In September, I wrote a series of five Rants on data centers, a concise and comprehensive collection that might just be the Data Center Digest you never knew you needed!

- Chip and server power density, cooling, and projected GW load growth.

- Data center facilities from modular to 200 GW-plus hyperscale.

- Efficiency ratings and power usage effectiveness scales.

- Data center HVAC (minus the H because that’s not required) options.

- Future power shortages and power supply complications.

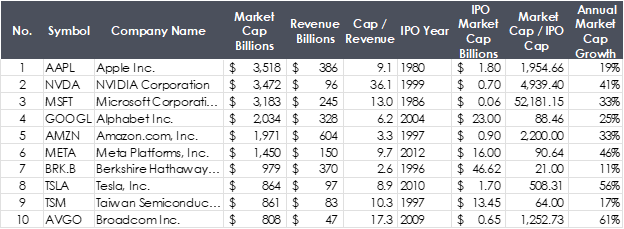

The anticipated load growth is due to artificial intelligence, which most professionals believe will explode—and so does Wall Street. Table 1 lists the current largest public companies in the United States, per StockAnalysis.com. The top six are massive artificial intelligence plays, with NVIDIA supplying the chips and the others buying them.

I researched and added data in the last four columns of the table, showing the initial public offering (IPO) year and the market capitalization at the time of the IPO.

Table 1 Largest Publicly Traded Companies in the U.S.

As tons of money pours into the AI speculation frenzy, some experts (that would not be me) are asking whether AI will be profitable.

As tons of money pours into the AI speculation frenzy, some experts (that would not be me) are asking whether AI will be profitable.

Will AI Change the World?

Two weeks ago, at the Inc. 5000 Conference, leaders of the fastest-growing companies in the country overwhelmingly believed AI would change everything. But what does Big Inc. think? One contributor to Big Inc. believes AI “will not change the world.”

Give me an example of changing the world, Jeff—the Apple iPod, which, as a Luddite, I never owned. Years later, I went straight to the iPhone, which cannibalized the iPod and destroyed competing products like the Sony Walkman, Motorola Flip Phone, and the Blackberry.

The iPod was smaller and lighter and offered customized playlists. Steve Jobs’ vision was to hook consumers with families of connected devices and services: Macs, iPads, iPhones, watches, iTunes, and Airpods.

World-Changing Disruption Ingredients

The keys to changing the world, according to the Inc. author, or being a disruptor, according to me, include these three elements:

- It makes life better / more convenient for people

- It commands a high price

- Future profits more than offset investment to build it

The Inc. commentator says AI passes none of these three tests. He writes that the users’ price is insufficient to cover the costs. “For example, GitHub Copilot, a service that helps programmers create, fix, and translate code, costs between $20 and $80 per month to run – way above the service’s $10 monthly subscription fee, according to The Wall Street Journal.” Fact check: true, as of one year ago.

