In this week’s Energy Rant, we’re covering the final segment of good, perfect, and real carbon targets.

There are two sources of carbon-free energy. First, we have the category of renewable with wind, solar, hydro, and some geothermal. Second, we have nuclear. Oops – third, we have efficiency and demand management.

The electricity market is bizarre to me. Last week I crudely explained how the regional transmission authorities (RTO) and their twins, independent system operators (ISO), balance the grid in real-time. Power supplied must match demand with very tight tolerances of voltage and frequency at all times.

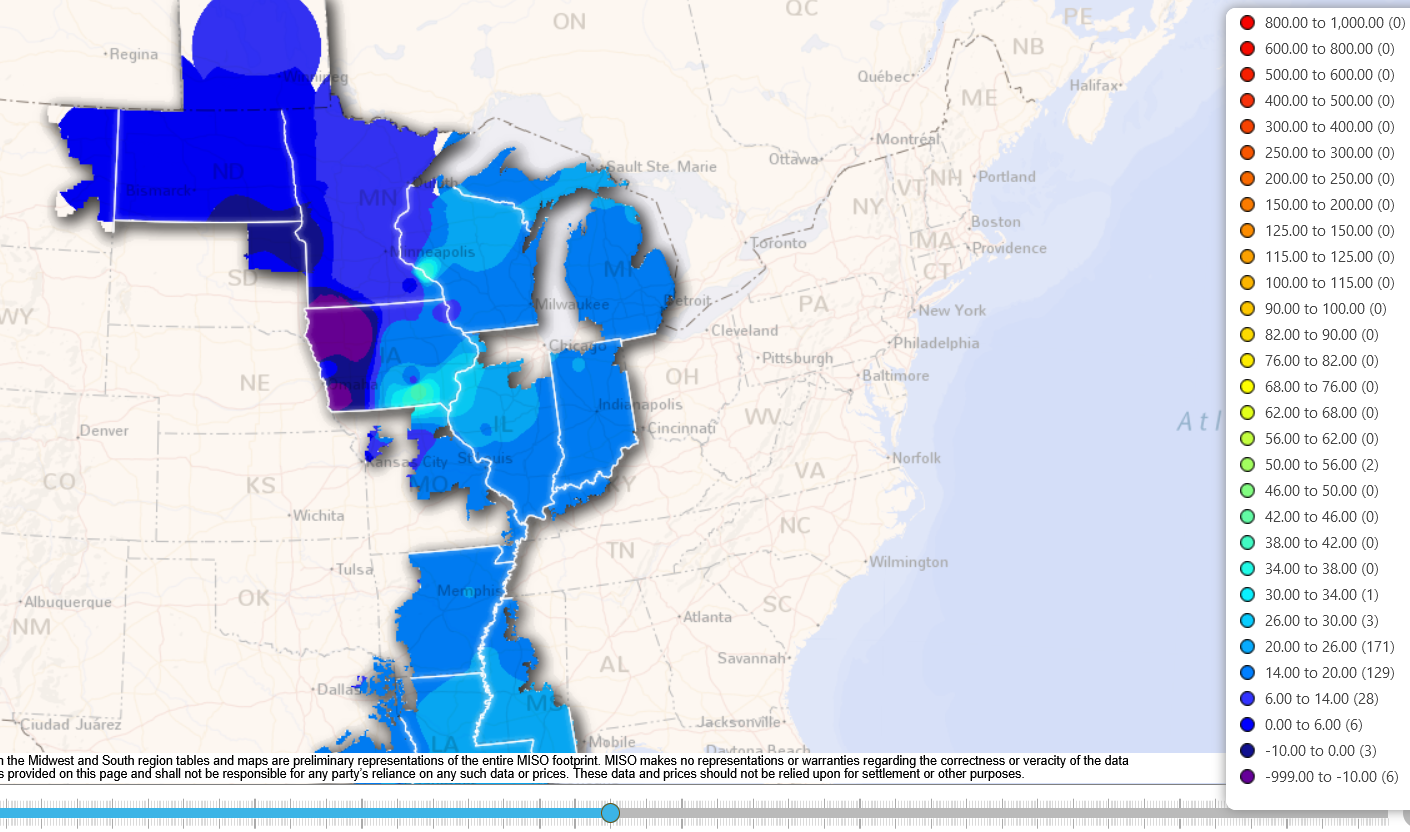

