My, how quickly some things can change, almost overnight, like natural gas markets. It seems only a year ago we had more natural gas than we could consume, as far as the eye could see. Barely three years ago, I wrote that Permian Basin oil production resulted in flaring off $1 million worth of natural gas per day, during rock bottom prices even. That was enough to fuel 2,500 MW of electricity generation. Customers are pissed off about soaring heating costs, which are 50% higher than a year ago.

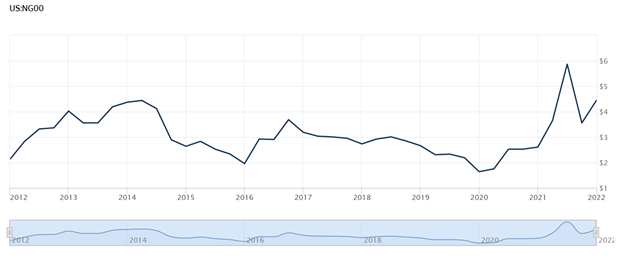

The chart below shows the NYMEX commodity price for natural gas over the last ten years. Although the commodity price is only $4-5 per million Btu, or $0.40-$0.50 per therm, my cost last month was $1.12 per therm. That’s $0.77 per therm with a delivery charge (pipelines and meter) of $0.35.

For the first time in my life, I have a mild case of dread when Xcel Energy tells me my bill is ready – not that I can’t afford it.

For the first time in my life, I have a mild case of dread when Xcel Energy tells me my bill is ready – not that I can’t afford it.

Running Up the Mudslide

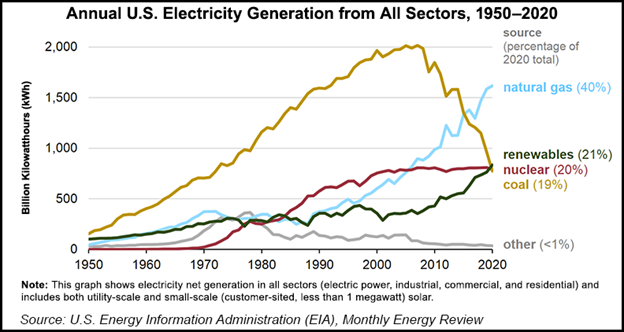

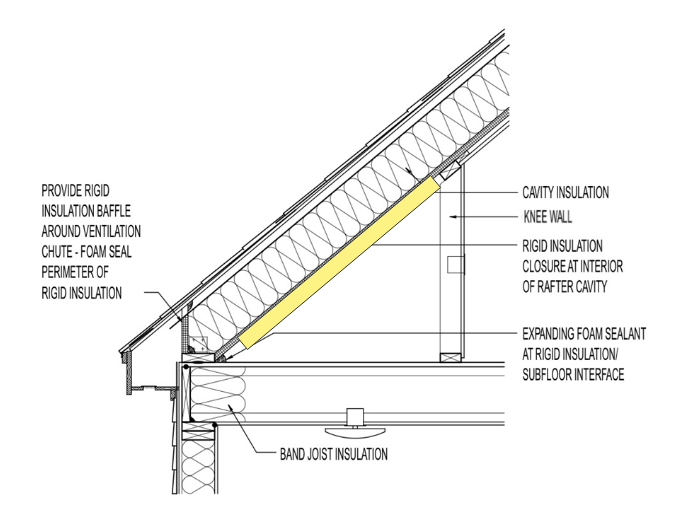

Our corporate purpose is to minimize waste and maximize value. I’ve gone to relatively crazy lengths to reduce waste in my home and not even cost-effectively – that’s called purpose! I nailed an inch of polyisocyanurate insulation (R-7) to the ceilings behind the knee wall in my home. See below. I had foam insulation blasted into my rim joist cavities in the basement to seal and insulate. I replaced the windows, and of course, replaced the boiler. My problem is the waste in economic loss that we are seeing and will continue to see as power generation is more reliant and concentrated on one fuel for thermal power generation: natural gas.