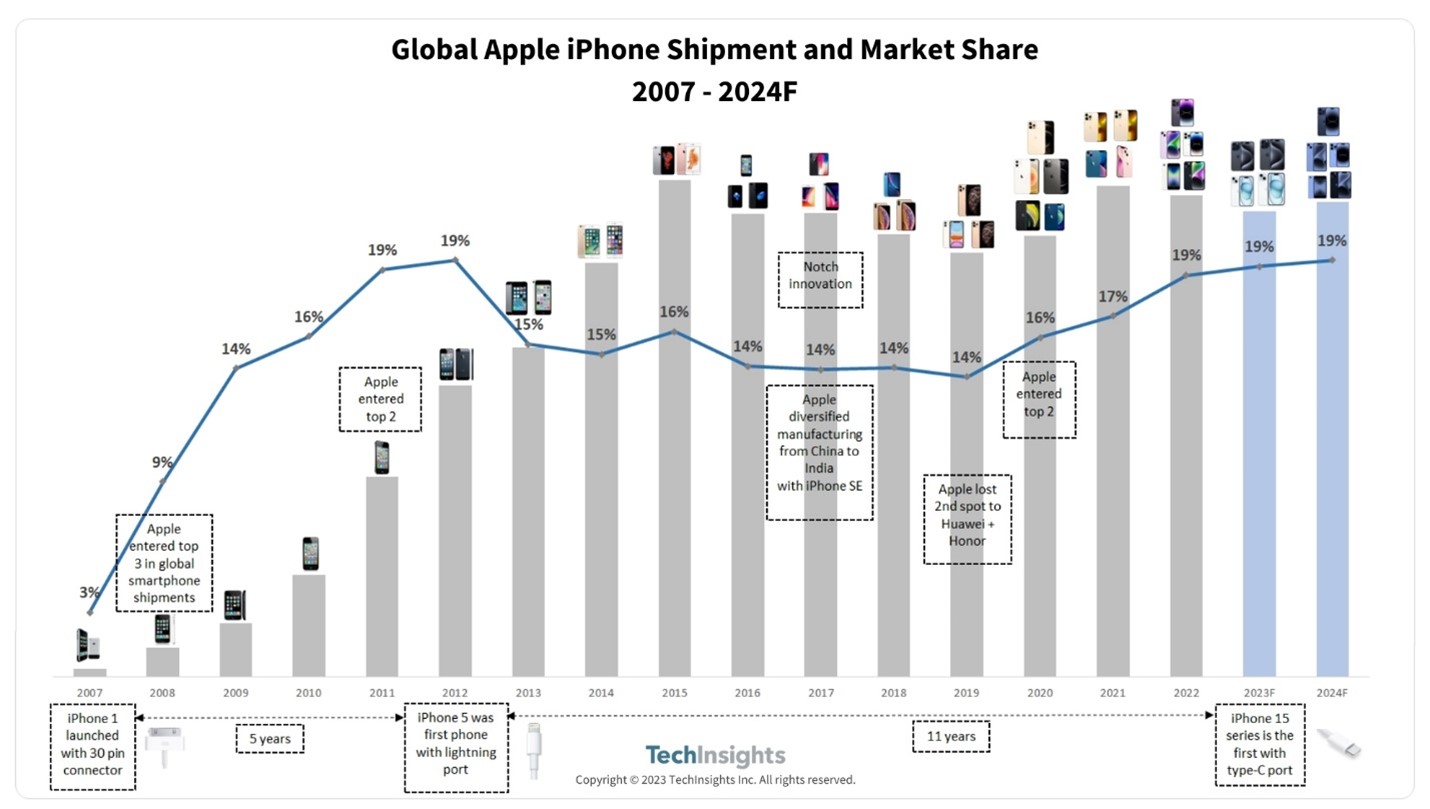

Please do not misunderstand: There are zillions of things and ideas in which large amounts of money can be made without changing the world. Reviewing the top six on the market cap list in Table 1, I would argue they all changed the world for better or worse. Also, Apple did not grab everything, but it did transform the world in terms of technology. Figure 1 shows Apple’s share of the smartphone market has hovered between 15% and 20% while Google’s Android alternative keeps technological pace by copying Apple, much like Bill Gates mastered the skill of taking others’ ideas, like the mouse, graphical user interfaces, spreadsheets, and word processors to craft a giant corporation himself.

Figure 1 iPhone Shipments and Market Share

Will EVs Change the World?

Will EVs Change the World?

Apply the three-way test to electric vehicles. Do they make life easier for people? No. Do they command a high price? Tesla, yes. Others, no. Is it profitable? Tesla, yes. Ford, no. Ford lost $132,000 per EV sold in Q1 2024. Tesla has figured out how to be profitable by creating a niche product that niche buyers want.

