Over the years, I’ve collected a few business phrases that resonate:

- Profit is an opinion

- Balance sheets are opinions

- Cash is truth

- Debt is truth

- Cash flow is a truth

- Price is truth

Profit is an opinion because there are billions of ways to calculate it, including millions of ways to calculate gross and net profit and millions of ways to manipulate the data. There may be quadrillions of ways to calculate balance sheets based on asset values alone. Enough said.

Cash and debt are concrete, real numbers we can look at every day. The change in cash and debt over time is cash flow. Since profit can be unicorns and Potemkin Villages, companies can run out of cash depending on how they spend money. The opposite is also true. Companies can generate gobs of cash without making a profit. How? Collect money before spending money, for example.

Trust and Appearance

I occasionally read industry news about utilities and related energy efficiency, load management, and business issues. Whenever I read that a utility will close a power plant or build something to save customers money, my first question is, compared to what? It’s an opinion, like profit.

Trust and appearances that support belief are critical to business. At Michaels, we are transparent to our employees. We provide cash balances, monthly revenues, and profit by profit center and show how profit is distributed and retained. Cash must follow the opinions, or trust erodes over time. We could hide everything, but we don’t believe in that for many reasons, including trust and ownership in goals from the corporate level to the individual. People want to see their contributions flow to the benefit of an organization.

Rate Shocks

The trouble I’ve seen with utilities on numerous occasions is statements of saving customers money are followed, sometimes shockingly soon, by rate-case filings to increase electricity prices by double digits. Price is the truth to the customer.

I see headlines like this one from The Wall Street Journal too frequently: Plan to Hike Electric Bills 29% Sparks Fury in Wyoming.

Quoting the article, the utility says:

- Renewable energy saves money for its 150,000 customers in a state prone to high winds.

- It needs to raise utility bills an average of about 21% to help pay for higher coal and natural gas, as well as to offset the impact of drought conditions on hydroelectric generation.

- It needs a temporary 7.6% hike through mid-2024 to pay for a sudden surge in fuel prices last year caused by extreme weather.

Quoting the article, Wyomingites say:

- “I’m not too sure that the state shouldn’t take over your business, buy you out, and deliver the electricity to our people,” Republican State Rep. Bill Allemand said.

- “A lot of our community are on fixed income, older, retired or small families. An extra $20 a month is hard on them,” said Leah Juarez, the mayor of Mills.

- Juarez said she would no longer provide city resources for renewable projects connected to Rocky Mountain Power.

I’ll pause with that last bullet because that is the crux of this post. If the industry doesn’t get honest with electricity customers, the energy transition is over.

Analysis

I analyze a lot of things for a lot of different purposes and audiences, and therefore, I have ready access to my library of facts and truths.

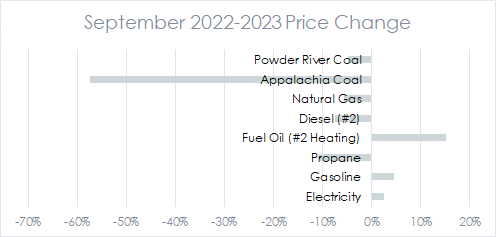

From September 2022 to September 2023, energy prices have escalated as follows.

These price changes reflect the cost to the user – utilities for coal[1] and retail natural gas[2], electricity[3], and petroleum products[4] for consumers. Powder River coal is Wyoming coal. In full transparency, the price of Powder River coal rose 13% from 2021 to 2022 (same source) for a compounded increase from 2021 to 2023 of 7%, a 3.6% annual escalation rate.

These price changes reflect the cost to the user – utilities for coal[1] and retail natural gas[2], electricity[3], and petroleum products[4] for consumers. Powder River coal is Wyoming coal. In full transparency, the price of Powder River coal rose 13% from 2021 to 2022 (same source) for a compounded increase from 2021 to 2023 of 7%, a 3.6% annual escalation rate.

The article states 71% of electricity sales in Wyoming were generated by coal. Using the sources cited above and the transportation cost,[5] the commodity cost of Powder River coal is 55% of the delivered fuel cost. The total coal fuel cost per kWh is $0.0208[6], assuming 32% coal plant efficiency calculated from the EPA’s eGRID data. The average price for electricity in Wyoming was 8.24 cents per kWh in 2021; the most recent data is available from the Energy Information Administration.

Therefore, the impact of coal prices on Wyoming electricity prices is:

- 71 portion of Wyoming’s electricity that is generated by coal, times

- 55 percent of the delivered cost of coal is the commodity cost, times

- $0.0208 per kWh of delivered coal fuel cost, divided by

- $0.0824 per kWh average cost of electricity, all sectors in Wyoming, equals

- 857282% of the cost of electricity in Wyoming is the cost of coal fuel

In other words, if the price of coal doubled, the price of electricity would increase by 9.857282%. Did the price double? See above.

Leaders and executives can manage their companies and inform their employees and customers as they see fit. I’ll end with a quote from Warren Buffet regarding trust. It’s rich, considering he owns the utility in question: “It takes 20 years to build a reputation and five minutes to ruin it.”

[2] https://www.eia.gov/dnav/ng/NG_PRI_SUM_A_EPG0_PRS_DMCF_M.htm

[3] My Wisconsin Northern States Power Bills

[4] https://www.eia.gov/petroleum/gasdiesel/

https://www.eia.gov/dnav/pet/PET_PRI_WFR_DCUS_SWI_W.htm

https://www.eia.gov/dnav/pet/PET_PRI_WFR_DCUS_SWI_W.htm

https://www.eia.gov/petroleum/gasdiesel/

[5] https://www.eia.gov/todayinenergy/detail.php?id=43695

[6] September 2023 fuel cost.