Last week we explored the mélange of combinations of energy efficiency portfolio administration, delivery, and evaluation among stakeholders, including public utilities’ commissions, utilities, for-profit and non-profit administrators, and program implementers. No two states are alike. This week we will discuss a few more things from the article in Public Utilities Fortnightly, Top Performing States in Energy Efficiency.

Impact of Energy Efficiency Resource Standards (EERS)

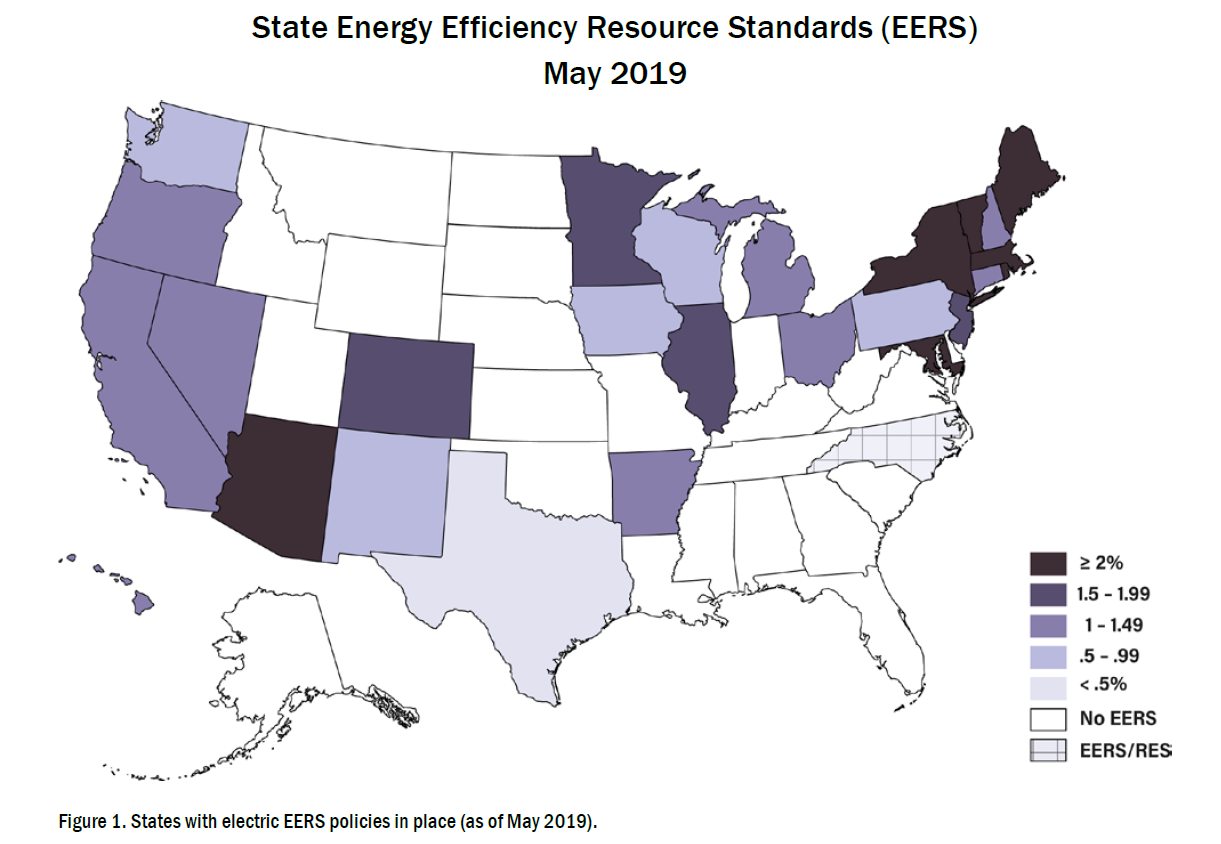

States have everything from carrots, sticks, both, or neither for meeting efficiency goals. Some states have energy efficiency resource standards. The map below, courtesy of ACEEE, shows recent EERS across the fruited plain. An EERS “is a long-term (3+ years), binding energy savings target for utilities or third-party program administrators.” A binding target is not much of a bind. It sounds like an optional ankle bracelet. Nevertheless, ACEEE reports that “states with an EERS in effect at that time achieved incremental electricity savings of 1.2% of retail sales on average, compared to average savings of 0.3% in states without an EERS.” In other words, making a target public and setting expectations indeed makes a significant difference.

