If you haven’t seen my recent conversation on The False [unrealistic] Promises of Electrification with Katherine Johnson on The KJ Show with Dr. KJ, check it out. I received a lot of great feedback from folks. I don’t grade my work except for my objective, New Year’s Predictions, but I’ll take others’ word for it on this one.

Gaslighting Natural Gas and Electricity Prices

Here is something from Food and Water Watch that caught my eye in the middle of the night: Lawmakers, Advocates Rally in Manhattan to Demand Action on Soaring Utility Bills. That is clickbait to me.

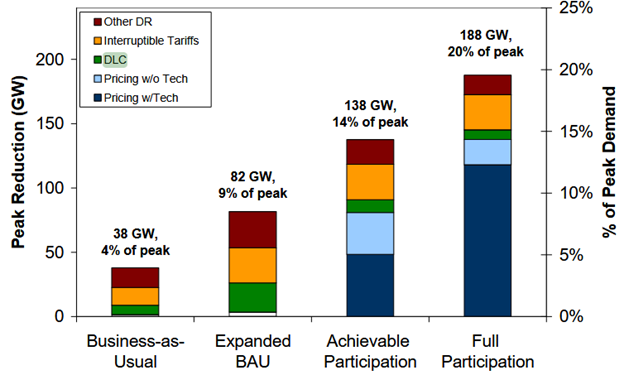

New York is strangling its electricity supply of natural gas, coal (gone since 2010), and fuel oil to generate electricity. Figure 1 shows the state’s generation mix in 2021.

Figure 1 New York’s Electricity Mix

That background knowledge piqued my interest in the Food and Water Watch piece. So, what’s their beef or tofu? The rally on the elite Upper West Side (one of my favorite places to visit in NYC, especially Zabar’s and H&H Bagels) “demand[ed] passage of the NY HEAT Act — a bill that would cap utility bills, end wasteful fossil fuel subsidies, and deliver real relief to households struggling with rising energy costs.” I doubt upper-west-siders care about their utility bills, but that’s another topic.

That background knowledge piqued my interest in the Food and Water Watch piece. So, what’s their beef or tofu? The rally on the elite Upper West Side (one of my favorite places to visit in NYC, especially Zabar’s and H&H Bagels) “demand[ed] passage of the NY HEAT Act — a bill that would cap utility bills, end wasteful fossil fuel subsidies, and deliver real relief to households struggling with rising energy costs.” I doubt upper-west-siders care about their utility bills, but that’s another topic.

Assemblymember Micah Lasher rhapsodizes, “The NY HEAT Act is not just about tackling climate change; it’s about New York leading the charge towards a sustainable future. By reducing our reliance on fossil fuels, we’re protecting our environment and shielding New Yorkers from the ever-increasing gas costs.”

Wow. Keep that guy away from the New York Public Service Commission. How does a comms department in a utility take on that form of gaslighting unreality? I would start with facts, which I understand don’t always work with gaslighters. Figure 2 shows the New York Mercantile Exchange’s price history for natural gas. Prices are lower today than in 2009, not even adjusted for inflation. Are eggs and lox for the H&H bagels less expensive today than in 2009?

Figure 2 NYMEX Natural Gas Prices

Due to imposed market constraints, natural gas prices may be high in New York. E.g., New York bans hydraulic fracturing. The idea of capping utility bills is over-the-top asinine. I’ll start and end by saying that would bankrupt utilities. Choking supply increases prices, especially with an inelastic commodity like electricity.

Due to imposed market constraints, natural gas prices may be high in New York. E.g., New York bans hydraulic fracturing. The idea of capping utility bills is over-the-top asinine. I’ll start and end by saying that would bankrupt utilities. Choking supply increases prices, especially with an inelastic commodity like electricity.

Derisking the Electricity Supply

For the main event, I have argued that load management resources are undervalued compared to building new gas-fired peakers or combined-cycle natural gas plants (The TRC is Calling). Why? For similar reasons, groceries cost more in a convenience store than in Sam’s Club, Costco, or my favorite, Woodman’s. In this context, convenience means speed of delivery. There are more convenience stores closer to more people. The drive is shorter; the hike into the store is shorter; the hunt inside the smaller footprint takes less time. In all, it’s much easier and faster, but the price is higher.

