The last two posts, Nuclear Power over the White Rabbit and the Clean Power Plan Corpse, demonstrated the fruits of an undiversified baseload fleet of power generation. Electricity prices, which were so low during most of my career that few cared about them, are soaring as natural gas – the basket in which all eggs lie – has become a global fuel. I predicted this as recently as 2017; Reverse Diversification Coming to a Utility Near You. Solar, wind, and storage will never compete with thermal baseload power generation in our lifetimes.

I’m covering three things in this post due to the pickle we have painted ourselves into (I love mixing metaphors). They are half-truths that got us here, the future of energy markets, and an overhaul of benefit-cost models.

Misinformation

The word misinformation is a faulty weapon frequently used by news reporters who want their spin and conclusion on facts. When I hear “misinformation,” it is safe to assume half the story is buried.

When I read the headline, “Solar Is Now 33% Cheaper Than Gas Power in the US, Guggenheim [Securities] Says,” the word misinformation comes to mind. Also, my money will never land in a Guggenheim account for investment if they are that dumb. The sun provides heat at a lower cost than natural gas. But what if it’s 114°F in Phoenix? Please turn it off. Or what if it’s minus 40°F in Fairbanks? Please turn it on. Statements like this result in rate cases for 129% increases in electricity prices. Lawmakers and policymakers either don’t understand this or don’t want to consider this misinformation.

Is Wholesale Competition Doomed?

Wholesale power deregulation started under George H. W. Bush’s Energy Policy Act of 1992. For a rocket ride of market history, see my post on MOPR, the minimum offer price rule for wholesale markets. MOPR’s purpose is to stem the advantage that renewables have over reliable, dispatchable, baseload powerplants, as mentioned in the previous section. The greatest non-energy benefit of thermal generation is reliability.

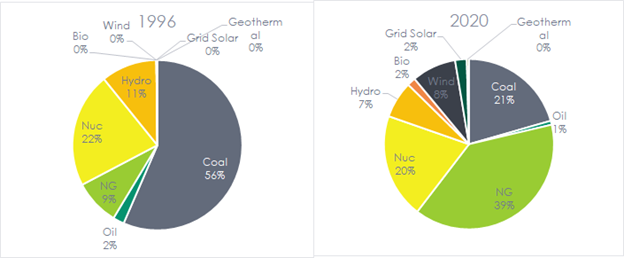

Back in the 1990s, when wholesale deregulation was conceived, we had plenty of excess capacity and coal and nuclear power, representing 78% of our electricity supply with months or more of fuel storage on site. Today, they represent only 41%, and nearly all excess capacity is gone. The good news is the average carbon intensity of our electricity supply in the U.S. is about 40% lower over the term. The bad news is that we’ve surrendered price sovereignty to the world market, and the two primary elements of cheap supply – reserve generating margin and fuel storage – are greatly reduced.[1]

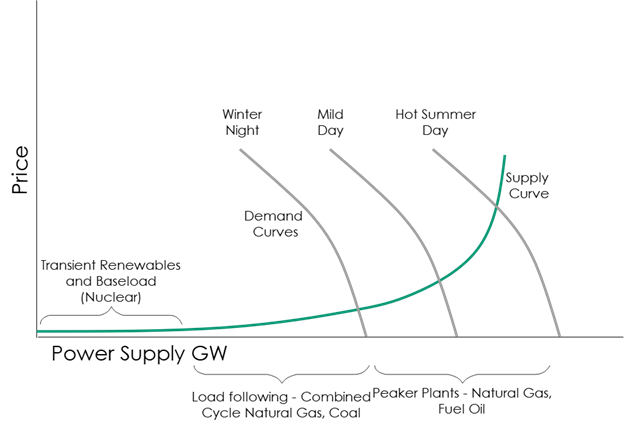

Wholesale markets work on forward-bid, reverse auctions, as explained here. A cartoon from that post is repurposed below[2]. There are three regimes of supply resources:

Wholesale markets work on forward-bid, reverse auctions, as explained here. A cartoon from that post is repurposed below[2]. There are three regimes of supply resources:

- Baseload plants, which provide the cheapest electricity, include renewables and nuclear power.

- Load-following supply, where an efficient grid would have a nice fleet of dispatchable, relatively low-cost supply.

- Peakers, which can be very expensive to operate. For example, fuel oil costs to operate a peaker plant are greater than the value of generated electricity (pre 129% electric rate hike)[3].

The problem is the transient renewables move the supply curve left and right in major swoops. If the wind blows to generate near full capacity, it extends the curve to the right such that nuclear power is beyond the demand curve, and they must sell at a loss because it is cheaper to sell at a loss for a while than shut down and restart.

The problem is the transient renewables move the supply curve left and right in major swoops. If the wind blows to generate near full capacity, it extends the curve to the right such that nuclear power is beyond the demand curve, and they must sell at a loss because it is cheaper to sell at a loss for a while than shut down and restart.

If I’m an investor who understands how the wholesale market works, I’m not investing in dispatchable natural gas power plants because I don’t know how often renewables will push me beyond the demand curve. And the future cost of natural gas looks like a wild guess. I need more assurances than what the “free market” offers.

If I’m an investor in renewables, I say give me more because I get the same price the poor bastards in the load following and peaker plants get. When electricity prices double, it’s all gravy for wind and solar generators. The last kW on the grid sets the price for all suppliers at any given time.

In engineering, we call this an unstable system. The market favors more instability with added random supply and discourages stability because fuel sources have been un-diversified.

Call me crazy, but I’ve warned for years that tilted competition in a market with zero storage will break the market. I believe the generating fleet must be regulated to provide a decent mix (diversity) of resources to keep prices within reason and maintain first-world reliability.

Benefit-Cost Test Overhaul

Efficiency and demand response programs are based on benefit-cost analyses (tests). The benefits are always avoided costs, and they include some combination of avoided transmission (like superhighways for electricity delivery), distribution (local roads), generation (power plants), primary fuel, and any number of other benefits, like emission reduction and air quality.

Stop and think about those benefits for a second. What do they look like to you? It looks to me like a fully regulated monopoly and a cost-of-service model, but that is not what we have. We have a competitive, free-agent market for electricity. Where are the avoided supply constraints, avoided fuel-shortage costs, and averted outage benefits? I call bull-BM on low avoided cost. Fix this!

[1] Fuel, generation, and emissions source: https://www.epa.gov/egrid/download-data

[2] The demand curves show some elasticity based on an aggressive price signal. Today, there is almost no elasticity, which would make the curves vertical lines.

[3] Typical turbine efficiency of 30%, current industrial bulk fuel oil prices.