Recent projects have led me to examine how deregulated electricity markets work. Since I am naturally curious, I wanted to investigate differences between electricity price performance of deregulated states versus those of regulated states. This week we examine the impacts of regulation/deregulation on pricing, and next week, we will look at the impacts that renewable energy has on pricing. Data used come from the Energy Information Administration[1].

Figures lie, liars figure, but Jeff merely presents all data available for you to decide, pound your chest, or cry. That is your prerogative.

Often data which do not support a narrative is filtered or censored. The goal posts are moved or the analysis period is manipulated to show the best results. While I don’t filter data, I also don’t have unlimited time to look at every state in the union.

Four Electricity Markets

Therefore, I chose four regions to examine because they each have something interesting happening, and they make for good comparisons and contrasts. Those four regions or markets include:

- Regulated Midwest states of South Dakota, Minnesota, and Iowa

- Deregulated Midwest states of Illinois, Ohio, and Pennsylvania

- Deregulated Texas

- Deregulated and re-regulated California

Incidentally, at this moment, we are working in all these states, except Pennsylvania.

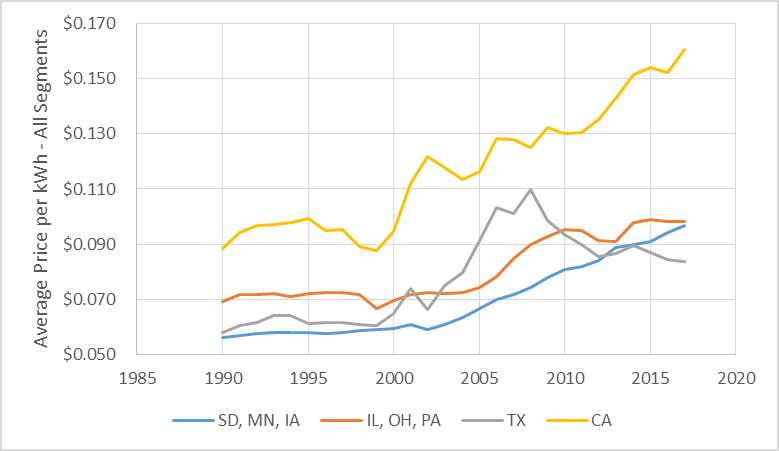

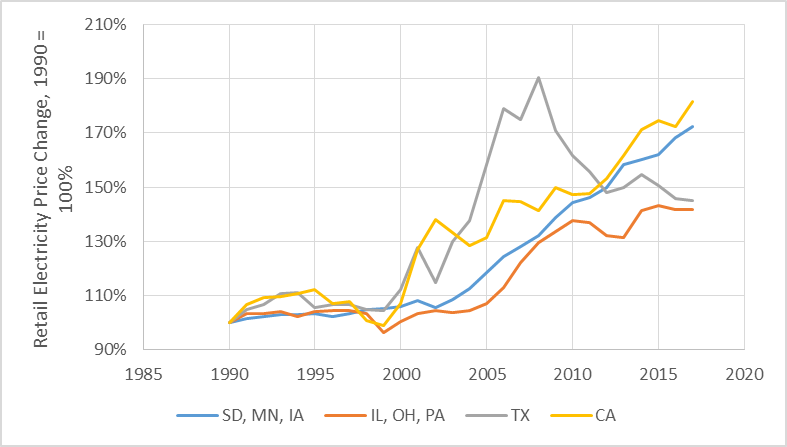

The following charts form the basis for this post. The first is the average retail cost of electricity by year, going back to 1990, the earliest year for which data from the EIA-linked site are available. California prices have increased the most, both from an absolute sense and on a percentage basis. Prices in the Midwest states have increased by almost as much on a percentage basis.

What Goes Up Comes Down

Deregulated states legislated to do so in the late 1990s. Utilities had to sell their generating assets or start deregulated subsidiaries to operate them by the early aughts. A few years later, market forces were allowed to drive the market for electricity. We can see why the utilities in those states wanted to deregulate – prices immediately popped, but then, trouble struck.

Prices spiked due to lack of elasticity in the market for electricity. Electricity is not something people can do without. It cannot be stored, imported from China, and there are no alternatives. As an economist and friend of ours told me recently, some supply or demand curves may be very inelastic in the short term, but over time, elasticity will present itself.

Since that time, FirstEnergy of Ohio and Pennsylvania, and TXU[2] of Texas have filed for various bankruptcies, restructurings and reorganizations, especially, if not exclusively, in power generating segments. Bankruptcies occurred in the Midwest deregulated states and Texas, but in more muted tones as compared with the swift destruction of wealth for California’s utility shareholders.

