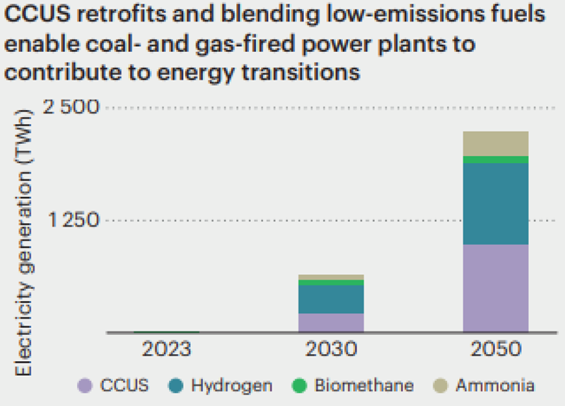

Last week, I was on a webinar when the following chart[1] emerged as a forecast for decarbonization.

I quickly thought of two things. First, an example from The Wall Street Journal, “Government often uses ‘catalytic tools’ such as regulation, tax incentives, grants, and loan guarantees to prompt innovation outside of government.” In other words, private equity and venture capitalists are not daft enough to shovel billions into hydrogen development. Only the government will do that. Hydrogen via electrolysis by renewable electricity supply can be done, but not cost-effectively. It will cost multiples of the price per million Btu of natural gas. Natural gas or carbon emissions would need to be taxed out of existence, but as I wrote a few weeks ago, consumers and businesses will not stand for that.

I quickly thought of two things. First, an example from The Wall Street Journal, “Government often uses ‘catalytic tools’ such as regulation, tax incentives, grants, and loan guarantees to prompt innovation outside of government.” In other words, private equity and venture capitalists are not daft enough to shovel billions into hydrogen development. Only the government will do that. Hydrogen via electrolysis by renewable electricity supply can be done, but not cost-effectively. It will cost multiples of the price per million Btu of natural gas. Natural gas or carbon emissions would need to be taxed out of existence, but as I wrote a few weeks ago, consumers and businesses will not stand for that.

Second, consider the investment flooding into big data and AI. Amazon alone, the peon from last week’s post, will pour a staggering $87 billion into Northern Virginia data centers. AI investment is at a frenetically speculative clip because fortunes may be made, but not for certain. Upstream suppliers of AI, like Nvidia, and even yawners like Intel and Advanced Micro Devices are doing well to exceptionally well. Midstream suppliers like Amazon and Google are relative stalwarts. The real gamblers, firms like the large-language modelers, including OpenAI, really don’t know what their service is worth and if it can charge enough to be profitable. Good luck!

Moving the ball forward between the micro and mega bookends of data centers (remember the disclaimer), I’m presenting some differences in data center facilities, ownership, and services this week.

Retail Collocation

Like thousands of other companies, Michaels Energy has traditionally networked its computing system and stored all files, servers, and computational engines on-premise. Over time, we have been migrating to the cloud for online services for customer relationship management, program tracking data, email, etc. We still have project files on premise, but those days are numbered. Going forward, we will migrate everything to retail (aka collocation) data centers as a service (DCaaS) to avoid messing around with hardware, outages, hassle, and labor to manage it in-house.

Wholesale Collocation

Larger users of data centers lease facilities in wads of 500 kW[2]or more, known as wholesale DCaaS. Like the definition of a hyperscale data center, the definition of wholesale varies from 300 kW to 10 MW. Wholesale data centers are chunked off with separate data halls – secure spaces within a facility – not just cages, but walled-off secure spaces or entire facilities. Wholesale data centers may collocate in a facility. They typically own and manage the computing hardware and lease a space or building.

Wholesale Enterprise

The largest wholesale DCaaS providers include enterprise contracts that take an entire facility. Think of Fortune 100 companies: JPMorgan, Coca-Cola, Exxon, Procter and Gamble, and Walmart.

Hyperscale

Hyperscale data centers “support primarily cloud service providers (CSPs) and large internet companies with enormous compute, storage, and networking requirements.” The site notes hyperscalers take 50,000 to 1 million square feet and have 5 to 100 megawatts of electric loads. Facilities can cost one billion dollars (think of Dr. Evil’s pinky, “boohahahahahh”). My lying eyes tell me these numbers are at the low end. I would start hyperscale at 500,000 sf and 100 MW.

Hyperscalers seek cheap land and electricity and access to enormous data pipes. Regions in the U.S. include Northern Virginia, Dallas, Northern California (Silicon Valley), Phoenix, Chicago, Atlanta, and Portland / Hillsboro. Hyperscalers include Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and Meta Platforms (Facebook).

Edge Data Centers

Edge is to data centers as distributed energy resources are to the grid. They are mini and micro data centers in distributed locations closer to the end user. One presenter at the Data Center Frontier Trends Summit advocated using distributed capacity from underutilized commercial real estate (office buildings) as a resource for distributed edge micro data centers. Simply plop modular data center boxes in unused parking spaces and power them with existing electrical service to the property.

Modular Data Centers

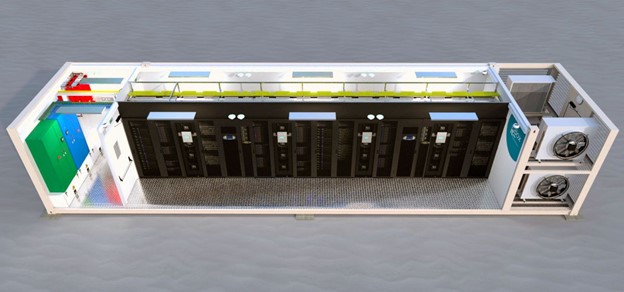

Finally, we have modular data centers, which flow from the edge data centers. These include packaged container data centers, as shown below.

This following image shows a container with power, IT, and cooling in one modular container.

This following image shows a container with power, IT, and cooling in one modular container.

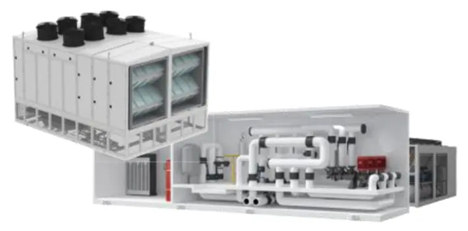

Modular data centers include prefabricated data halls that may be used to build out wholesale collocation and even hyperscale data centers. They include servers and networking equipment, while the larger facility provides power and cooling. “Prefabricated data halls, which comprise several thousand square feet of space and 50 to 200+ racks, allow large wholesale and hyperscale data centers to be built from smaller subsystems.”

Modular data centers include prefabricated data halls that may be used to build out wholesale collocation and even hyperscale data centers. They include servers and networking equipment, while the larger facility provides power and cooling. “Prefabricated data halls, which comprise several thousand square feet of space and 50 to 200+ racks, allow large wholesale and hyperscale data centers to be built from smaller subsystems.”

Finally, we have the prefabricated power and cooling modules. Power modules include uninterruptible power supplies, batteries, switchgear, and automatic transfer switches. The cooling modules are for chilled water, air-cooled, or water-cooled, with or without economizers for free cooling. Components include chillers, valves, pumps, variable speed drives, and chilled water storage for resiliency.

Next Up

Next Up

Next week, we will examine the wide range of HVAC efficiencies and designs for data centers and then consider how these exploding electrical loads might be met with generation and transmission assets.

[1] Source: Rocky Mountain Institute.

[2]The equivalent of about 200 homes at peak summer load.

Next Up

Next Up