In the last two Rant posts, we explored dated benefit-cost tests for energy efficiency and demand response programs and introduced flaws with dated ratemaking schemes. Both constructs are based on a century-old “cost of service” business model for monopolistic utilities.

In a nutshell, the cost of service includes the debt and equity financing of generation, transmission, distribution, and operations and maintenance, which includes employees, fuel, storm damage repair, and arboriculture. Add up all those costs, including competitive investor returns on equity and debt, and then smear those costs as equitably as possible across the customer base. The sum of those costs is called the revenue requirement.

Ratemaking Basics

The ”smear” includes five functions of ratemaking[1]:

- Capital attraction

- Reasonably priced energy

- Efficiency incentive

- Demand control (or consumer rationing)

- Income transfer

Efficiency in the context above means economic efficiency driving toward pricing that would be considered competitive against companies with similar financial risk.

Income transfer is a social, as in socialism function. It is the balance of payments and who pays what, including low-income, industrial, small business, and wealthy EV owners versus what the investors need (capital attraction) to draw money to build things and deliver electricity.

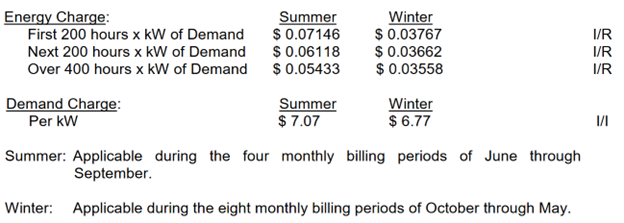

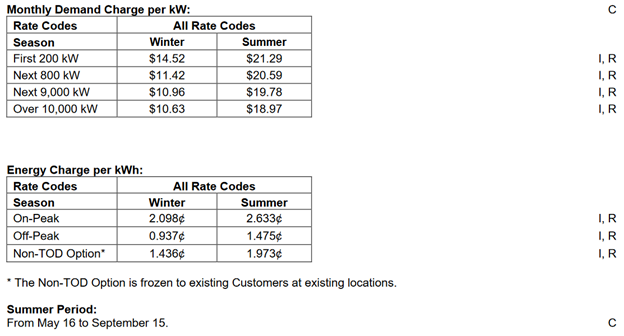

The demand control function would include demand charges versus energy charges and the way these are structured. One example of a structure is inverted block rates, in which the more the customer uses, the lower the incremental cost. Inverted blocks may apply to energy and demand, as shown in the tables below, for energy and demand, respectively.

Figure 1: Utility Block Rate – Energy Charge

Figure 2: Utility Block Rate – Demand Charge

Figure 2: Utility Block Rate – Demand Charge

The demand control function is where utilities and the commissions and intervenors that regulate and twist arms need to focus to minimize the revenue requirement and adequately reward investors during this transition to increasing shares of intermittent renewable energy supply. As I ranted last week, flat rates or anything like them must become as extinct as leaded gasoline.

The demand control function is where utilities and the commissions and intervenors that regulate and twist arms need to focus to minimize the revenue requirement and adequately reward investors during this transition to increasing shares of intermittent renewable energy supply. As I ranted last week, flat rates or anything like them must become as extinct as leaded gasoline.

We need flexible loads and energy storage to keep prices via the revenue requirement low and the reliability of the electricity supply high. As we discuss in our webinars, this blog, and confirmed by utility commissioners and consumer advocates, reliability and downward pressure on rates are paramount.

Bills are Coming Due

Why and how is there “nothing but upward pressure[2]” on prices and growing concern about reliability?

First, it was easy to construct thousands of megawatts of utility-scale renewable solar and wind power generation on top of an abundance of dispatchable thermal power generation. Second, these subsidized renewable generators with zero marginal energy cost suppressed prices and drove thousands of megawatts of dispatchable generation out of business.

One of the reasons the Midcontinent Independent System Operator (MISO) was able to keep the air conditioners churning during a couple of heat waves this summer was delayed thermal plant closures – i.e., pausing the transition. This is not a sustainable solution, as these aging plants will need significant upgrades, environmental controls, or outright replacement. The loss of dispatchable thermal plants plus extreme weather will escalate adequacy issues, increase outage risk, and put tremendous upward pressure on prices. The easy supply-side decisions are all behind us.

Looking Ahead

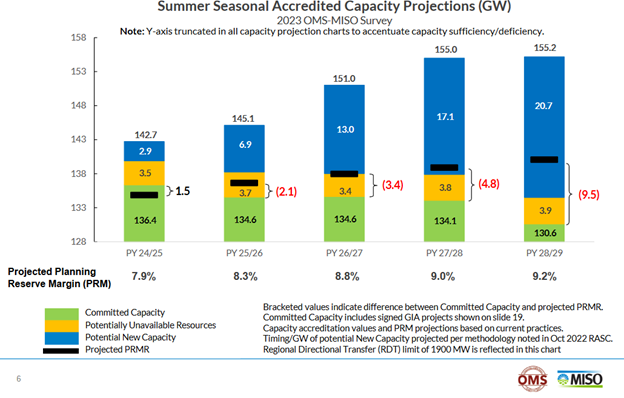

What does the trend look like? The following chart from MISO and the Organization of MISO States demonstrates the PRMR or planning reserve margin requirement via the thick black line. All is wonderful when that is in the green as it is for 24/25. The yellow part appropriately signals caution, representing thermal plants on the fence. That is a zone of risk. The blue portions represent even higher risk as those resources are merely on the drawing board.

Clearly, we need flexible loads and storage to put low-cost downward pressure on the PRMR. AND we need load flex and storage to resume rather than pause the transition. To make this happen, we need rate reforms and innovative programs. Next week, we will wrap up this four-post series to provide some common sense and innovations to get us out of this painted-in corner.

Clearly, we need flexible loads and storage to put low-cost downward pressure on the PRMR. AND we need load flex and storage to resume rather than pause the transition. To make this happen, we need rate reforms and innovative programs. Next week, we will wrap up this four-post series to provide some common sense and innovations to get us out of this painted-in corner.

Parting Commentary: Ahead of the Curve

A few weeks ago, I provided the math that demonstrated a shortage of housing combined with soaring mortgage rates doubled the cost of home ownership in just a couple of years. Sunday, September 3, 2023, Zerohedge got the memo. Ahead of the curve. That’s where the Energy Rant is; therefore, you, as a reader, are too.

[1] Tomain, J. P. (2022). Energy Law in a Nutshell. West Academic Publishing.

[2] Paraphrasing from Chris Ayers, President of the National Association of State Utility Consumer Advocates