Why doesn’t load management behind the utility meter fetch higher prices for shorter timelines? It does, compared to other load management alternatives. Customers and aggregators fetch better prices or fatter bill credits for 10-minute orders versus 60-minute orders versus day-ahead orders. However, the opening bid for load management resources is often tied to the “cost of new entry” (CONE), the estimated cost of a gas-turbine generator that might be spinning power onto the grid in five years instead of sixty minutes from now.

Rising Electricity and Capacity Costs

The Midcontinent Independent System Operator (MISO) auctioned capacity resources at $666.50 per MW-day for this summer (2025), up from $30/MW-day last year. At $666.50 per MW-day, capacity costs are roughly 2x MISO’s CONE estimate. That’s not a lot of price premium for “convenience.” MISO is clinging to a 10% reserve margin (a low number) by a shred of dental floss.

Additionally, the cost of delivered electricity is rising faster than average inflation, and the cost of an outage in lost productivity is at least 1,000 times the cost of electricity. There’s more. In addition to speed to market, glacial CONE assets cost more than estimated, per a recent study from Boston University.

Cost Overrun Risk

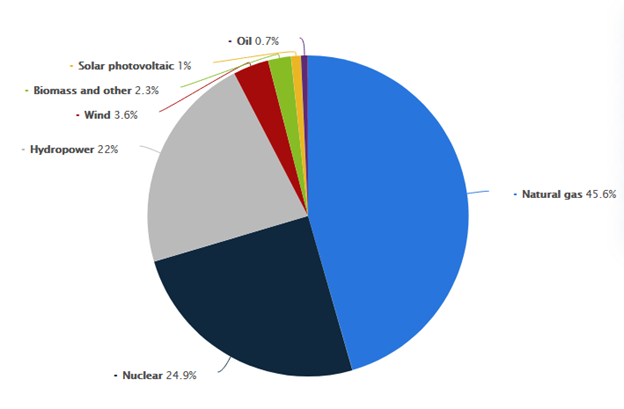

Cost overruns are well-known for nuclear power generation, largely due to a lack of scale (number of plants built) over the last three decades. However, the cost overruns of thermal power generation, which includes natural gas plants, are similar. Thermal power plants may have averaged only 9% over budget all time, but you’re only as good as your last at-bat, as we used to say in baseball. The more recent data in Figure 3 show that overruns have been much higher in recent decades. To be clear, this is a pretty skimpy data set and a bit disappointing.

You might notice subplots B and C look suspiciously similar. That’s the way the report is published, friends. My guess is they both represent nuclear because they start around 1970. This what I get for paying $34.95 for a report.

Figure 3 Cost Overruns for Nuclear and Thermal Power Generation

Derisking

Derisking

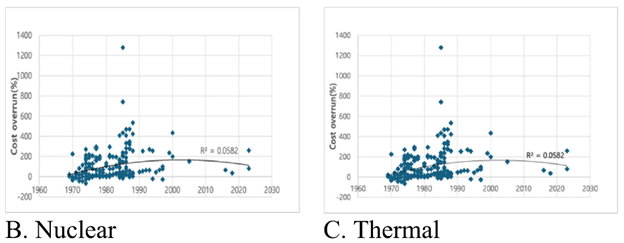

These are heady times in the utility and regulatory worlds – exciting but risky. Will there be an AI bubble? Probably? Utilities are striking giant deals with hyperscalers that run short of the expected useful life of the generation assets. For example, Entergy’s deal with Meta in Louisiana is for 15 years on power plants with 40-50 years of life expectancies. The race is on for electricity anywhere by any means. To derisk the future, I suggest 10-20% peak load management through a portfolio of demand response, grid-interactive, efficient buildings, and thermal energy storage across the entire portfolio of customers, especially data centers. As it turns out, my guess aligns with FERC’s guess in Figure 4. Not bad!

Figure 4 U.S. Demand Response Potential (2019)

Derisking

Derisking