Reform

Utilities can invest in things like EV charger incentives to increase sales over the long term. Those funds don’t come from utility tariff riders that fund efficiency. However, they could use rider funds to finance and deliver energy efficiency on the customer side of the meter if archaic regulatory norms were blown to bits. Regulators and regulatory staff need to think big picture – again, quit thinking that the rider dollars need to return directly to customer pockets, wallets, and bank accounts.

Transform a Market

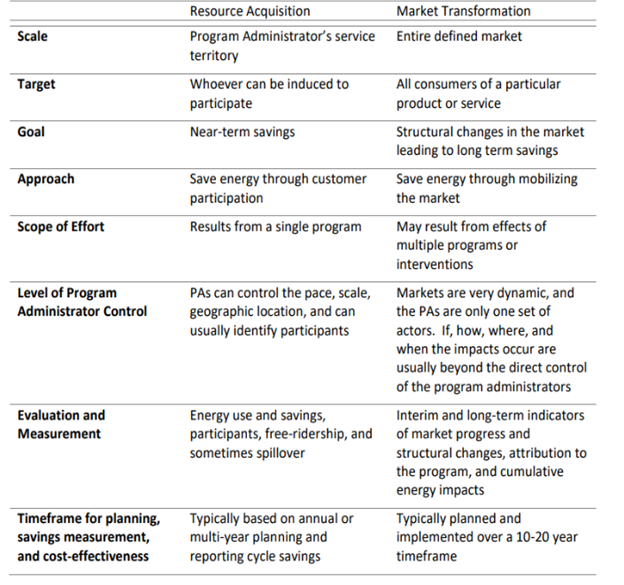

Programs in the efficiency industry fall into two categories: resource acquisition and market transformation. Simply put, the resource acquisition is “buying” efficiency upgrades through wealth transfers that I shredded in the recent post of better than best programs. Come to think of it, once I finish, nearly all of my program recommendations will direct portfolios away from resource handouts and instead to structural market transformation.

The Midwest Energy Efficiency Alliance provides a fine comparison table below.

One example of transforming the market includes a warpath I’ve been on and off for more than ten years. Here is an ACEEE Summer Study paper I presented ten years ago. The topic: get rid of centralized air handling systems[1] in commercial buildings to save fan energy and ubiquitous simultaneous heating and cooling. Recommendation: central air handling systems do not qualify for anything.

One example of transforming the market includes a warpath I’ve been on and off for more than ten years. Here is an ACEEE Summer Study paper I presented ten years ago. The topic: get rid of centralized air handling systems[1] in commercial buildings to save fan energy and ubiquitous simultaneous heating and cooling. Recommendation: central air handling systems do not qualify for anything.

Commercial new construction programs struggle to find savings with today’s ridiculously complex and stringent energy codes that cannot be successfully conquered. I have written on this topic many times.

Instead, why not require simple, dedicated outdoor air systems (see ACEEE paper above) and especially displacement ventilation, which eliminates the possibility of simultaneous heating and cooling and wasted fan energy while resulting in quieter, more comfortable, and healthier indoor environments?

There are many other opportunities, including integrated HVAC and refrigeration systems in grocery stores that maximize exergy capture.

Two things need to happen. First evaluators need to be smacked around a little as Val Jensen might like to do. We need to stop designing programs to be evaluated under the outdated resource acquisition model – where savings are achieved by nickels and dimes for lilliputian upgrades of efficiency here and there. Second, we need to redirect funds to smash the mold of how buildings are designed, and if you want to use a four-barrel carburetor on a 400 cubic inch engine, have at it, but not in my program.

[1] E.g., an air-handing system that serves an entire floor, say 20,000 square feet, with many disparate temperature control zones.