This post features my predictions from a year ago and what has happened since.

Forecast #1: “The Ukraine war will not end peacefully with a desirable outcome as long as the bipartisan U.S. Congress keeps laundering money through the military-industrial complex (and others) in this proxy war with Russia.”

The Wall Street Journal, December 15, 2023: “Nearly two years into the war, Putin’s gamble that Russia can outlast Kyiv’s Western backers appears to be paying off.” That was after Ukrainian President Zelensky visited Washington in December to urge Congress to send more weapons, to no avail.

The average Ukrainian soldier is 43 years old, up from 30 to 35 at the beginning of the war. I have said the U.S. will send weapons as long as there are hands in Ukraine to shoot them. They are running out of hands. Shameful.

Forecast #2: “Belarus, an ally of Russia, may be drawn into the war.”

As of December 4, 2023, Belarus has only observed the war.

Forecast #3: “To restore its prominence among natural disasters, the tornado lobby, outraged by the inflammatory language used to describe snow and cold fronts as ‘bomb cyclones’ and ‘polar vortices,’ will file for the naming rights to ‘Satan’s funnel.’”

If I had done some research, I would have found that they already have a somewhat scary name for a tornado: a wedge, not to be confused with a wedgie.

Forecast #4: “The list of postponing power plant closures grows, but outage risks will remain high.”

On December 14, 2023, the California Public Utilities Commission approved an extension for Diablo Canyon, the state’s last operating nuclear power plant, for five years to operate through 2030.

On May 19, 2023, Utility Dive reported the Midcontinent Independent System Operator (MISO)’s capacity auction results. “’ Reduced load forecasts and actions taken by members such as delayed retirements and increased imports may not be repeatable,’ the grid operator said.”

“Power plant retirements, driven by economics, environmental regulations, and state and utility decarbonization goals, will lead to tightening supply,” said Vinay Gupta, senior manager for energy power markets at ICF. “These retirements could threaten utilities’ ability to meet the resource adequacy requirements, increasing the value of existing and new firm capacity.”

Forecast #5: Concessions made to Virginia Senator Joe Manchin for supporting the Inflation Reduction Act would go nowhere. Specifically, permitting for the Mountain Valley natural gas pipeline would die in Congress.

Timeline:

May 6, 2022, the Fourth Circuit[1] tied up construction of the last five percent of the pipeline at the behest of environmental groups. If not completed by October 2022, developers would have “to ask the Federal Energy Regulatory Commission to extend its Certificate of Public Convenience and Necessity.”

June 3, 2023, the President signed the debt ceiling increase, which “expedites the remaining permits” for the pipeline despite the Fourth Circuit.

July 11, 2023, “A Republican intercession in the debt-ceiling legislation promised to liberate the pipeline from limbo.” But “for the umpteenth time, a three-judge panel [from the Fourth Circuit] on Monday halted pipeline construction even though Congress and President Biden have stripped the court of jurisdiction.”

July 27, 2023, the United States Supreme Court vacated the Fourth Circuit’s order to block construction. Dig away!

Wow. This is another example of the need for behind-the-meter solutions because building infrastructure – offshore wind, transmission lines, etc., takes FOREVER.

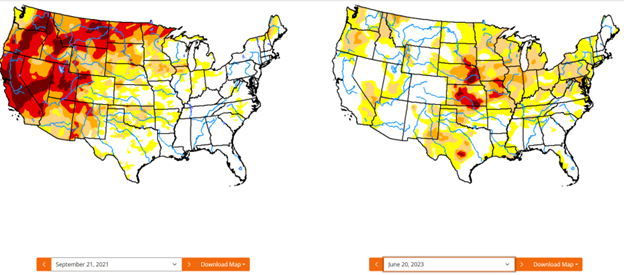

Forecast #6: “The [California] drought will be over by the end of the rainy season in spring, and the reservoirs will be full.”

The following charts are from the University of Nebraska-Lincoln’s U.S. Drought Monitor, comparing the end of Summer 2021 to the beginning of Summer 2023.

Forecast #7: “Wind and solar installations will fall under 10 GW for the first time since 2014.”

