Eight and a half years ago in Betting with Deregulation – A Risky Proposition, I wrote the following in this blog, “Companies who want deregulation of anything must be prepared for eventual pain – just ask the major airlines and a bunch of telecom companies, many of which no longer exist. There will be pluses and minuses for producers and customers alike. For example, the industry is now flooding into natural gas and renewables because they’re cheap. The market is de-diversifying, and at some point, probably within a decade, that will not end well for consumers. Deregulated markets don’t care what fuel costs are. In regulated markets, these are pass-through costs leading to some short-term volatility, but it is choppy seas compared to a tsunami.”

Hmm, and what are we seeing today? Rapidly shrinking reserve generating capacities and resultant soaring prices.

Since then and even before then, at least a dozen times, I’ve cautioned and lampooned that phony, manipulated “competitive” markets are headed for a day of reckoning. Here is a quick sampling:

- From 2023, 1500 Pages of Deregulation

- From 2023, Electricity Market Manipulation

- From 2022, Power Grid’s Glide Path to Reckoning

- From 2023, Capacity Market Poker

- From 2023, Energy Transition – Four Factors to Watch

- From 2021, Years of Dominos Fall in Texas

- And finally (for this sample), from 2011, Burnin Down the House

- Unprecedented New Generation Additions

Per RTO Insider, the Midcontinent Independent System Operator, MISO, not to be confused with soup, says, “its members need to add projects at an ‘unprecedented’ 17 GW/year clip.” That is unprecedented, considering the all-time peak load is 127 GW.

In April 2023, MISO had 600 projects in the queue with a total nameplate capacity of 123 GW, but 115 GW was a combination of storage and non-dispatchable wind and solar generation. In 2022, there were 900 projects in the queue, representing 171 GW of nameplate capacity. Conclusion: The queue is an ever-shifting mirage that includes minuscule firm, dispatchable, and reliable sources of electrons.

I predict 3 GW of planned fossil fuel plant closures will be reversed (announced) in the MISO footprint in 2025. Three GW isn’t much compared to the need for 17 GW per year, but 3 GW is a lot of generation.

Wholesale Electricity Markets

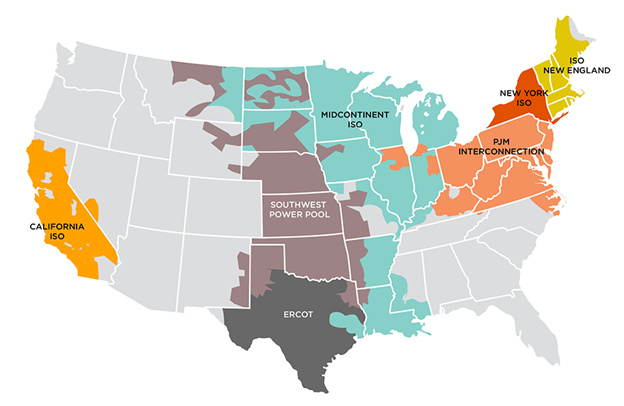

Figure 1 displays a map of the Federal Energy Regulatory Commission’s (FERC) regulated Regional Transmission Organizations (RTOs). From left to right, markets include:

- Cal-ISO, CAISO, pronounced kahy-so and not queso, as I refer to it

- Southwest Power Pool, SPP

- Electric Reliability Council of Texas, ERCOT, where EUCOT – yoo-cot – may be more appropriate.

- Midcontinent Independent System Operator, MISO

- PJM (Pennsylvania, New Jersey, Maryland) Interconnection, better known as PJM

- New York ISO, aka New York ISO

- ISO New England, aka ISO New England

Figure 1 FERC-Regulated RTOs

To achieve “competition,” FERC order 888 required utilities to provide open-access transmission service comparable to the transmission service they provide themselves. The objective was to avoid scenarios of excessive market power to allow third-party generators to participate in wholesale markets. FERC order 2000 established frameworks for competitive Regional Transmission Organizations (RTOs) and encouraged utilities to join.

To achieve “competition,” FERC order 888 required utilities to provide open-access transmission service comparable to the transmission service they provide themselves. The objective was to avoid scenarios of excessive market power to allow third-party generators to participate in wholesale markets. FERC order 2000 established frameworks for competitive Regional Transmission Organizations (RTOs) and encouraged utilities to join.

The problem with RTOs, explained another way, in addition to the 20 already noted in other Rant posts, is that no single entity is responsible for inexpensive, reliable power. Utilities have a return on equity for investors at the top of their minds, maybe second to catastrophes like wildfires that may bankrupt them. RTO planners are left begging for more firm capacity (not intermittent renewables) to come online. Another anvil thrown into the sinking reliability ship is the fact that states have renewable portfolio standards and bans on natural gas for firm dispatchable generation.

Think about this: The entire era of RTO existence covers only the last 20-25 years when there was no load growth, starting with a baseline of excessive capacity. Those days are over. Load is growing again, albeit at a relatively minuscule 2% annually, but that’s 10x compared to the last 25 years. In addition, power plants are reaching the end of their useful lifetimes. I believe this is why MISO needs 17 GW of new generation per year when its peak is only ~125 GW.

Vertically Integrated Regions

The utilities that will emerge as the winners in the next decade in terms of price and reliability will be those that are still vertically integrated—sole entities responsible for everything.

The southeast quadrant of the country is laser-focused on reliable and inexpensive electricity to spur economic and manufacturing growth. Kevin Doyle, VP of the Consumer Energy Alliance, recently published an article in RealClearWire describing Georgia’s success in providing predicably inexpensive and reliable electricity supply through traditional regulation versus deregulated markets, especially in the Northeast.

Atlanta is a top 10 market for data center development, with 76% growth in the first half of 2024 compared to the previous year. He explains the virtues of Vogtle Units 3 and 4, nuclear power plants that were lambasted for cost and schedule overruns. Those units will provide inexpensive, reliable power for six decades – something most likely not factored into their full cost of electricity.

Mr. Doyle also describes Georgia’s leadership in renewable power generation. Renewables have their place in supplying electricity, but they must be optimally integrated, which doesn’t happen in deregulated wholesale electricity markets, including Texas. California has already overbuilt and overcompensated solar developers, leading to soaring prices. Result: $6.5 billion in wealth transfers to solar owners, 40 cents/kWh off-peak and 80 cents/kWh on-peak electricity.

Reregulate

Utilities should take back 100% responsibility for inexpensive and reliable electricity supply. However, I don’t know how the deregulated toothpaste gets divided and jammed back into vertically integrated utility tubes. Reregulation is starting to be discussed, for example, here and here.

Demand Side is the Only Hope – NOW

In the meantime, I suggest utilities and RTOs start acquiring load management agreements with customers as fast as humanly possible because, as the experts say, we’re not going to build our way out of this. What does that mean? It means only one thing to me: demand-side resources behind the meter. Move! Now!