Diversity Anyone?

Diversity Anyone?

Everyone knows diversification is a good thing, except it is checked at the door for electricity production. Forbes says diversification reduces risk. Really? Apparently, this doesn’t apply to the power-generation industry. On the other hand, it’s a political and policy issue. I get that, but it won’t change the result: wild rides, shortages, and outages.

Fossils Rejuvenated

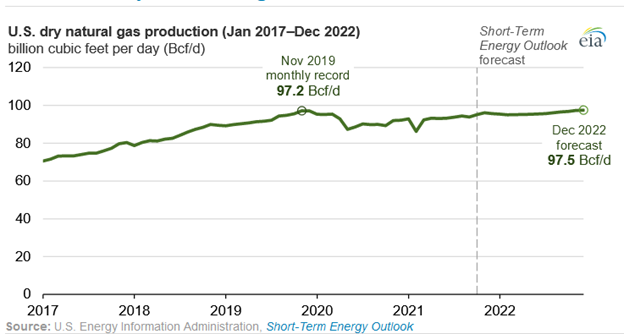

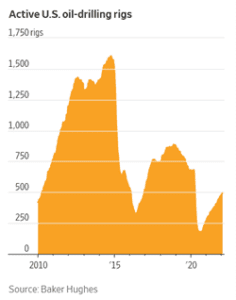

The EIA projects that the US will set a natural gas production record in 2022, not by a lot, however. Drilling expansion plummeted in the spring of 2020 for some reason.

Meanwhile, the pressure on natural gas prices is exerted by demand for power generation, Vladimir Putin, and liquified natural gas (LNG) exports. Climate warriors may rejoice for a second while I pop that bubble. The high price of natural gas is driving power generation into the arms of coal, setting the planet on a slam dunk for record coal consumption this year, as predicted by me in January.

Meanwhile, the pressure on natural gas prices is exerted by demand for power generation, Vladimir Putin, and liquified natural gas (LNG) exports. Climate warriors may rejoice for a second while I pop that bubble. The high price of natural gas is driving power generation into the arms of coal, setting the planet on a slam dunk for record coal consumption this year, as predicted by me in January.

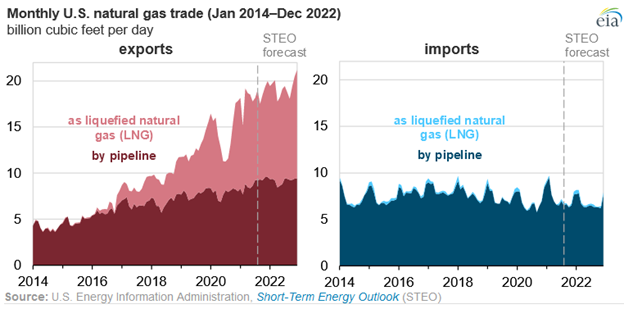

The U.S. consumes about 85 billion cubic feet of natural gas per day, while our LNG exports are growing about 10 billion cubic feet per day. Cheaper energy always finds its way to high-bid markets like Europe.

The U.S. consumes about 85 billion cubic feet of natural gas per day, while our LNG exports are growing about 10 billion cubic feet per day. Cheaper energy always finds its way to high-bid markets like Europe.

But what’s more interesting is, suddenly, we find ourselves back in the fear of 1979 when inflation was roaring. Hmm. Could there be a connection?

But what’s more interesting is, suddenly, we find ourselves back in the fear of 1979 when inflation was roaring. Hmm. Could there be a connection?

What about efficiency, like 1979? It’s always the forgotten resource.

What’s Next?

A friend sent me a link to an article from Zerohedge, explaining how the energy crisis, particularly natural gas, will get much worse. What?

