Last week, we looked at Total Resource Cost (TRC) tests that were developed decades ago to put a high value on avoided source energy costs. That was right for the time, but not today. I demonstrated that energy costs, mostly dominated by natural gas, are near historic lows, while zero-energy-cost renewables supply more electricity than coal-fired generation. Of course, renewable sources have zero source-energy consumption. Yet, utility commissioners are laser-focused on keeping electricity prices in check and maintaining the reliability of the electric grid.

Electric Rate Basics

Like the TRC, most utility rates (tariffs) are stuck in the 1970s. I know little about ratemaking, but I know the following. Rate structures were developed to effectively allocate the cost of service to all customers. Rates were/are based on “the cost of service,” including generation, transmission, and distribution costs, substations, electric meters, and so on.

Back in the day, only large general service customers, maybe those over 500 kW were billed for demand and energy. Why split demand (kW) and energy (kWh) components on a bill? Because the demand charges represent the cost of generation, transmission, and distribution capacity, while energy represents the cost of fuel. Indeed, some tariffs today almost give away energy because the blended cost of energy, including very cheap natural gas, uranium, and free wind and solar, is next to zero.

Underutilized Smart Grid

General service and residential rates are stuck in the 1950s. I ranted about the Deaf and Mute Smart Grid nine years ago, and almost nothing by way of rates has changed since. Before the “smart grid”, it was too expensive to bill small and medium-sized businesses and residential customers for their true cost of service, plus energy – like a large general service customer. It was too expensive because multiple meters and mathematical jujitsu were required. Isn’t this what the smart grid was deployed to do?

Commissioners, hear me, please. Why are small business and residential customers still paying flat rates with no demand charges? Resistance is anchored to bedrock. Flat rates provide little-to-no opportunity for customers to manage energy costs through load and energy management and support the grid by shifting loads to periods of plentiful energy supply and low grid stress.

Twelve Rush Hours

Twelve Rush Hours

Not only do we have rate structures that have been left in the dust by vastly under-deployed metering technology, but the rates also do not reflect today’s generation mix. They reflect a fleet of base-generating coal and nuclear power generation. I was on a Teams meeting last week with a seasoned energy guy who said utilities like demand charges because there is little customers can do to avoid them. Think about that! Why is that?

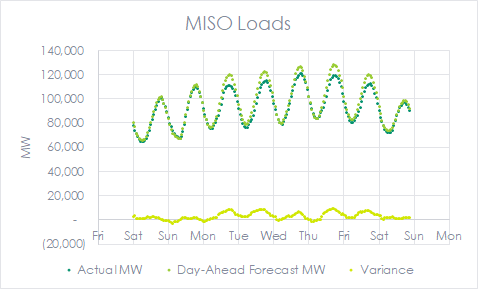

Peak demand windows are typically 12 hours, say from 9:00 A.M. till 9:00 P.M. Why, for the love of climate change, is that the case? The first five or six hours of this window have no impact on the cost of delivery (capacity). Those five or six hours result in “can’t do anything about demand charges.” To demonstrate the un-need for twelve-hour peak periods, look at last week’s MISO loads that clearly show the period of grid stress is only about four hours – not twelVAH!

Customers can do a lot of things to move load out of a four-hour window. They practically have to close down to avoid load in a twelve-hour window. What does the futility of load reduction over twelve hours mean to ratepayers? Most customers plow ahead with business as usual, resulting in higher customer and aggregate electric demand, requiring more generation, transmission, and distribution, resulting in higher full cost of electricity (FCOE) across the board. Innovative utilities are providing alternatives to customers which I will explain in future posts in this series.

Customers can do a lot of things to move load out of a four-hour window. They practically have to close down to avoid load in a twelve-hour window. What does the futility of load reduction over twelve hours mean to ratepayers? Most customers plow ahead with business as usual, resulting in higher customer and aggregate electric demand, requiring more generation, transmission, and distribution, resulting in higher full cost of electricity (FCOE) across the board. Innovative utilities are providing alternatives to customers which I will explain in future posts in this series.

Ratepayers versus Customers

By the way, some folks insist on the term “customer” rather than “ratepayer.” I use both. A ratepayer is like a taxpayer. Are you considered a customer of the government for paying taxes? Similarly, energy users who are stuck with a fixed bill with no flexibility around such charges are not customers. They are captive ratepayers.

Off-Peak Demand Charges?

What is the purpose of off-peak demand charges? On-peak is typically non-holiday, Monday through Friday for the twelve hours noted above – i.e., 60 hours per week. The off-peak period is the other 108 hours per week. A typical tariff will charge customers for off-peak demand that exceeds on-peak demand. Why? Maybe for reasons dating to slide rule days.

Renewable Ready?

The rapidly growing reliance on renewable resources is also tightening and sharply increasing the loss of load probability, not just in California with the infamous duck curve, but soon, the entire United States and the planet. For a summary of load shape devolution with examples, see our Golden Opportunities white paper.

Unlock Load Management with Rate Reforms

Electric rate reforms are necessary to improve grid reliability and decrease the cost of electricity service for all customers. Advanced metering infrastructure (AMI) is deployed in most of the country, but “smart grid,” which is supposedly synonymous with AMI, is a non-sequitur. It is vastly underutilized to treat ratepayers as customers – a partnership to keep costs low for all.

Next week I will cover some innovations in rates: time of use, critical peak pricing, and alternative peak demand windows.

Tailwind, Headwind

An article written by Gregory Litra on EnergyCentral.com last week gave me a chuckle. He wrote about tailwinds and headwinds for utilities deploying capital.

- Tailwind: The Inflation Reduction Act established policy support for funding infrastructure projects. Per Goldman Sachs, the IRA created “the most supportive regulatory environment in clean tech history.”

- Headwind: Interest rates have been ratcheting higher over the past twelve months. [Mortgage rates are the highest they’ve been this century]

My take: the IRA is causing, or at least not mitigating inflation, resulting in higher interest rates.