I spent part of last week at the Smart Electric Power Alliance’s Grid Evolution Summit. In my notes I wrote, SEPA is out of the closet. They are full-throated in support of decarbonization of the grid. A carbon-free grid brings a limitless stream of what-ifs. This post features a few of those.

Regulated Vertical Markets

In regulated, vertically-integrated electricity markets, utilities drive decarbonization in collaboration with stakeholders across the board – cities, communities, industry, landowners, consumer advocates, regulators, legislators, and economic development authorities. I realized from Summit presentations that some utilities do better than others managing and lining up all these stakeholders. The reason for stakeholder engagement in vertical markets is, of course, to pave the way for wind farms while keeping prices “affordable.” “yaaaay.”

The name of the game here is “affordable,” and convincing the public, and especially regulators and ideological lawmakers, that what is proposed or built is better than the status quo, which is primarily coal and nuclear.

Deregulated Competitive Electricity

Deregulated states present a range of differences, as I have mentioned before, most recently, here. Deregulated states under control of the same regional transmission organization, like PJM, have substantially varied policies. Republicans in Ohio, for example, in an unfree-market lurch chose to shield coal and nuclear plants from forces of innovation including renewables, storage, and efficiency. Meanwhile, I learned directly from the CIO from a Pennsylvania utility that their policymakers have made it clear, there will be no bailouts, at least so far.

Who knew purple/blue Pennsylvania is a more free market and innovative state than deep red Ohio? You do now, thanks to your wisdom for reading this blog.

Protection Seekers Beware

I’m sure you’ve been in an audience or pew, listening to a speaker while nodding your head and thinking or saying out loud, “Amen, brother” (or sister). This was the case as I listened to Willie Phillips, Chairman of the District of Columbia Public Service Commission. He was one of four panelists in a session entitled, “Game Changers: Innovation in Regulation and Market Design.” He is a whip-smart dude, and I’d love to listen to him for at least an hour and talk with him for a lot longer. He said, there is a long history of innovators coming after and (in my words) whooping regulated protected industries’ buttocks.

Consider the taxi market. For the better part of eighty years, maybe more, the Taxi industry enjoyed great monopolistic protections of local governments. In fact, I rode in cabs in the days of yore reading the regulations and customer rights on taxi seats, visors, and windows – anywhere a sticker could be affixed. I thought, “I’ll bet this industry is controlled by the mafia in cahoots with City Hall.” The lack of innovation and high costs, with kickbacks to the mayor, city councilpersons, and the Don, resulted in exorbitant pricing and lousy service.

You don’t need me to tell you what happened next.

Do you know what’s interesting? No, Jeff. Tell me more. Ok, I will.

The innovation that ran over the privileged monopoly of taxi services seems to have produced a miracle. I arrived at midnight at Reagan National for the SEPA Summit last week. Do I Uber or take a taxi? The disadvantage of Uber/Lyft is, where the heck are the pickup locations? At one airport I visited this past year, the pickup locations were a hike and located on a floor in a parking ramp. It can take 15 minutes or more to find the place and then order a ride. I opted for a taxi, a Prius even, that was waiting just outside the door.

The charge from DCA to 1000 H Street in DC was barely $20. I couldn’t believe it. The return ride was barely $15! I’d bet that 25 years ago when I lived in Northern VA, the same trip would cost more, not even adjusted for inflation. This is the force that hammered the protected (and still highly advantaged) taxi industry. I’m sure the Uber/Lyft disruption took out the rainbow of taxi companies in the area. Where there used to be many, it seems there are only a couple, but they are leaner and much more responsive, including speedy payment transactions.

Utility – is this how your customers see you?

Other examples of protected, regulated markets that were badly damaged due to technology include television, radio, and cable TV. They were forced to innovate, like the taxis to curb erosion of their market, but that takes them only so far.

What About Utilities?

I may need to write another post for the possible implications for utilities, but I will strongly advise this: If ever there were a time utilities should want a JD Power score, it’s now. Options for customers are here, and they are only going to get cheaper and more competitive. With electricity prices on the rise in regulated states, I’d be concerned. It isn’t sustainable.

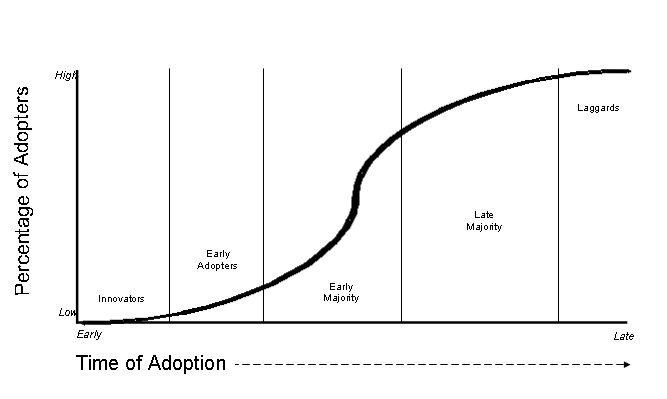

Alternatives to utilities are moving out of the virtue-signaling Innovator portion of adoption curves and into the early adopter phase. Utilities need to start giving customers reasons to stay, rather than reasons to cut the wire, even in monopoly territories.

More next week.