I am typically afforded the freedom to chase rabbits as I write these posts, but last week my mission was to reflect on 2020 and forecast 2021. In the process of starting that, I chased a rabbit that is the subject of this post.

It is as easy to shoot down ideas as it is to be negative because humans have a negativity bias, which means negative events have a greater impact on brains than positive ones. For example, I recently read that the joy of finding $20 in a coat pocket, say from a year ago, is overwhelmed by the shock of realizing you lost $20 that you needed to buy a pair of $7 lattes for a friend and yourself.

To forecast the future, it is essential to study the past, and one thing never changes: human nature. Tribalism, what’s in it for me, security, safety, winning, power, world domination, and so on – essentially all the good and bad things that make us human. Only times and technologies change. People do not.

Efficiency’s Founding

Our industry was founded due to several things: dependence on foreign energy, especially oil, fear of running out of energy, particularly oil. In my formative years, oil and natural gas were in short supply, to the point that supplying buildings with natural gas was prohibited around 1979. That spawned a blowout of coal-fired power plants because coal was/is a domestic source.

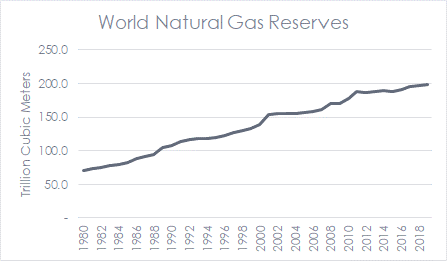

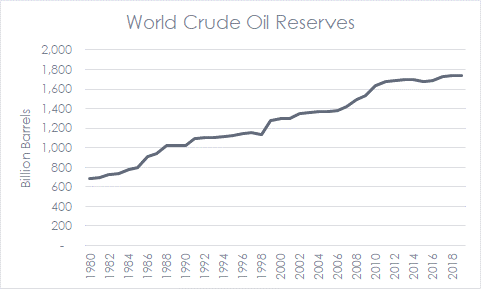

Now we have reserves of natural gas and oil that will last decades, and the reserves keep rising. Coal is exceedingly abundant, with proven reserves to last about 400 years. Crude and natural gas reserves have increased by about 80% during my career in efficiency alone! Why does this matter? It’s competition!

China

China

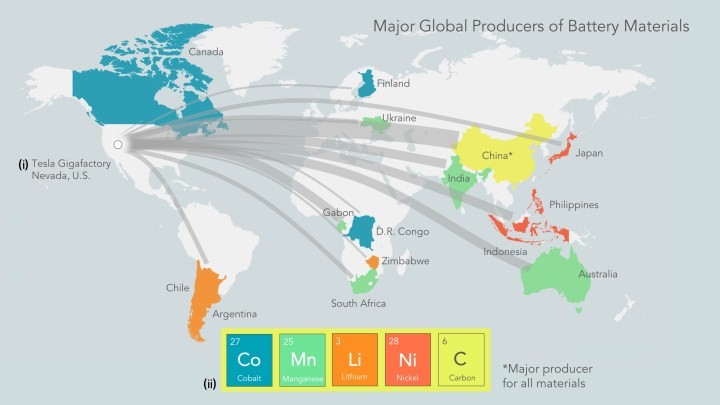

We not only have competition from gluts of conventional fuel; we have foreign competition from the likes of China. China has more coal-fired power generation in planning (98 GW under construction and 152 GW under development) than the entire functioning coal fleet of power plants in the United States. Coal’s share of global power generation is growing. The upshot of all of China’s coal generation is their market for electric vehicles is surging, probably because of the big three energy reserves (coal, oil, and natural gas); China has more coal. As a result, emissions due to EVs in China are greater than those powered by gasoline. They also have dominant reserves for rare earth materials for battery construction and manufacturing. They stick a stiff pricing signal to the tune of $13,000 to license a vehicle with an internal combustion engine.

In the U.S., we have a bit less centralized planning compared to China. Our industry seems to simultaneously want distributed energy resources and China-like top-down policies to move folks to electrified lifestyles from EVs to space heating and away from carbon-spewing power generation.

Security

Why does all this matter? Consider the big picture. People and countries use what they have to their advantage, and if that advantage is forfeited, there will be consequences. As I’ve written, there is no such thing as an unintended consequence. Just get rid of that word. Forfeiting energy independence for dependence on rare earth minerals (most of which come from third-world countries using child labor in dangerous mines to make EV batteries) comes with consequences. See here per PBS: “They continually inhale cobalt dust, which can cause fatal lung disease,” all for a dollar or two for a day in these mines. This is not the answer. It does not compute. Social justice?

While everyone seems to be charging ahead with the lithium-ion battery-powered car, it is not scalable. And what is the embodied energy in the car batteries that take an average of 500,000 pounds of earth (about nine 18-wheelers loaded to the limit) to make just one unit? Every mile driven requires five pounds of earth, just for the battery! How much energy does it take to ship these materials around the planet to manufacture the unit? I couldn’t find that answer, because it’s a hard question. Subsequently, I found that this EV driver writes the same things.

Li-Ion Alternatives

Better alternatives to Li-ion batteries may include hydrogen and fuel cells or different battery technologies.

How much material does a fuel cell require? I don’t know, but it blows my mind that all car manufacturers are developing vehicles, seemingly all using Li-ion technology requiring materials that are extremely rare, from all over the world, mostly in control of despots. If there’s one thing learned in 2020, it was the importance, control, and ownership of critical supply chains.

Look what just fell into my Firefox “pocket” – a New York Times story about a guy in New York who makes hydrogen with solar panels to power his hydrogen hypercar: 0-60 mph in 2.2 seconds and a 1,000 mile driving range. I suggest some thought and planning along those lines.

Look what just fell into my Firefox “pocket” – a New York Times story about a guy in New York who makes hydrogen with solar panels to power his hydrogen hypercar: 0-60 mph in 2.2 seconds and a 1,000 mile driving range. I suggest some thought and planning along those lines.

Sodium Sulfur

What about other battery technologies? Sodium sulfur batteries seem to be an opportunity to overtake Li-ion. Something much more scalable, less damaging, greener, and safer while avoiding serious geopolitical risks of lithium-ion technology is required for any meaningful adoption of EVs. There are (pun alert) tons of consequences continuing with the Li-ion path.

Electric Vehicle enthusiasm, the hunt for a decent battery, and Sodium-Sulfur technology are 60 years old, at least. Ford, you know, the car company that’s worth 4.8% of Tesla, was developing EVs and sodium-sulfur batteries in 1966. Where are they now?

Smells Like Teen Spirit. You’re welcome.

China

China