Longtime Rant readers know I keep both feet on planet Earth, capturing all sides (typically two) and explaining, yes, but (fill in the blank). For the next case study, I was recently presented with a slide deck from the Rocky Mountain Institute (RMI), The Cleantech Revolution, It’s Exponential, Disruptive, and Now.

There are many brilliant people at RMI. Amory Lovins, its cofounder, is one such brilliant revolutionary. Amory’s famous home in the Rockies can grow bananas in winter. That’s great, but is it scalable? It is 4,000 square feet and was completed in 1984 for $500,000, which would be over $1.5 million today, according to the consumer price index. Considering the cost of housing these days, it may be closer to $2.5 million today.

Here are a few themes from the slide deck:

- “Cleantech costs have fallen by up to 80 percent, while investment is up nearly tenfold and solar generation has risen twelvefold.”

- Exponential growth of cleantech will continue, and by 2030, “we[1]” will be installing 1,000 GW of solar per year.

- “Renewables will drive fossil fuels out of electricity generation, electrification will push fossils out of final energy” [transportation and heating]. Some 75% of fossil fuel demand is exposed to become stranded assets.

I will dissect some of these statements.

Solar Costs and Generation

Solar panel costs have plummeted, but there will be a price floor that is not unlike that of personal computers. Prices of computers fell since the Apple Macintosh was introduced for an inflation-adjusted price of $7,700 in 2024 dollars. I’m drafting this blog post on a Dell 7340 laptop, which retails for around $1,300, depending on features. The Dell probably has at least 1000x the computing power and RAM, a high-resolution monitor, and a touch screen – all advantages over the 1984 Mac. In those terms, the cost per value probably fell by 99%.

But cost isn’t the only factor. The solar industry has been brutal over the decades. As I explained in Solar Wars, the Inflation Reduction Act is delivering the opposite of its namesake. The Wall Street Journal reports the IRA drove up inflation and interest rates, crushing longtime solar companies and other energy revolutionaries. Their op-ed Another Green Energy Subsidy Bust chronicles the following lowlights:

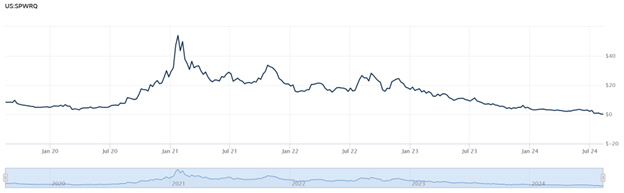

- SunPower, one of the country’s top rooftop solar installers, [last] week declared bankruptcy.

- SunPower was a 39-year-old company – just a year younger than Michaels Energy. Indeed, a company doesn’t exist that long while being managed by fools.

- SunPower reported a “severe liquidity crisis caused by a sharp decline in demand in the solar market and SunPower’s inability to obtain new capital.”

- The sharp decline in demand is noted by The Journal article and explained in Solar Wars.

- Other solar bankruptcies in 2024 include Titan Solar Power and Sunworks. As of my drafting this, you could buy 180,000 shares of Sunworks for $54.

- British Petroleum and Orsted wrote down $1.1 billion and $4.0 billion in canceled offshore wind projects. The Journal quips, “Talk about stranded assets.”

- Shell is closing its California hydrogen stations because no one is buying fuel cell cars. Hydrogen. ???? Forty-five years of failure denial lives on.

SunPower’s stock peaked four days after President Biden was sworn into office at $54.01 per share. Today, if you want to throw $54 away, you could purchase 348 shares of SunPower. The price is so low they had to show negative values on the Y-axis.

Exponential Growth

Exponential Growth

Growth is exponential until it isn’t, and it hits a ceiling. Electric vehicles are the latest example. In California, which by far has the most significant share of EVs in the United States, the market share of EVs dropped for the first time in quarter two of this year.

California has an optimal climate for EVs. The Society of Automotive Engineers (SAE) recently posted an article on EV cabin heating: EV Give Me Heat! “Pushing the HVAC button in an EV, though, elicits second thoughts such as, ‘If I turn on the heat, will I have enough range to get home?’ Most passenger-vehicle owners [I estimate 80%] won’t accept the tradeoffs in cabin comfort that come with doing away with the ‘heat engine.'”

California has an optimal climate for EVs. The Society of Automotive Engineers (SAE) recently posted an article on EV cabin heating: EV Give Me Heat! “Pushing the HVAC button in an EV, though, elicits second thoughts such as, ‘If I turn on the heat, will I have enough range to get home?’ Most passenger-vehicle owners [I estimate 80%] won’t accept the tradeoffs in cabin comfort that come with doing away with the ‘heat engine.'”

Yes. I first pointed to the cabin heating issue fourteen (14) years ago and reiterated the challenge for cold climate EVs ten years ago. Cabin heating and defrosting are major loads.

Renewables Destroy Fossil Fuels

Unfortunately, “electrification will [not] push fossils out of final energy” anytime soon – like for thirty years for two fundamental reasons: storage and delivery advantages of fossil fuels.

For example, per the SAE paper, the 14.8-gallon tank in the author’s hybrid pickup truck holds five times the energy of an extended-range Ford Mach-E. A Google search of “F150 pickup fuel tank replacement” shows the average cost is $170. A Ford Mach-E battery retails for $16,022.12 on FordParts.com. That’s a bargain price because Digital Insurance says they cost $33,000. Toss in the factor of 5 in energy storage, and the battery storage costs 500 times more than the gasoline alternative for heating. Or, as some people like to say, gasoline storage is 500 times less expensive than battery energy storage. And because mineral extraction requires 500,000 pounds of earth to make one battery, the floor price of an EV battery is an immovable object. Where does the energy to move and process the 500,000 pounds come from?

Natural gas is even simpler to harvest and transport than petroleum because it’s, uh, natural. Energy-intensive and expensive refining is not necessary.

More recently, on Sunday, The Wall Street Journal published another article, “Clean Fuel Startups Were Supposed to Be the Next Big Thing. Now They Are Collapsing.” Investors include Chevron, BP, Shell, General Electric, and startups like Plug Power. All sought alternative fuels from green hydrogen to liquid fuels from feedstocks, including cooking fats, oils, plant material, and even trash. Startup stocks are down 80-90%, and they can’t get the money to continue operating. These startups need “great amounts of power” while “interest rates, supply chain disruptions, and expensive power-grid upgrades have driven up electricity prices.” The startups are also losing bids for clean electricity to data center operators.

Conclusion

The energy transition will be a longer and more difficult grind than many realize. If it were easy, we would already be there. “There are no shortcuts to any place worth going.” -Beverly Sills

[1]If “we” is the United States, “we” only have a peak load of 880 GW, and so a 1,000 GW of solar per year, even with a capacity factor of only 22%, is far more than the grid can handle or anything can store.