As we prepare to take our energy storage solutions to market, I gathered recent news reports, analyzed them all, and came to some conclusions. I concluded that utilities, and especially regulators, need to think differently. What got us here – constant load growth and earning returns on conventional rate base by building power plants, transmission, and distribution systems – will not get us there (the energy transition) without turmoil and upheaval.

[Ad] Sign up for AESP’s decarb course to learn more details. Public service commissions get 50% off. Why? Because they must know this stuff.

Nothing Lasts Forever

Like everything, the electric utility monopoly will not last forever. I introduced this risk several years ago in my earlier presentations on electrification for the Wisconsin Public Utilities Institute’s (WPUI) Energy Utility Basics course. The next edition is October 2023. Register here.

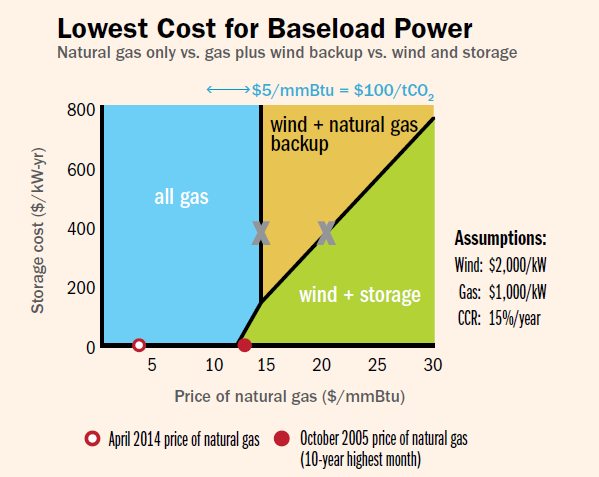

The monopoly model will end when less expensive and/or more reliable alternatives emerge. For example, I demonstrated a couple of weeks ago that solar plus batteries cost $1.24 per kWh. A few days ago, I found that Princeton used the same methodology with wind and batteries or wind and natural gas. Battery storage costs have fallen about 10% since the Princeton analysis.

Per Lazard, utility-scale renewable generation and storage are substantially cheaper than residential. However, utilities have transmission, distribution, employees, outage recovery, etc. What does “it” look like at scale, is the question.

Loss of Customer Risks

It’s easy for a home to generate as much electricity with solar as it consumes. The homeowner needs some cheap battery storage, like lead acid, which won’t catch fire and is 90% recyclable. Here in the Midwest, solar aligns well with the cooling season. Combine solar, a little battery storage, and a heat pump, and a homeowner is set. For winter, I would install a backup natural gas generator for resilience, power generation, and heat. Nothing is wasted. The waste heat from the generator makes the heat pump it powers exceptionally efficient, and if there’s still heat left over, there is water to heat for hot showers.

The technologies are all there. It just takes some VC to package it with controls and scale it. I’d bet my house that such a power-generating, HVAC, and water-heating system would be cleaner than the grid for decades and maybe forever.

Microgrids

Microgrids are a growing phenomenon. What is driving the trend? Resilience and reliability. By definition, a microgrid can isolate from the macrogrid and keep the lights on. What happens when microgrids start banding together and building their own resilience and reliability network? Pretty soon, they may ask why we are paying the macrogrid for standby charges.

Storage

More than anything, what I’m reading about energy storage tells me that conventional thinking is still firmly in place. Utilities and commissions must think differently about storage, and the models for utilities to profit must be revised, i.e., performance-based ratemaking.

Here is a simple concept: energy storage deployment should be just like the resource stack of power supply. Buy the least expensive resources first and build from there. Lithium-ion batteries are the peaker plants of storage. They are by far the most expensive storage technology per lifetime kWh.

Thermal Storage

The least expensive storage is thermal, which is manufactured with exotic, environmentally innocuous materials like blow-molded plastic, salt, and water. Read all about it in AESP’s current Energy Intel Magazine.

Thermal energy storage has a resource stack as well. Frozen food and chilled water are ready to go today. As a system, it must be designed to fit the application. Utilities should consider owning these assets behind the meter, and commissions should support that.

I’ll bet it won’t be long before thermal storage is written into energy codes. Appliances like refrigerators, heat pumps, and water heaters will use phase-change materials for thermal energy storage.

Pumped Hydro Storage

Building pumped hydro costs about $2,500 per kW of delivery for eight hours, not counting transmission. This is according to the construction of one facility planned for Nevada and backed by a PNNL study. The problem with pumped hydro is that it requires expensive transmission lines to the tune of $2.0 to $2.5 million per mile. The transmission cost for thermal storage behind the meter is zero.

Behind-the-meter thermal is about $1,300 per kW; no T&D is required.

Battery Storage

Per our conversations with them, utilities are wisely looking for less expensive storage alternatives, especially compared to batteries. However, I read about battery projects that seem to be designed to displace large baseload power plants. Why?

For instance, why would you put battery storage on site with grid-scale solar? The power must still be transmitted and distributed with poles and wires. Constraints develop, especially if electrification takes off and more poles and wires are needed. Put the storage on the other side of the constraint to delay or avoid T&D upgrades! I even read about one utility building a battery storage system at a substation and then planned to add transmission capacity to that substation. What? Why would you do that? That is old-school thinking – build stuff to earn a return. No! Be wise to keep costs at a minimum.

Conclusion

Utilities had it easy for 100 years. Loads grew at seven percent annually, and they built generation, transmission, and distribution to keep up. Making money was as easy as falling off a log. The last twenty years have become more complex as load growth flattened and peak loads increased. At the same time, some regions have built out vast supplies of renewable, intermittent generation.

There are two sides to everything. Electrification and the energy transition are a threat and an opportunity at the same time. If I were a utility executive, I would forget the monopoly model and play like the company is at risk of losing customers. I would focus like a laser to keep prices low and reliability high while lobbying lawmakers and commissions for performance-based ratemaking.