https://www.aceee.org/sites/default/files/state-eers-0519.pdf

Compensation, Rewards, and Penalties for Efficiency Administrators

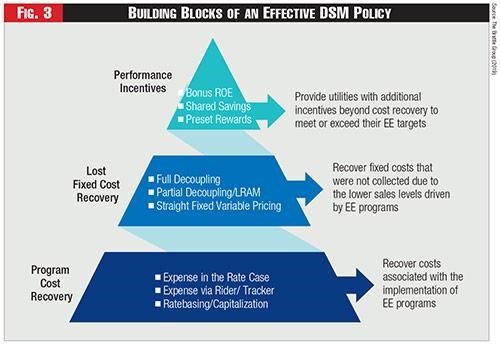

The Fortnightly article mentions nine ways in which utilities are compensated for running efficiency programs. The bottom tier pays for program delivery. The second tier compensates for lost revenues due to efficiency. The third tier on top includes incentives and bonuses.

First, there is recovering the cost to administer and deliver the programs. They include:

- Add an expense to the rate case. This is less transparent than a rider as if any customers read and understand their tariff to see the rider.

- Rider added to the cost of energy used. This is likely most common.

- Ratebasing, which presumably means adding the cost to the rate base.[1] This would be a heck of a deal because it treats efficiency like a supply-side resource. Frankly, I think there is very little if any of this in the country. Provide examples, please.

The second tier includes compensation for lower energy sales. When energy sales decline, revenue declines, and this is a problem not just due to efficiency but flat, no-growth sales. These mechanisms include:

- Decoupling, which separates revenue from sales. I believe that where decoupling is absent, utilities still recover to achieve their entire revenue requirement. It just takes longer.

- LRAM, or lost revenue adjustment mechanism, allows utilities to get paid for the savings. For more LRAM, see my post from exactly six years ago. In there, you can see why if a utility’s sales are decreasing, decoupling is the best for them. If sales are increasing, LRAM!

- “Straight fixed variable pricing” seems like the oxymoron of the year. No idea.

The third group of incentive options for high performance includes:

- Bonus ROE. What is ROE? Don’t look in the article because it’s not there. It is Return on Equity. In this regulated industry, regulators set the return on investment, in this case, equity. I believe the market determines bond returns[2], but that is an operating expense passed through to the customers. Doing well on efficiency allows utilities to get a higher ROE in places where it is permitted.

- Shared savings, as it sounds, benefits the utility through evaluated net savings, and there is the rub. Evaluation transforms from “how are you doing?” to “how much added profit will I say you deserve?” That is a no-win situation, and for sure, the evaluator better not be working for the utility.

- Preset awards are essentially bonuses based on performance, I believe, for hitting kWh (energy) or kW (coincident peak load) targets. Sticks can also be deployed. Some states have sticks and no carrots, and that’s a raw deal.

A paper produced by the National Renewable Energy Lab provides better and more in-depth discussions about performance-based regulation (PBR) in Next-Generation Performance-Based Regulation (a title only an engineer would love). The first PBR option is “no explicit incentive.” This works well in the scenario I explained last week, where a state has a “cooperative environment of trust to do the right thing with decent but not great oversight.” The paper says, “all regulation is incentive regulation.” Really? Yes, because it’s all public relations – looking good to customers, regulators, and antagonizing interveners. Why? Because looking good and being liked makes it easier to build stuff and pass rate cases (raise prices).

Ahead

Did you hear the story of the Christmas ham? The family tradition includes ham for Christmas dinner.

Every year, like some ritual, the family cook hacked off the end of the ham until somebody finally asked, “Dude, what are you doing?”. Grandma’s roasting oven back in the day wasn’t big enough for the ham, so she had to lop it off to fit in the pan. Apparently, they got the same ham from the same hog every year, but that’s beside the point. Grandma retired from cooking. The current oven is plenty big, and so they stopped hacking off the end. Duh!

Every year, like some ritual, the family cook hacked off the end of the ham until somebody finally asked, “Dude, what are you doing?”. Grandma’s roasting oven back in the day wasn’t big enough for the ham, so she had to lop it off to fit in the pan. Apparently, they got the same ham from the same hog every year, but that’s beside the point. Grandma retired from cooking. The current oven is plenty big, and so they stopped hacking off the end. Duh!

Efficiency cost-effectiveness models are like Grandma’s Christmas ham. They began because we were running out of oil, natural gas, and everything else. In 2021, we are weighing their cost-effectiveness like it’s 1979. Dude, what are you doing? Wind turbines, solar panels, batteries, and transmission lines are anything but free, but we treat them as such. Change the model!!!!!!!!!!!!

[1] The article does a poor job of explaining these things. The term “ratebase” does not appear in the article.

[2] Investment risk, competing rates, and competing investments, e.g., equity.