The Chasm

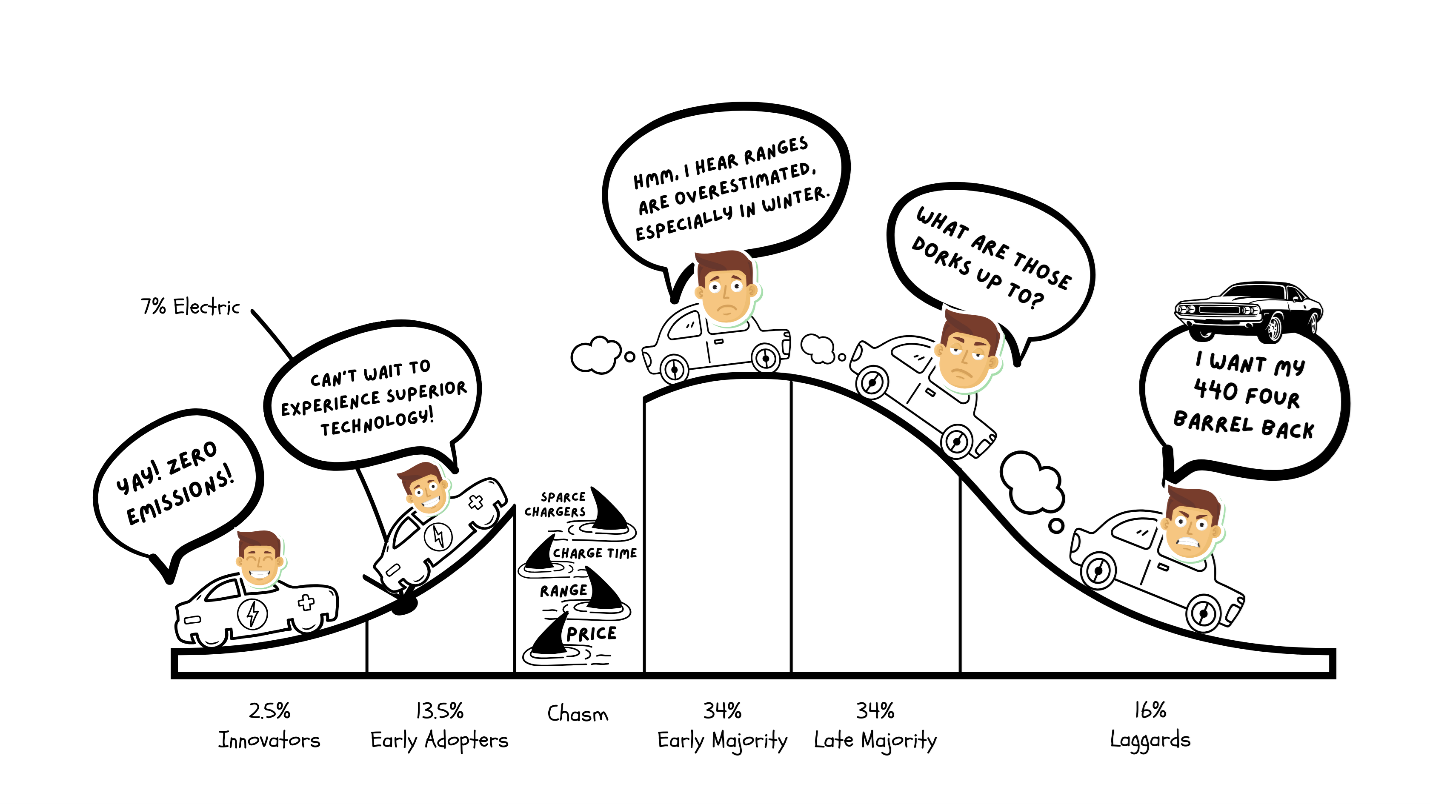

Can automakers succeed by getting the technology across the chasm? The chasm is the moat in front of the majorities on the market adoption curve.

We recently created the following market adoption curve for my electrification presentation to the Wisconsin Public Utilities Institute’s Energy Utilities Basics program. Sign up for next year; it’s a fantastic five-day course!

The EV market is approaching the chasm—the divide between innovators, early adopters, and the majority of the customer base. My theory is that the majority expect EVs to perform like gassers in terms of refueling time and range. However, The Wall Street Journal quotes shoppers and retailers: “We thought we could build a million of them and sell them,” said a VP with Sheehy Auto Stores, a large Mid-Atlantic dealer. They had a 6-12 month supply of EVs compared to one month of gassers.

The EV market is approaching the chasm—the divide between innovators, early adopters, and the majority of the customer base. My theory is that the majority expect EVs to perform like gassers in terms of refueling time and range. However, The Wall Street Journal quotes shoppers and retailers: “We thought we could build a million of them and sell them,” said a VP with Sheehy Auto Stores, a large Mid-Atlantic dealer. They had a 6-12 month supply of EVs compared to one month of gassers.

“I’m not hearing the consumer confidence in the technology,” said Mary Rice, dealer principal at Toyota of Greensboro in North Carolina, “People aren’t beating down the door to buy these things, and they all have a different excuse why they aren’t buying one.”

Customers are learning that the range is less than advertised, especially in cold weather. Where have I heard this before? According to the Society of Automotive Engineers, the range penalty in cold weather is 30-40%.

Price, convenience, and profit are not present for mass-adoption of pure EVs, known as battery electric vehicles, or BEVs. I’ll detail a much better alternative soon.

The Reverse Chasm of Fossil Fuels

I attended an electrification session at the ACEEE Summer Study for Efficiency in Buildings (they were impossible to miss). In one presentation, I was curious about a decades-long price increase in natural gas fuel costs. It showed natural gas prices soaring over 20-30 years. How is this when demand is falling? The theory is that once enough people are off natural gas, fewer customers will cover the fixed infrastructure and delivery costs.????Ok.

However, long before the point of crumbling demand for fossil fuels, there is a declining price magnet for consumers—the masses in the middle majority shown above. I call this the reverse chasm. In 85% of cases, the majority will choose the lowest-cost, most-convenient option.

I’m just telling it like it is because we sell to customers, too. The economics must be favorable, or at least equal, to advance. That is the challenge for electrification. Products and services that can deliver will succeed, and that’s what we plan to do!