There is weekly, if not daily, chatter about the end of the monopolistic electric utility systems we have today. They call it the utility death spiral, and it goes like this:

- Distributed generation, also known as DG, which includes rooftop solar photovoltaic (PV) systems will compete directly with utility power.

- Utilities are stuck with fixed rate base for which they need to be paid through purchased energy from customers.

- Photovoltaic may produce competitively-priced energy for some customers after the bevy of incentives and tax breaks. Home-generated electricity drives down the utility’s revenue.

- Utility raises prices to cover their fixed cost.

- Photovoltaic becomes more cost effective for more customers, and the cycle repeats – into a death spiral for the utility.

I’m as qualified as anyone to be wrong with predictions about the future, so I would like to point out some questionable projections from the likes of Forbes. In fact, this rant boils down to not predicting what will happen, but predicting what will not happen.

The Forbes article, which is based on Morningstar babble, exemplifies three utilities (actually three holding companies) that are most vulnerable to the death spiral. One is Exelon, with which I am somewhat familiar. Ironically, a few years back, Exelon gambled on the institution of carbon trading. In response, they sold off their coal generation assets to essentially become a nuclear-only generator of electricity. Talk about predicting the future. That did not go so well – at least the carbon trading bonanza they thought would reap them mountains of money did not and will not happen. Now, ironically, Morningstar claims Exelon is screwed with their centralized, all-nuclear fleet. No comment. I don’t know.

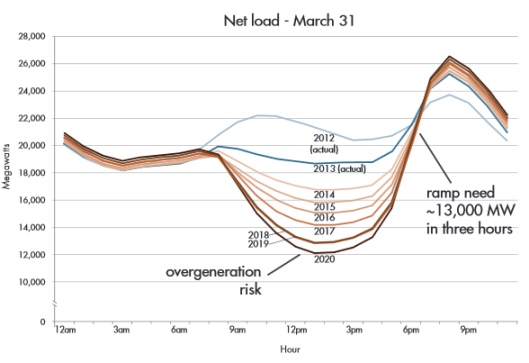

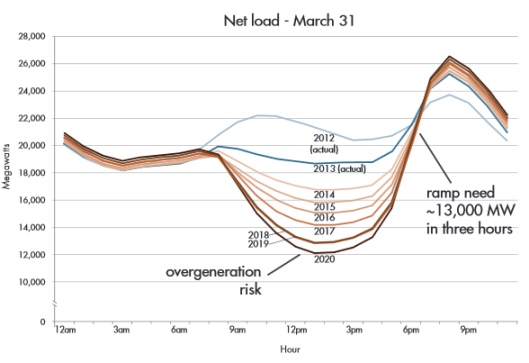

Now I will introduce another minor (not) problem with the death-by-PV-spiral theory. The chart nearby comes from the California ISO – that is, the independent system operator, which controls the grid. This is called the duck curve. Get it?

California has a goal of 33% renewable energy production by 2020, and the chart demonstrates the annual path from the grid’s point of view to that point. The curves show power required by non-renewable sources.

Look at that whopping 13,000 MW ramp that will be required at the end of the day as the sun sets! It seems another California train wreck may be on the way. On top of this, they just shut down 2200 MW of nuclear capacity with the decommissioning of San Onofre nuclear generating station (SONGS as it is known) last year. There goes 2200 MW baseload capacity to cover the duck’s head and tail. Southern California Edison developed a brochure just for PR of the shutdown. The Q&A section is all about environment. I’m thinking, “How do you plan to keep the lights on?” Answer: demand response. Clearly, the duck shows us, to my surprise, that PV isn’t helping at all with peak demand and rather indeed is exacerbating the challenge/problem.

So, let’s point out what seems like insanity to me. The state of California is encouraging the retirement of operational assets that can provide a steady flow of power. At the same time, they are paying like crazy to dig deeper into the duck’s belly with new PV. Meanwhile, the peak requirement is actually growing, requiring additional pixy dust from somewhere.

Last time, I took a beating by some PV enthusiasts, kind of like the heat pump story told last week. Pesky reality has a way of doing that.

It also happens that this professor from UC San Diego’s Laboratory on International Law and Regulation and founding director of Stanford’s Program on Energy and Sustainable Development agrees.

The whole scheme seems to be heading toward exponential price increases for the state, and it’s based on a hell-bent pursuit of 33% renewable energy by 2020. There are serious consequences in the pursuit of arbitrary, political fairy tails. Ironically, who will get burned the most? Low income customers. They can’t afford PV. They don’t need tax giveaways. They will pay more for energy.

How could this duck effect be mitigated? Energy storage? That will pile on more cost. Additional DG in the form of things like natural-gas-fired peakers? More cost. Some serious reality is coming down the pike. It will be interesting to see what unfolds, but I think it’s safe to say there are going to be some mighty ticked off customers. This is why the death spiral, in my view, is not going to happen, at least from sea to shining sea.

Making policy on political sound bites, knee jerks, and emotion is not a good thing. This kind of stuff is sold with no mention of downside at all. There is always downside. There will be a huge price to pay, particularly by the poor who can least afford this stuff.

I would guess there are significant changes coming for the utility industry, and I will make further guesses in coming weeks. This is a fascinating topic.

California just needs super-daylight-savings-adjustments. If they can adjust time so that the sun sets at 11PM, then everything will be fine.

There are lots of moving parts here. Yes, the curve looks pretty scary with business as usual. Much of it can be mitigated with proper rate design. Thermal storage is way too often overlooked. If I have every residence in California moving up there a/c load to fill in the ducks back now there home is comfortable when they get home and I’ve shaved part of the peak. Ice storage for commercial loads can make sense as well. There are other very electric price sensitive industries that would be reactionary as well such as foundries, likely shaving more off the back off your late afternoon peak.

The question becomes is the renewable target in its purest form a good idea? Do you accept climate change; are there enough fossil fuels for the next 10 generations at a reasonable cost? If your answer to the second and third questions is yes and no respectively then the renewable target is appropriate.

You are right to point out that other problems arise, because there are rarely silver bullets, but that doesn’t mean we can’t begin to work out those new problems that arise. Your article does a good job highlighting the forthcoming issue but it ignores the possibility of reasonable measures to mitigate the negative effects.

Thanks, Kurt. You are correct. We have a saying here: “Anything is possible. It depends on how much you [or people] are willing to pay for it.” This is the answer to any question that begins, “Is it possible to…”.

I’m sure you’ve seen research showing huge gaps between what people agree with and support by way of reduced emissions, energy efficiency and the environment – and what they do about it themselves or are willing to pay for it.

Utility customers of all sizes seem to think utilities have enormous capacity to absorb costs without charging the customer. This is simply an untenable business proposition. Since our clients are utilities I tend to defend them. In this case, these expensive mandates come from government and utilities take the beating by the public when they see their eventual higher energy bills.