This is the second in a two-post series on electricity prices as impacted by deregulation and renewable energy penetration. Last week we explored deregulation in Regulation v Deregulation in True Color. This week, we examine the effects of increasing shares of renewable energy (like wind) being added to the grid. Again, the source for all this information is the U.S. Energy Information Administration, so you can fact check away!

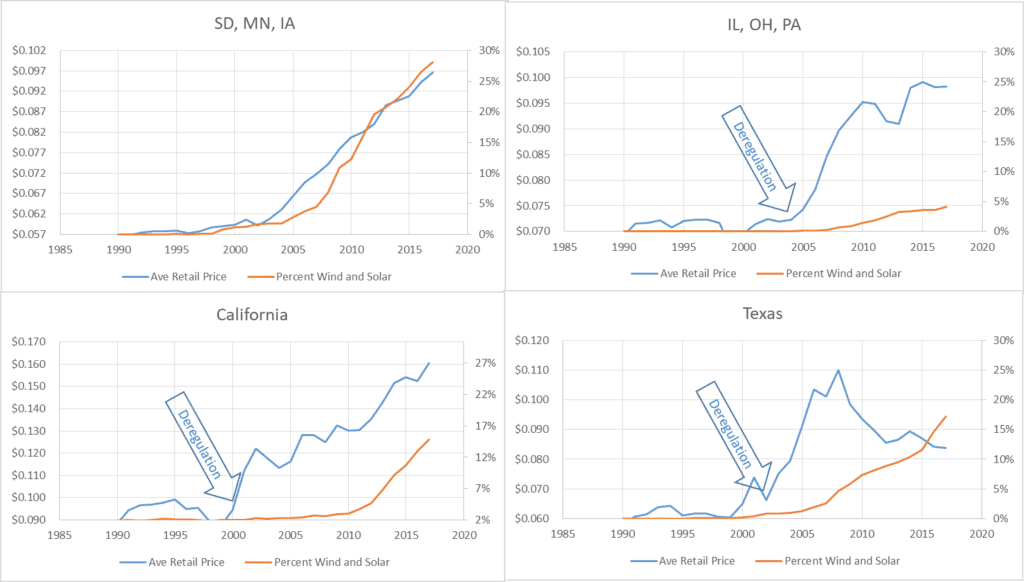

To recap, we are examining four regional markets as follows:

- Regulated Midwest states of South Dakota, Minnesota, and Iowa

- Deregulated Midwest states of Illinois, Ohio, and Pennsylvania

- Deregulated Texas

- Deregulated and re-regulated California

Price Stability, Elasticity, and Risk

Indeed, electricity prices are quite stable and slow to move for one primary reason: we have a bountiful domestic fuel supply that is not subject to wars and other disruptions around the globe. Fuel prices are subject to commodity price fluctuations, which are loosely tied to global fuels and other commodities. I.e., when the price of corn and pork bellies are sky high, natural gas prices tend to be dragged along to some extent.

On that note, remember I wrote last week that there is little elasticity in energy markets in the short term. This is true for price spikes in either direction – up or down. In the case of natural gas, with prices as low as they have been due to fracking, people in search of profit will develop means to deliver it to foreign markets, and that is what is happening. Look for fun times ahead as we are foolishly counting on forever-cheap natural gas.

What that might mean here in the Midwest is we have not one; not two; but three generating fleets to keep the lights on in the most extreme weather. What do you mean, Jeff? Wind generation is being built like crazy from the wall of states starting with North Dakota, working south to Texas, including neighboring states on either side of that wall.

During this year’s “polar vortex” wind turbines needed to shut down because they cannot handle temperatures below minus 20F. Wind is displacing coal and nuclear – the most reliable energy sources for generating electricity, by far. Natural gas? Pffft! Not when it’s minus 25F in the Midwest. That is our dominant heating fuel. Wind – no. Natural gas – no. Coal/nuclear – yes, I know what was dispatched and what was shut down during the “vortex,” straight from a transmission system operator.

Some believe wind energy is being built to combat climate change, i.e., global warming. That is incorrect. Nevertheless, it is an interesting dichotomy that what many think is fighting global warming cannot operate because it’s too cold.

Discuss.

Capitalism

Of course, the real reason wind generation was and is being built is profit. The interesting thing is it has vastly different impacts depending on whether the market is regulated or deregulated.

The following montage shows, the average retail rate for electricity and the percent of energy produced by utility-scale renewable sources. Both the price and percent renewables were set to use 1990 as the baseline, which is the earliest period in the EIA data set.

The first takeaway is that the onset of deregulation resulted in price increases, as explained last week. The second takeaway is a strong correlation of wind energy production and prices for the regulated Midwest states. Draw your conclusions. I’ve drawn mine.

Why is the correlation not present in Texas? Because the market is deregulated and generators only get the price the market will bear, and not a “required” weighted cost of capital to build it. The Texas scenario presents a different oncoming challenge, not unlike the foolish concentrated reliance on natural gas we have.

Paying the Piper

Texas runs an energy market rather than a capacity market, as described in Capacity Market v Energy Market – What’s the Diff?. In Texas, power generators are only compensated for energy sold on the open market. Capacity markets compensate generators merely for being available to dispatch when needed.

Since Texas, or more appropriately, the Electric Reliability Council of Texas, does not compensate generators for capacity, they are running low on reserve capacity – barely 5%. This is compounded with the flood of cheap wind-generated electricity, most of the time. Low prices result in closures of dispatchable, aka reliable, generators and keep investments in new dispatchable resources out of the market.

At least Texas’ wind resources are more reliable and steady throughout the year, compared to the upper Midwest, as noted in Dig Some Wind. Solar is a viable resource to stem summer peaks while avoiding the craziness of the California duck. Solar energy sellers can sell straight into high prices every day in Texas.

Meanwhile, the eastern Midwest is unfavorable for renewable energy, whether it’s wind or solar. The Buckeye legislature is batting around House Bill 6, which would spare two nukes and two lumps of coal via price supports. I will say, at least they are having much of the battle in the light of day rather than slipping it into a last minute grab bag before everyone, including the reporters and interest groups, leave town for the year.

Results and the Bottom Line

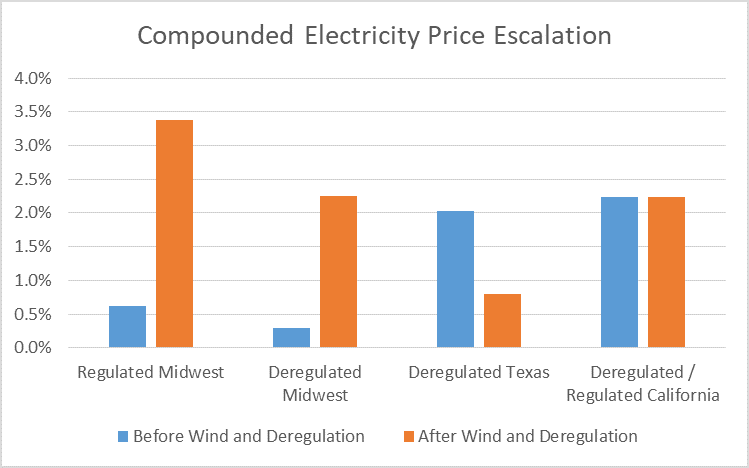

We are presented with interesting comparisons because both deregulation and utility-scale renewables started with significance in 2004.

The following chart shows compounded escalation of electricity prices before wind and deregulation (1990-2004) and since wind deregulation impacted the market (2004-2017).

Interesting.

Note all renewable data are for utility-owned generation only. California would have a considerable fleet of customer owned renewable generation.