Two weeks ago, I wrote the “electric storage industry that is grabbing all they can before someone figures out that will never be the answer to bridging gaps of intermittent renewables.”

Time’s up. Utility Dive last week quoted a North American Electric Reliability Corporation (NERC) spokesman: “Batteries aren’t going to do it, and we’re going to need a backup fuel for wind and solar. So this [natural gas] is important to invest in.”

The rest of this post includes a dive into consumer choice and what things might look like at scale.

Consumer News

In fresh news from Holman Jenkins of The Wall Street Journal, aspiring EV manufacturers like Ford are shunning small, efficient EVs for the large, powerful ones like the Mach E and the F-150 Lightning. He wrote that in favor of big electric SUVs, Nissan is scuttling its semi-efficient Leaf (its horsepower was doubled in recent years). Uh oh, ACEEE, you’ve got a bigger problem than GM and the Hummer. It seems almost no one is buying EVs to save the planet.

He concludes, “According to the consultancy AlixPartners, some $526 billion is currently being invested to create dozens of mostly high-end electric vehicles aimed at the 17% of buyers who constitute the luxury market. The impact on climate of these cars will be zero [as confirmed by ACEEE].” A year ago, I wrote that EV buyers, which is to say, Tesla buyers, are not unlike those who like premium sports cars – and that’s ok.

I have a neighbor a few doors down with an itty bitty Chevrolet Bolt. If roads, parking lots, and charging centers were full of cars like them, it would produce many benefits and solve many EV challenges, like charge times.

Generation

Another consequence decarb fans must consider right now is our power-generating fleet. To date, we have shoved wind and solar onto the supply grid while keeping electricity prices low. That free ride is quickly coming to an end. The grid had plenty of excess capacity in the past ten years with no load growth and rapidly expanding renewable generation on both sides of the meter. But now, a combination of aging thermal generation (coal, natural gas, and nuclear) and wholesale electricity market pricing pressures resulting from intermittent renewable supplies are rapidly driving thermal generation offline. I’ve been writing about this for a long time, and now the grid operators, MISO, CAISO, and certainly ERCOT, plus NERC, are sounding the alarm bells.

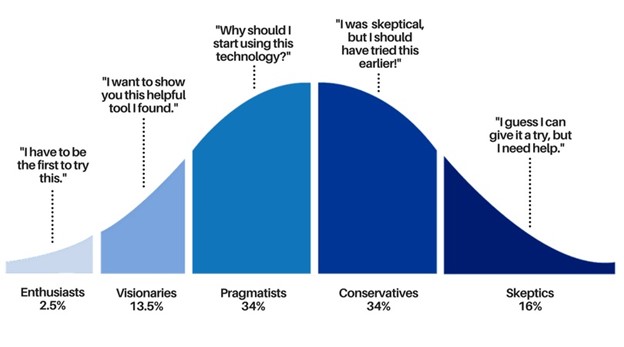

Because batteries won’t cut it per the NERC guy above, renewable capacity must be accompanied by ~80% thermal generation capacity to compensate for stifling hot and calm August weather and the net-ramp wall in the afternoon. So, what’s it going to be? Keep in mind that electrification essentially hasn’t started yet. It’s pre innovator on the adoption curve.

Because batteries won’t cut it per the NERC guy above, renewable capacity must be accompanied by ~80% thermal generation capacity to compensate for stifling hot and calm August weather and the net-ramp wall in the afternoon. So, what’s it going to be? Keep in mind that electrification essentially hasn’t started yet. It’s pre innovator on the adoption curve.

Learn from Others’ Mistakes

Learn from Others’ Mistakes

One of my truths is to learn from mistakes, especially others’ mistakes. Will the United States learn from Europe’s experience of removing options? Since it is boxed in, Europe declared dirty and dangerous natural gas and nuclear sources to be “sustainable resources”. Their “taxonomy” of sustainable resources “aims to boost green investments and prevent ‘greenwashing.” Boohahahaha! This is not The Onion reporting. It’s CNBC. I would note that the CNBC article on emissions from natural gas v coal is wrong. They say natural gas emits 58% as much CO2 as coal – not for today’s efficient combined cycle natural gas plants. They emit only about 33% of coal generation: 0.7 lb/kWh v 2.2 lb/kWh.

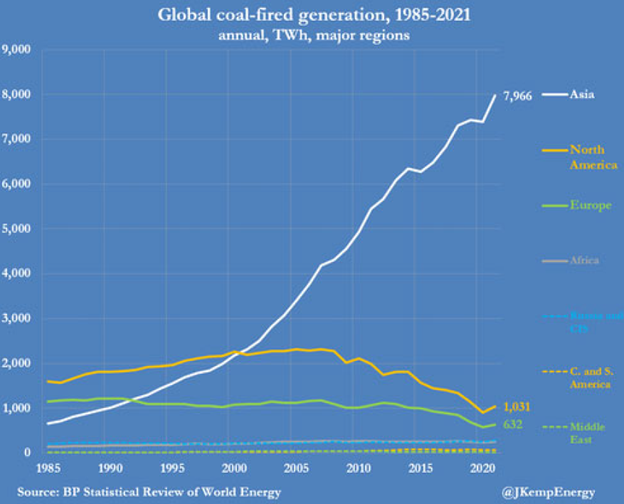

Zerohedge.com, which in many ways publishes more informative and sophisticated analysis than The Wall Street Journal, Bloomberg, or the Financial Times of London, provides an excellent analysis of coal use worldwide and in Europe. Physics wins, and policy consequences lose, making 2022 a record year for coal consumption as predicted at the beginning of the year.

By the way, the top scoring ESG companies rely on manufacturing from China, where coal dominates, and the Three Gorges Dam destroys the environment, and that doesn’t include their atrocious labor practices. ESG is a scam!

Now is the Time

It is time to decide and make policy NOW before we find ourselves in a European painted corner. Our base load is large – at about 60%. For example, MISO’s average peak load in July is about 110,000 MW, and the minimum is about 60,000 MW. People need to think about this holistically and at scale. Demands from the grid are far greater than managing home energy usage and car charging.

A Resource Plan

Nuclear power is expensive because we build one plant every 20 years. The smartest guy I know in the power sector, an engineer I interviewed, wrote the Lazard levelized cost of electricity is not accurate. I do not blame Lazard because they must make impossible projections like the future cost of carbon and regulation. Will there be a carbon tax? How about the price of natural gas? Will it be $3 or $9? What are they using for the lifespan of a nuclear power plant? The original 30 years or the proven 60 years?

I suggest 50% nuclear and a bunch of combined-cycle natural gas to handle the wild swings in renewable production. The U.S. was around 20% nuclear for a long time. France is at 70% for “energy security.” Uranium, like coal, unlike natural gas, and especially electricity, can be stored for a long time.

My plan would reduce carbon from the electricity sector by about 80% at a reasonable cost. What about the waste? Choices: 1) concentrated, contained, and safe, or 2) floating in the air for decades, plus climate change?

People with leverage are finally going public that renewables plus storage will not work at scale for a reasonable cost. The alternative is high electricity costs and handing over the rest of our critical manufacturing to despots like Xi and Putin.

Efficiency and Demand Management

Since nuclear is unsavory to many but necessary, how about a massive buildout of efficiency, passive (built-in) demand management, and load shifting capability? Tap these low-risk, highly-reliable resources first.