Last week I mentioned genuine intelligence over artificial happy-talk intelligence. Want to know what the latter looks like? See this Forbes article in which data solves all problems, including heating and cooling buildings. “There is an opportunity to build the foundations of a long-term digital strategy for buildings in all industries, to achieve decarbonization goals, reduce energy use and running costs, and boost resiliency and competitiveness.” How many Btus of energy are in a terabyte anyway?

Harnessing data, plus actionable analytics, which is rare, can help shave 10% or even 20% off energy costs. Still, it must be integrated with new, not to be confused with fancy or sexy, technology to top 30% or even more savings. From there, decarbonization will include heavy baseload nuclear power. Ontario just announced it is exploring the use of large-scale power plants to meet zero-carbon electricity going forward. Good for them.

Deregulation?

“Deregulated” electricity markets are simply another set of rules, guardrails, caps, and minimums compared to regulated electricity markets. I laughed out loud when I read that the ERCOT grid is managed by a 1,500 paged document – like a Reactor Plant Manual for a nuclear submarine.

Last week, I mentioned the 2014 TXU (Dallas) power generation company bankruptcy. I saved the following gem for this week – in 2007, Texas lawmakers cried that TXU was making too much money. A senate committee voted 9-0 on a bill that “would give state utility regulators the ability to block a transaction if they felt it was contrary to the public interest.” That’s regulation and not deregulation. You have a competitive market, or you don’t. It’s crap like this that produces blackouts, $250 billion in property damage, and 250 deaths. How? It tells investors don’t come here because they will be smacked down if they make a profit.

Every state has various policies for portfolio standards, energy efficiency programs, and more. How are floods of cheap electricity at intermittent times from some states balanced with other states that don’t have high renewable energy portfolio standards? Price controls, essentially, through MOPR, the minimum offer price rule, which sets a price floor. So, the price can’t be too high, and it can’t be too low. Where is the competition?

Trending Retail Electricity Prices

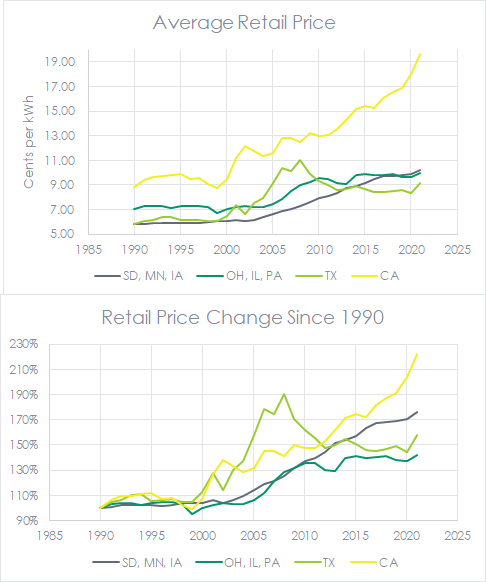

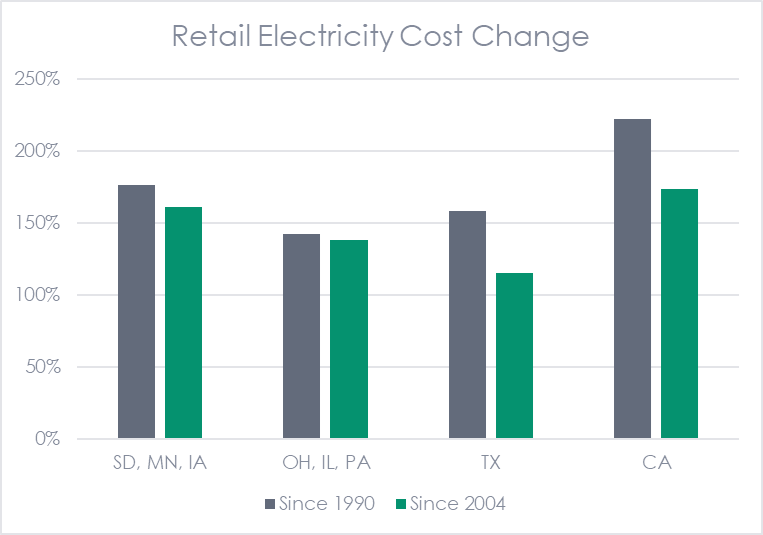

About four years ago, I compared electricity prices over time for a basket of states based on regulation and other factors. I updated the data through 2021, the latest available.

- South Dakota, Minnesota, and Iowa have deregulated wholesale but regulated retail. They also have some of the country’s highest percentages of renewable energy production.

- Ohio, Illinois, and Pennsylvania have deregulated retail and very little renewable generation.

- Texas is the most deregulated state in the country, and they have roughly half the renewable generation percentage compared to SD, MN, and IA.

- California has deregulated wholesale and a lot of solar generation. They have also aggressively moved out of coal and natural gas and are clinging to one nuclear power station in operation.

Price changes since 1990, the first data readily available from the EIA source, and 2004, when deregulation and the buildout of many renewables began in earnest, are presented below.

Price changes since 1990, the first data readily available from the EIA source, and 2004, when deregulation and the buildout of many renewables began in earnest, are presented below.

What do these data tell us? One could argue:

What do these data tell us? One could argue:

- Deregulation didn’t work well in OH, IL, and PA since all the price increases occurred after deregulation.

- Since 2004, states rich in renewable resources have seen steady price increases, except Texas, where outages cost $250 billion.

- California’s massive expansion of solar and batteries are, uh, well, you look at the graph.

Where is most of the electricity storage? California. Note to every other state in the union: see how solar and batteries are working out?

The Stacked Deck

The deck is stacked against new dispatchable resources, and that will result in more Uri disasters. First, decades of tax credits for renewable generation have driven baseload plants off the grid. Second, MOPRs try to protect incumbent baseload generation from going out of business, pushing us into blackout territory. Third, both price caps and tax advantages for renewable resources make investing in baseload, dispatchable power too risky, leading to the same result.

Another risk is the shifting politics of Washington. Remember MATS, the mercury and air toxics standard, in which SCOTUS “directed the EPA to determine whether its standards were appropriate and necessary”? That’s like asking an eight-year-old whether he cleaned his room without looking. Anyway, MATS assumptions include pregnant women eating six pounds of lake fish per year, with unmeasurable detriments. The Trump EPA pulled it. The Biden EPA just put it back in place. It’s really about coal, but the signal to the market is, look out – if you build the wrong kind of plant, we can find a way to make you close it in five or ten years.

Reverse Diversification

Natural gas is the only type of baseload power plant that has a chance of being built these days. However, the natural gas capacity to deliver to those plants is constrained. Electrify everything. With what?

The Bottom Line

The bottom line with deregulation is that there are too many fingers in the pie and cooks in the kitchen. There are too many artificial market forces, carrots, and sticks. The rules change every four years or less. There are plenty of lower-risk, higher-return places to put your money, like crypto, Zimbabwean penny stocks, or commodities futures options. Most of all, no one entity is accountable – not the generators, local distribution companies, load-serving entities, legislatures, or even the regional transmission organizations.

Want an example? Uri.