A couple of weeks ago, I drove across Southern Minnesota, starting in the SW where wind alley is, and therefore, hundreds, or maybe thousands of wind turbines. The following was my observation while cruising I-90.

Since the turbines were not spinning, I can only assume that excessive wind forced the Midcontinent Independent System Operator to curtail several hundred megawatts of wind generation. This, for one reason, is why net zero is as worthless as a three-dollar bill[1], but also, utilities have power purchase agreements with these non-spinning resources, right? Who pays?

Since the turbines were not spinning, I can only assume that excessive wind forced the Midcontinent Independent System Operator to curtail several hundred megawatts of wind generation. This, for one reason, is why net zero is as worthless as a three-dollar bill[1], but also, utilities have power purchase agreements with these non-spinning resources, right? Who pays?

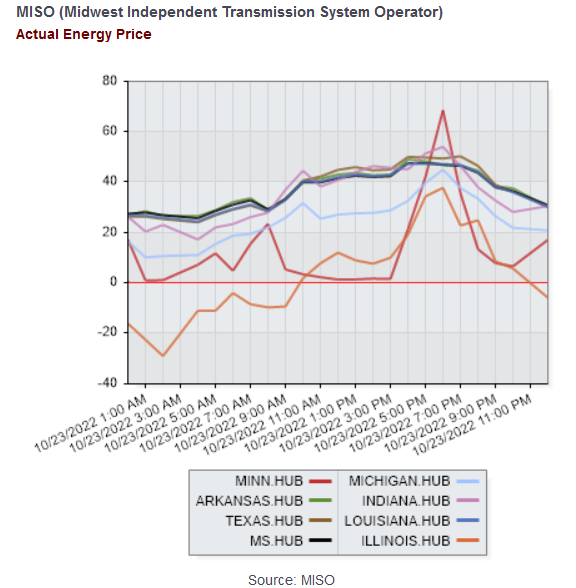

The MISO hub prices were as follows that day. The video was shot at 5:16 PM as MN hub prices shot upward.

The Grid We Have

The Grid We Have

The grid was built around large, continuous-duty, baseload power-generating assets fueled chiefly by coal, with a lot of nuclear generation built in the 1960s-1980s. The transmission system to deliver that power to load centers was a hub and spoke arrangement. Over time, grids interconnected to one another for reliability and lower cost through diversification, the opposite of what is happening today. The grid was not developed for blankets of distributed energy resources, including hundreds of two-megawatt wind turbines and acres of solar panels.

Utility-Scale Renewable Interconnection Pileup

In August, Utility Dive published, Why the Energy Transition Broke the U.S. Interconnection System. Translation: there is a huge interconnection application backlog for utility-scale wind and solar to reach wholesale power markets. Why is this the case? We will find out, at least via publicly available articles and reports.

Utility Dive notes that 700 GW[2] of solar, 400 GW of storage (not that anyone can build that much due to material shortages), and 200 GW of wind are in the interconnection queue. Less than a quarter of the applications are successful, and the rest are withdrawn.

From A to B

The fundamental problem, as one expert notes, is a shortage of transmission. Again, continuous-duty power plants and the grid were wisely designed to serve load centers. Transmission systems were designed for local, not regional or national, needs. The grid is not designed to move bulk power from where the wind is, and the population isn’t, to those load centers.

I am reminded again of the phony argument that wind and solar are 33% cheaper than natural gas-generated power. The former has a problem. It must get to market. What about that cost?

People Vote

The top priorities of grid operators, Independent System Operators (ISOs), and Regional Transmission Organizations (RTOs) are reliability and access to markets. Transmission permitting is mainly a state issue, per the Dive article, and states look out for their own interests. If I’m a state lawmaker, do I want to side with big business to run a transmission line across the state to serve some other state, like Illinois? What’s in it for my constituents? Nothing, except for the transmission, wind generators, and landowners, almost none of whom are constituents. The wind developers may not even be U.S.-based, and the transmission company is likely not U.S. based.

Lazy Developers and Expensive Networks

The Dive article says the RTOs don’t provide enough information for developers to know where to connect to the grid most cost-effectively. I differ. The RTOs offer an unbelievable amount of data, and in my opinion, it is not their job to tell generators where to build. For one, lawsuits would surely follow.

Concentric Energy Advisors produced a report, How Transmission Planning and Cost Allocation are Inhibiting Wind and Solar in SPP, MISO, and PJM. Their arguments mostly align with the Dive arguments. They say regional transmission investment is on the decrease while overall transmission outside (e.g., more local) is robust for reliability. They say, “future generation resource mix [wind and solar] is plainly visible in the generator interconnection queues where prospective generators are confronted with extremely high network upgrade costs to interconnect to the transmission system.” Oh, 33% cheaper? I.e., the cost to round up dozens of square miles of relatively tiny generators and connect them to the transmission system is immense.

Concentric writes that only 15% (not a quarter per the Dive article) of permit applications in PJM make it through the queue. Do they get built? Nearly a third in MISO drop out after reaching “advanced stages” of the process.

Concentric writes that only 15% (not a quarter per the Dive article) of permit applications in PJM make it through the queue. Do they get built? Nearly a third in MISO drop out after reaching “advanced stages” of the process.

Chicken Egg Cycle

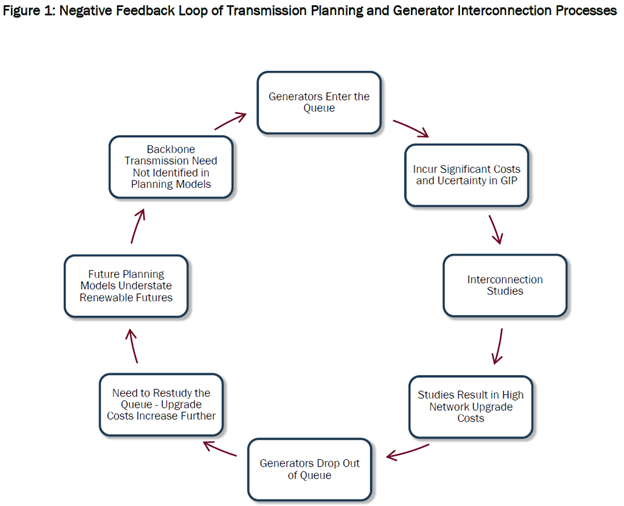

Concentric describes a chicken-egg cycle: “Generators are unable to move through the queues without more transmission capacity, but the need for new transmission capacity identified in RTO planning processes somewhat depends on the generators’ ability to move through the queues and secure signed interconnection agreements.” The RTOs focus “primarily on how to solve reliability, congestion, and interconnection issues at least cost.” Generator network upgrades are the other 33%-cheaper guys’ problems.

Concentric succinctly lays out the cycle below. GIP = generator interconnection process. High interconnection costs result in a high withdrawal rate. Everyone needs to recalculate when applications are withdrawn – a colossal mess.

It is somewhat gratifying to see that seven years after posting Distributed Energy, Batteries, and Bread Machines, I was correct both then and now. Economies of scale in bulk commodity production win in competitive markets. If not, we’d have more small farms and higher food prices, and Amazon would be known only as a river.

It is somewhat gratifying to see that seven years after posting Distributed Energy, Batteries, and Bread Machines, I was correct both then and now. Economies of scale in bulk commodity production win in competitive markets. If not, we’d have more small farms and higher food prices, and Amazon would be known only as a river.

[1] Because these turbines are shut down while coal, nuclear, and natural gas in the same market are churning out kWh.

[2] One GW is a big power plant, like a nuclear reactor or a very large coal generating station.