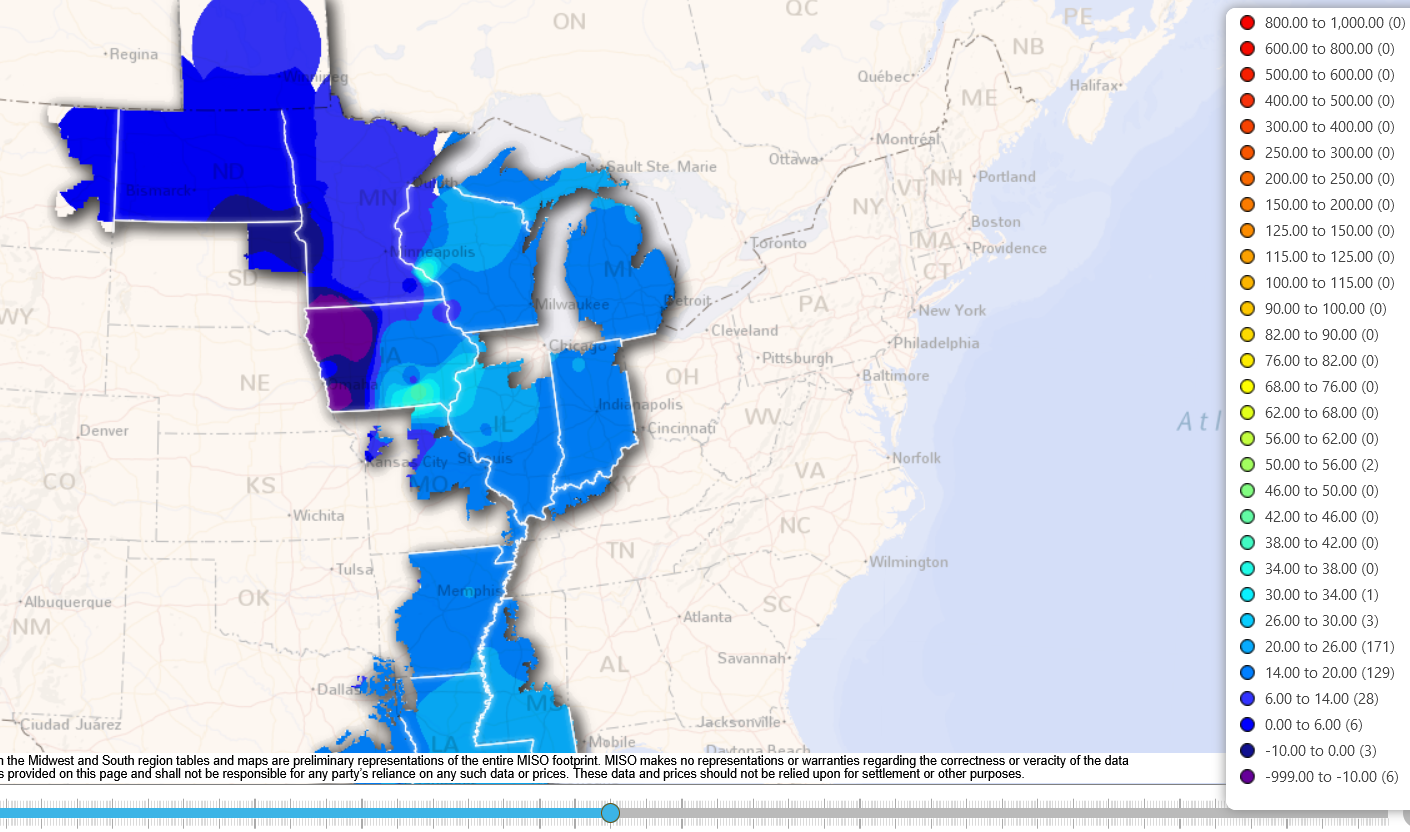

The chart below shows electricity prices at 2:00 PM on Friday, November 6, 2020, as provided by the Midcontinent Independent System Operator. The Western part of Iowa has negative prices because the wind was blowing hard, and there are many giant wind turbines over there. I have two questions: Will prices be negative when the production tax credit fades away? The reason prices are negative is producers can sell at say, minus 1.5 cents per kWh and take a 2.0 cent tax credit from the federal government, netting 0.5 cents per kWh. So I guess turbines will be shut down when that credit expires.

