As a glutton for punishment (I look forward to getting past sciatica so I can run marathons again), I tasked myself with getting to the technical bottom of this article from Utility Dive: Energy storage for grid reliability can increase carbon emissions: University of Michigan study. The article doesn’t get into the details, so I dived into the source document sponsored by the University of Michigan – a brutal read – like the last miles of a marathon, maybe Heartbreak Hill or Central Park. I spare readers the pain so they can follow along from their La-Z-Boys.

I know enough about wholesale electricity markets to use terminology and make mistakes. However, the markets function under a reverse auction procurement model for both energy (megawatt-hours) and ancillary services, i.e., frequency regulation (megawatts).

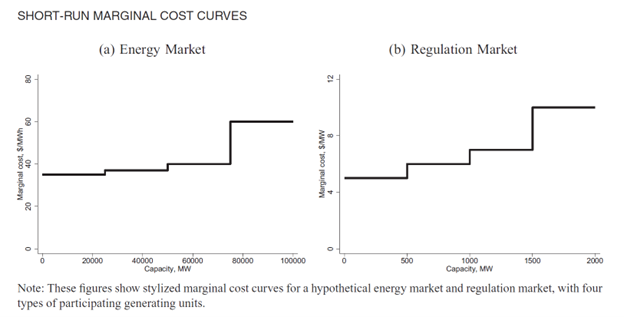

Generators place their bids to supply electricity (energy) and ancillary services. Bids are stacked from the lowest to the highest, as shown in the example charts below, which were taken from the Michigan study. The point at which the system load crosses the supply curve sets the price for all generators powering the grid at that point. The higher the load, the higher the price. For example, if the balancing authority’s total load is 80,000 MW, everybody supplying electricity gets $60 per MWh or $0.06 per kWh.

In terms of capacity and dollars, the ancillary market (e.g., frequency regulation) is significantly smaller but vital. Typically, 10-20% of a generator’s capacity is available for frequency regulation. Generators can bid both energy and regulation, but they must deliver. Delivering frequency regulation requires that generators do not operate at full capacity. They must be available to modulate (speed up or down) to provide the service.

In terms of capacity and dollars, the ancillary market (e.g., frequency regulation) is significantly smaller but vital. Typically, 10-20% of a generator’s capacity is available for frequency regulation. Generators can bid both energy and regulation, but they must deliver. Delivering frequency regulation requires that generators do not operate at full capacity. They must be available to modulate (speed up or down) to provide the service.

Ancillary services are critical for balancing the grid, especially with greater penetrations of renewable energy online. Solar and wind generation have zero capacity for frequency regulation. They produce what they produce and can’t predictably supply more power to deliver frequency regulation.

Minimum Capacity and Fuel Cost

Several variables come into play for regulation: the minimum operating capacity of the generator and marginal fuel cost are two factors. Coal has a lower marginal fuel cost than natural gas, but coal-fired power plants are less flexible and have higher minimum capacities. All else equal, the study notes that higher regulation requirements favor natural gas-fired power plants over coal, lowering emissions. However, it also increases the cost of delivered electricity because 1) fuel cost increases, and 2) more generators are running at part load – less productivity from each asset and maybe less fuel efficiency, depending on the plant design.

Enter Batteries

Grid-scale batteries are mainly used in the regulation market because they are expensive per unit of energy supplied, their capacity to deliver energy is puny compared to coal, natural gas, nuclear, and renewable sources, and they have a low marginal cost of electricity – round-trip losses, essentially. The Michigan study notes that “nearly all storage capacity in PJM[1] is built for the provision of frequency regulation.” You can guess what that means: batteries elbow some natural gas out of the regulation market, giving marginal fuel costs more leverage in the energy market. Since coal is less expensive on the margin than natural gas, the energy market shifts from natural gas to coal, which raises carbon dioxide emissions.

Two Theories

The Michigan study notes this second theory: batteries result in higher CO2 emissions due to frequency regulation, fuel costs, and minimum operating capacities of power plants. Five years ago, I introduced the first theory of how batteries increase CO2 emissions: they are charged with electricity from generators with marginal capacity, which means generators powered by coal or natural gas. Since batteries have 10-30% round-trip losses, charging and discharging batteries require more thermal generation and more emissions compared to generators delivering electricity to the grid directly.

I’ll end with a huge caveat to both theories. I believe both theories are legitimate for the analyzed scenarios. However, at some point, there may be no coal-fired plants in operation and that may alleviate the impacts of the regulation market. On the third hand, renewable generation, batteries, and inverter-based technologies are less durable, resilient, and prone to faults than spinning masses in thermal power plants. The future will be interesting.

Hydrogen’s Hype-to-Reality Ratio

In the bonus department, a few weeks ago, I wrote about the colors of hydrogen: brown, gray, blue, and green. Although I wrote about the differences and how they are manufactured, I did not opine on hydrogen’s readiness as a fuel. I wrote in last fall’s Rant Harvest that hydrogen is five years away from mainstream commercial readiness, as it has been for 40 years. Joel Gilbert claims it was five years away, 50 years ago. These truths aren’t deterring the government from making another run at it as they allocate billions to more hydrogen projects that may demonstrate science on the scale of a potato battery. It can be done, but is it within four orders of magnitude of conventional sources in scale and cost-effectiveness?

With that background, I noted a Forbes article last week, Green Hydrogen Hype Hits Some Very Expensive Hurdles. “Two years ago, this was super-hyped. It was like, everybody’s exuberant,” Raffi Garabedian, CEO of Electric Hydrogen, told Forbes. “What’s happened is people started realizing, ‘Oh, shit, this thing I’ve been talking about for a while — the hype-to-reality ratio — projects aren’t getting built. I wonder why?’ People have started realizing this is really hard.”

[1] PJM interconnection is the load balancing authority in this case.