A geologist with ten years of experience in the Zerohedge article says there are no places left to drill/frack in the Permian Basin. He says that Venezuela, Mexico, and Saudi Arabia are all lying about their reserves. He concludes, in summary, that when you shop for groceries, hurry to the checkout before the price of bread in the cart increases 50%. Never mind that we were almost out of natural gas in 1979, and now we have more “proved reserves” than ever: 500 trillion cubic feet. Per my math, it’s 16 years at 85 billion cubic feet per day.

However, on the same day, February 3, The Wall Street Journal published Oil Frackers Brace for End of Shale Boom. That article had all kinds of projections from different sources, saying Bakken in North Dakota and Permian in Texas and New Mexico will hit peak production in 5-10 years. But it doesn’t matter because investors and companies are resilient and tenacious. If there is money to be made, they will make it happen as they have for decades.

A Slinky

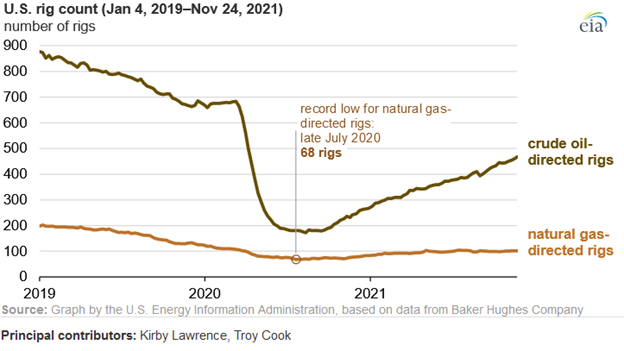

Oil and natural gas producers seem to operate like a slinky in boom/bust cycles. First, there is a race to see who can produce the most to dominate the market. That is followed by a glut that drives prices into the ground (pun alert) or even negative as it did two years ago for oil. Take my oil, please! Now, in the second phase, we are in that burned period of scarcity when drillers and investors aren’t in a hurry to pour more capital into drilling rigs.

Oil and natural gas producers seem to operate like a slinky in boom/bust cycles. First, there is a race to see who can produce the most to dominate the market. That is followed by a glut that drives prices into the ground (pun alert) or even negative as it did two years ago for oil. Take my oil, please! Now, in the second phase, we are in that burned period of scarcity when drillers and investors aren’t in a hurry to pour more capital into drilling rigs.

Uh, uh, uh, uh, hold on. Today, February 21, 2022, The Wall Street Journal reports that high prices are luring drillers back to formations that were left for dead less than two years ago: in Colorado, Oklahoma, Utah, and Kansas.

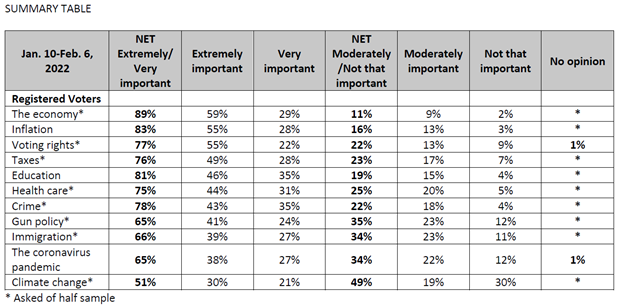

Jeff, why does this matter? Who cares? This is old technology, and we are migrating toward an energy revolution. First, the move toward the energy revolution will be like the slinky as well. To the masses, it comes and goes. You have a wildfire, a major hurricane, flood, or drought – OMG, we need to fix the climate! Nothing hits a brick wall like scarcity and high prices. To demonstrate, see the results of a recent CNN poll below. Money still rules, or as they say, cash is king.

But more importantly than the slinky, the utility industry is drifting into dangerous territory due to concentrated reliance on natural gas. Consumers and businesses will not tolerate soaring prices and unreliable service. More to come on that topic next week.

But more importantly than the slinky, the utility industry is drifting into dangerous territory due to concentrated reliance on natural gas. Consumers and businesses will not tolerate soaring prices and unreliable service. More to come on that topic next week.

Diversity Anyone?

Diversity Anyone?

Good job Jeff, enjoyed reading and great information!

Aye, Thanks Russ!