The second question is, how does negative pricing work? Wind producers pay other generators, primarily coal and natural gas plants, to curtail and produce nothing but keep their spinning reserves[1]. These plants are burning fuel to produce nothing. What is the efficiency of that? Zero, like an idling car. This is why coal plants are closing everywhere.

Out of the Box

I always applaud thinking outside the box. In Part II of this series, I demonstrated that there is no reasonable electricity storage technology that can keep the lights on for days of calm weather where there are large percentages of wind generation. That is, in the absence of conventional resources to fill the void. Such a duration of no wind for days is not unusual under a summertime omega high over the upper Midwest.

So what’s an alternative to storage? Per PV Magazine, “dump[2]” the excess power.

Do the PV Mag folks read this blog? They pillory every storage technology that I evaluated in this four-part series of posts.

They say:

”Don’t build a battery that costs $1 billion, works 2% of the time, and moves around just 100 GWh of electricity. Instead, build an Energy Imbalance Market or an Extended Day Ahead Market for $100 million that moves around hundreds of GWh of electricity.”

And:

“Detractors of RE [renewable energy] seized upon the duck curve[3] as proof that RE could never be more than a supporting actor on the grid. Some technology promoters use the duck curve as an excuse to hawk their wares. These duck hunters have everything:

- Batteries

- Hydrogen and/or Power to X

- Pumped hydro

- Compressed and liquid air

- Blocks that get stacked in the air by cranes

- Blocks that get pulled uphill by trains

- MTV’s Dan Cortese[4]”

Their ideas seem plausible, but some will be fraught with political haggling because change results in winners and losers. They recommend (descriptions condensed by me):

- Build lots of RE. (I think we’re already there in some places)

- Trade electricity regionally. (I would say, trade across the seams discussed last week)

- Use price signals that drive demand response.

- Deploy heat pumps and EVs and make things like pool pumps controllable.

- Use gas as a bridge.

The market, tax credits, and a glut of generating assets got us to where we are today: massive carbon reductions. The progress made would not have otherwise happened. It was not a political war on coal, but a market that developed cheap natural gas that produces electricity with about one-quarter of the CO2 emissions of coal.

Dumping Issues

However, there are some issues with the PV Magazine ideas. First, there is a frequency and voltage response. Renewable resources cannot provide this while maintaining the required voltage and frequency. Electricity-consuming equipment cannot handle drifting out of those tight bands. It isn’t like a slow internet connection.

Second, while good, in my opinion, the pricing and demand response idea is going to run into a buzzsaw because some customers will pay more and others less under that regime. It will be very political, and I don’t mean left vs right. Instead, it will be this “special interest” group against that special interest group. Think AARP vs manufacturers vs Sierra Club vs consumer advocates vs farmers et al.

Third, “dumping” more and more renewable power means more curtailment time for steam turbines. As more renewables come online in this case, conventional sources get less and less efficient over a year’s time.

So what’s the answer? As I said at the outset of this series, I’m an engineer, and I can’t help it. We need a certain amount of dispatchable capacity that is available instantly (spinning reserve). This is something renewable sources cannot provide. We need a certain amount of capacity that can meet the load for several days. This is something storage cannot provide. Creating a super-grid discussed last week can diversify the renewable market, particularly, wind. Nuclear is expensive, even when generating at near capacity at all times. Triangulate all that with price, reliability, and politics, and there is the answer with several thousand degrees of freedom. It isn’t easy. We’ve made a lot of progress. A lot more will occur. That’s good! But perfect won’t happen. We will have to find it elsewhere.

[1] A spinning reserve is typically a steam turbine that can instantly take the load in case there is a fault. It has to be kept hot and spinning, requiring some fuel use.

[2] How? It isn’t generated and dumped, but simply not generated = curtailed. I can’t resist those sorts of corrections.

[3] This refers to the net load shape after massive amounts of solar-generated electricity are foisted onto the grid. For more, see here.

[4] Must be some pop culture thing I know nothing about.