Forecast #7: “Wind and solar installations will fall under 10 GW for the first time since 2014.”

Solar plus wind installations have surpassed 10 GW through the third quarter of 2023. Solar installations are up roughly 5%, with 8.4 GW installed through three quarters, while onshore wind declined 60%, with 2.3 GW installed through three quarters. I got this half correct per my headline, “Utility Scale Renewable Construction Decline.” Combined, solar and wind installations are down about 11% through three quarters.

Forecast #8: “The intended results of the infrastructure bill and ‘Inflation Reduction Act’ will be stunted by at least five factors in 2023, such as physics, trade disputes, specifications, and uncovered requirements.”

The infrastructure bill includes electric vehicles and buses[2], home energy retrofits, wind and solar, smart grid, storage, carbon capture, and hydrogen[3]. The IRA provides federal grants, loans, and tax credits for heat pumps, heat pump water heaters, and zero-carbon power generation, including qualifying nuclear, electric vehicles, hydrogen, renewable jet fuel, and energy storage[4].

According to The Wall Street Journal, 1) inflation and resultant high interest rates, and 2) geopolitical tensions drive investments toward energy security such that “the path to a low-carbon future now looks less straightforward.” The geopolitical tensions include the Ukraine war, which reduced natural gas and oil supply from Russia to the world market. Reduced supply from Russia drew investment from others away from renewables to increase the supply of oil and natural gas.

The New York Times reports that 3) receiving a $7,500 tax credit for an EV becomes harder on January 1, 2024. The reason includes three words: supply, chain, and Chy-nuh. China is entrenched in the supply chain and is arguably the biggest winner in the infrastructure and “inflation reduction” acts. Per the Times article, we 4) can’t build manufacturing fast enough.

In January 2023, The Wall Street Journal reported that the 5) Interior Department blocked mining development of “the world’s largest undeveloped mineral deposits, including copper, nickel, and cobalt that are needed in vast quantities for EV batteries.” Location: Minnesota’s Superior National Forest. I.e., the government prefers we wreck Indonesia and Congo, where there are no regulations.

Forecast #9: “EV sales will not double [in the U.S.] in 2023.” This bet was against Wood Mackenzie, which projected 100% growth.

Per Experion, EV sales are up 56.7% through September, while sales of “Other” car types (not gasoline, hybrid, diesel, or fuel cell) are up 2,892.7%[5]. Sales of conventional cars with internal combustion engines, aka gassers, even increased 1.4%. Last month, the New York Times noted that BloombergNEF projects 47% EV sales growth in 2023 and 32% in 2024.

Forecast 10: Electric grid attacks, particularly on substations, will continue.

In September, Politico wrote that utilities reported 60 physical threats or attacks to major grid infrastructure. Nine of those attacks led to power disruptions, and the country was on pace to meet or exceed 2022’s 164 major cyber and physical attacks.

Forecast 11: The press would cherry-pick incidents to report those with the appropriate profile to fit narratives.

One Zerohedge article pointed to this one from The Wall Street Journal, saying incidents were prompted by a diversity of dishevelment, including the pandemic, social tensions, and economic challenges. For example, Vandals in Washington a year ago shot up substations so they could shoplift. Profiles of attackers have this common thread: weapons.

Forecast 12: “Joe Mansion will announce that he will retire at the end of his term in 2024 to ‘spend more time with his family,’ which is code for “I’m doomed, and I do not want to experience evisceration at the ballot box.”

Ah, the best for last. On November 9, Joe announced he would not run for re-election so he could travel the country to “see if there is an interest in creating a movement to mobilize the middle.” He used different code.

[1] Presumably, the U.S. Court of Appeals for the Fourth Circuit, Richmond, VA.

[2] https://www.whitehouse.gov/build/guidebook/

[3] https://www.mckinsey.com/capabilities/sustainability/our-insights/one-year-into-the-bil-catalyzing-us-investments-in-energy

[4] https://www.mckinsey.com/industries/public-sector/our-insights/the-inflation-reduction-act-heres-whats-in-it

[5] Examples of “other” not provided.