From the price curves above, it appears the so-called great recession of 2008 triggered a lasting market correction for electricity prices in the deregulated states. That recession initiated a struggle for survival and that, along with flat load growth, has introduced us to a divergence of electricity prices in deregulated v regulated states.

Nuclear Lifelines

Keeping up with the nuclear plant shutdowns and nuclear plant bailouts is nearly a full-time job in these deregulated states. As of two months ago, Illinois and New York passed bailout bills that have withstood court challenges. Nuclear generators in Pennsylvania and Ohio are still fighting for price supports.

As I wrote about three years ago, this is regulating deregulation. They are not allowing the market to “work.” Because of the lack of storage, alternatives, and other issues noted above, the market for electricity works poorly.

On the other hand, the fully regulated market performs more poorly than the somewhat-partially-half-pregnant-regulated states. Why? Because utilities in regulated states make money by building stuff known as rate base – power plants, windmills, substations, and transmission systems. This added rate base makes fully-depreciated (paid for) assets unnecessary, and therefore, nuclear and coal plants are shut down – like junking your car after five years of car payments. Meanwhile, deregulated states want to retain nukes because they want low prices.

Findings

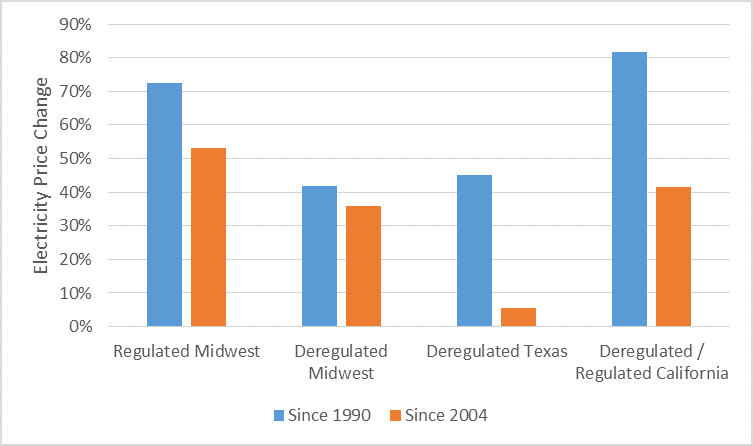

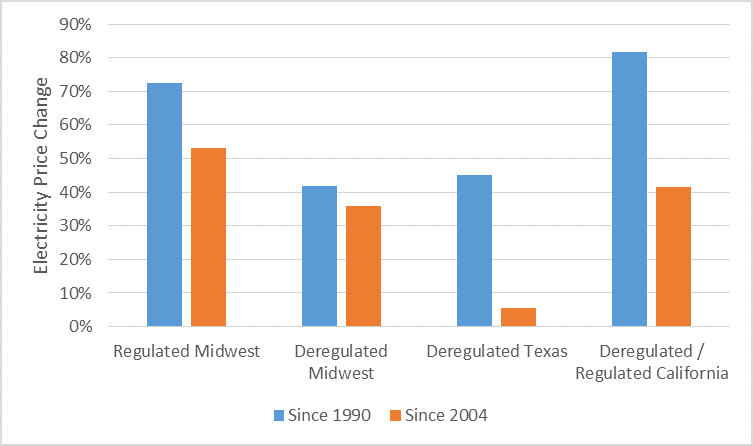

The following chart summarizes price impacts for the four markets noted above. As I mentioned, analysis periods can be chosen to paint the desired picture. The data show price changes over all years, since 1990, and from 2004 through today. The latter period represents the period of deregulation, plus or minus a year or two.

Regulated Midwest

As you might guess, the regulated Midwest states have the smoothest price curves, but also some of the biggest price increases. Since the start of deregulation, the regulated states have the steepest price increases. Why is that? Next week.

Deregulated Midwest

Over the long haul, deregulated Midwest states have the steadiest prices, although prices jumped during the early years of deregulation, and went mostly flat over the last decade.

Deregulated Texas

Deregulated Texas has the lowest prices since deregulation was enacted, but the foundation of that is about to give way or needs a major investment. Why? Next week.

Deregulated / Regulated California

California suffers from the most knee jerk energy policy, and prices demonstrate the results. It’s only going to get worse. Who wants to invest in utilities that have gone bankrupt twice in barely two decades for reasons that were nearly all foisted upon them? That requires a higher cost of capital and higher rates.

[1] https://www.eia.gov/electricity/state/ – note the good stuff is a couple of clicks in.

[2] TXU, today known as Oncor (transmission and distribution), TXU Energy (retail energy sales), and TXU Power (power generation), later known as Texas Electric Competitive Holdings, and then finally, as Vistra, as it is today.

Join the discussion 3 Comments