My top “strength,” as scientifically assessed by Gallup CliftonStrengths®, is context, which may also be defined as a historian. My other top strengths include attention deficit, information hoarder, and rabbit hole aficionado[1].

Orwell’s famous 1984 quote says, who controls the past, controls the future, and who controls the present controls the past. Well, I’m not controlling anything; I’m hoarding it. Those who study the past can more accurately forecast the future because human nature never changes.

History Lessons from Utilities

History Lessons from Utilities

There are limitless examples of companies leaving their lane to pursue bad ideas and things their customers don’t want. Examples within our industry include investor-owned utilities in the late 1990s and early aughts going wild under deregulation. Enron wasn’t the only debacle of that era. Utilities had grand ideas of owning power generation around the world, resorts in foreign countries, and telecom companies. That didn’t end well. They took significant financial hits and returned to what they do well: market protection and regulated utilities.

Think of how difficult it would be to move out of a model where you only must sell to three to five people (utility commissioners) to one where products and services are sold on the merits, take it, or leave it.

History Lessons from Fast Food

Another example was fast food, e.g., McDonald’s venture into selling healthy foods like salads and apple slices. Dude, that’s not why we go to McDonald’s. I go there for the salty burger, with two thin slices of pickle, minced onions, shots of ketchup, and mustard sandwiched between a smashed bun. Delicious[2], cheap, and consistent.

History Lessons from Big Oil

More recently, big oil companies, British Petroleum, and Shell Oil, pulled back from green investments. Why? Because shareholders rule. Exxon didn’t waver from its core business, kicking BP’s and Shell’s keisters in the scorecard that matters most: revenue and profit.

History Lessons Not Learned by the Big Three

After presenting these misguided dalliances, I ask how long the big three American automakers, or whatever they are called these days, will subject themselves to the pains of trying to develop electric vehicles. Ford lost more money per EV sold than the vehicle’s sticker price in Q1, 2023, for a margin of minus 102%.[3]. A good place to shop for unemployed engineers may be at the gates of Ford’s design studios. Come on over to our efficiency and load management industry, folks! The water’s nice!

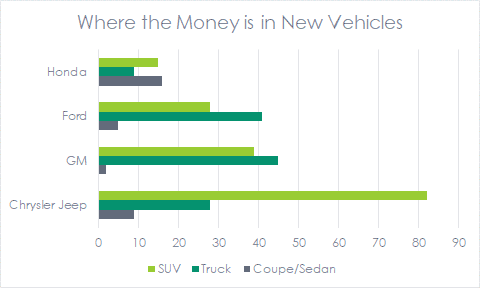

The big three’s sweet spot is, always has been, and always will be gas-guzzlers, and in modern times, that means light trucks and SUVs. That’s where the money is for them. Why would they leave that sweet spot, and how long will the executives hemorrhage cash from shareholder equity?

The big three attempted to pivot to efficient vehicles in the 1980s when Japanese carmakers came out of nowhere with far superior cars. Forty years later, nothing has changed, as we shall see below. To demonstrate the futility of EVs for the big three, I pulled new vehicle inventories for area dealers and display the results in the chart below. Listen – your customers do not want apple slices and salads.

EV Market Share and Consumer Preference

EV Market Share and Consumer Preference

Last week Zerohedge reported that EVs are piling up in dealer lots, with inventories up 342%. Granted, it’s easy to double or triple a tiny number. They wrote, “Tesla continued to dominate the luxury EV segment with a market share of 25.5 percent, followed by Mercedes at 12.5 percent, BMW at 12.2 percent, and Lexus at 11 percent. Among EVs priced above $50,000, Ford held the biggest share at 22.1 percent, followed by Chevrolet at 12.1 percent.” Note that there is no market for anything less than a luxury SUV.

The Big Three have almost completely abandoned the sedan and coupe market to Honda, Toyota, Hyundai, Kia, BMW, Mercedes, Lexus, Infinity, Acura, and Audi. That is where the EV action is and will be because hauling soccer teams, construction equipment, and pulling cargo is the domain of the ICE – hundreds of miles and thousands of pounds of towing capacity in a 24–48-hour timeframe.

The vocals in our industry think we’re in the end-days of the ICE powertrain. I recently learned that EVs have long passed the chasm, which by definition is about 14% market share. We are not close to that in the United States. Non-hybrid EV market share in the U.S., is about 3% as of 2022[4].Electric vehicle sales in California alone are close to 18%[5].

Advice

Where is he going with this? Like power generation, which I will discuss soon, not everyone is going to pile into one technology. Going back to CliftonStrengths®, I suggest embracing your sweet spot, whether you are a consulting company, individual, or auto-manufacturer. Ignore this advice at the peril of animosity from your shareholders and boards of directors.

[1] I code strengths with my own nomenclature that mean something.

[2] To the tastebuds of the beholder.

[3] https://www.thestreet.com/technology/ford-loses-nearly-60000-for-every-electric-vehicle-sold

[4] https://www.iea.org/energy-system/transport/electric-vehicles

[5] https://electriccarsreport.com/2022/11/cumulative-2022-ev-sales-in-california-in-q3-surpass-total-ev-sales-in-2021/

Summer Saving Tips Contest

It’s summertime. We want you to tell us how you save energy in your home this summer for a chance to win big coin with your wit and innovation. Smart thermostats? Zzzz. Pull the drapes? Baant! Cook outside? Yawn. Reverse the ceiling fan? Eyeroll here. How about this: I cook rice on my stovetop for my beloved dog, Sunny. I run the exhaust to remove the heat from my house as it cooks on the stovetop (boring). Once cooked, I take the pot outside to cool off. Mmm, not bad. What about this? I add a few inches of cold tap water to my dishpan and take the pot of cooked hot rice off the stove into the dishpan to heat the water to wash the pot! That reduces the cooling load on my house and water heating energy to do the dishes. Insanely stupendous!

Can you top that? Use the social links below to view our posts for this contest and comment with your unique idea! Post your idea by July 20th. The winner gets a cash prize of $500 and a feature in our August edition of the Hopper and our social media. We can’t wait to read all your ideas!

EV Market Share and Consumer Preference

EV Market Share and Consumer Preference