One of many sources of information that fuel my brain to write this blog is the American Energy Society’s Energy Matters newsletter. The newsletter features many items I don’t find elsewhere, and impressively, they seem unbiased – it is what it is.

Power Generation

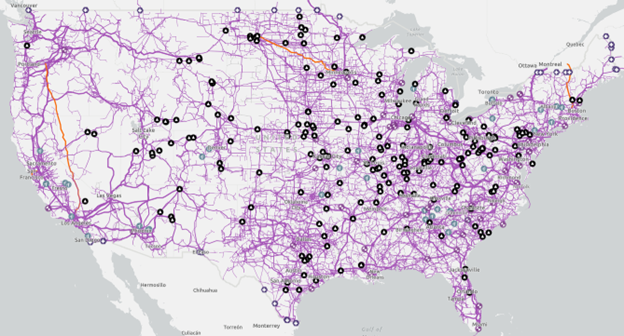

According to a linked New York Times article, 200 coal-fired power plants have closed in the last decade, with 200 remaining and 50 slated for shutdown in the next five years. They also linked to this informative, interactive map showing power generation from the Energy Information Administration. The black dots represent the remaining coal-fired power plants, roughly half of which are small 5-10 MW plants serving food processing and other manufacturing facilities. It’s also handy for looking up transmission line voltages and capacities – energy nerds delight!

Maybe more interestingly, users can click on any of these plants and see monthly power generation over time. The problem with wind energy, as I demonstrated last week, is that it may disappear for days at a time, but also, as I mentioned as far back as 2010, the wind blows the least in July and August, when summer peak loads arrive in the Midwest and the Mid-Continent Independent System Operator region. The chart below shows electricity production by the Green Acres Breeze wind farm, which casts shadows over where I grew up. The annual nadir of production is reliably July-August. That’s a reliability problem at scale.

Maybe more interestingly, users can click on any of these plants and see monthly power generation over time. The problem with wind energy, as I demonstrated last week, is that it may disappear for days at a time, but also, as I mentioned as far back as 2010, the wind blows the least in July and August, when summer peak loads arrive in the Midwest and the Mid-Continent Independent System Operator region. The chart below shows electricity production by the Green Acres Breeze wind farm, which casts shadows over where I grew up. The annual nadir of production is reliably July-August. That’s a reliability problem at scale.

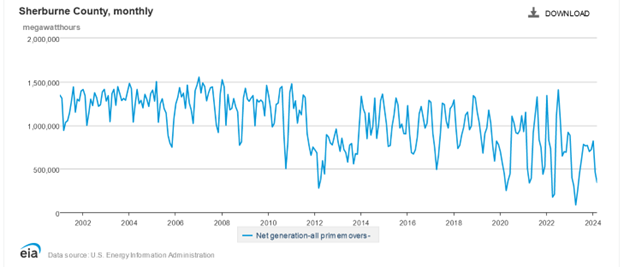

The following chart shows production from the Sherburne County Generating Station (Sherco) – a coal-fired facility in Becker, MN. It produces peak power, partly to offset the disappearance of wind generation, and ramps up and down more as wind assets have come online in the last decade. You can see why coal faces a tough sledding from this chart alone by comparing production from the aughts versus production in the teens and 20s as wind energy came online. Xcel Energy shut down Unit 2 in December 2023 and plans to shut down Unit 1 in December 2026 and Unit 3 in 2030. Here is a nice video of the process produced by The Wall Street Journal.

The following chart shows production from the Sherburne County Generating Station (Sherco) – a coal-fired facility in Becker, MN. It produces peak power, partly to offset the disappearance of wind generation, and ramps up and down more as wind assets have come online in the last decade. You can see why coal faces a tough sledding from this chart alone by comparing production from the aughts versus production in the teens and 20s as wind energy came online. Xcel Energy shut down Unit 2 in December 2023 and plans to shut down Unit 1 in December 2026 and Unit 3 in 2030. Here is a nice video of the process produced by The Wall Street Journal.

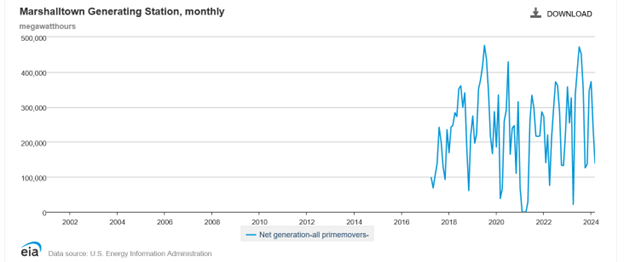

Natural gas plants are also picking up summer load. The next chart shows production by Alliant Energy’s Marshalltown Generating Station, an efficient combined-cycle natural gas plant. The load factor has only been 35% since it began operation in 2017, but the load is coming, as we see below.

Natural gas plants are also picking up summer load. The next chart shows production by Alliant Energy’s Marshalltown Generating Station, an efficient combined-cycle natural gas plant. The load factor has only been 35% since it began operation in 2017, but the load is coming, as we see below.

Soaring Loads

Soaring Loads

What does a broken record sound like? A scratched vinyl record repeats the same thing every revolution. A broken record would seem to make a racket. At the risk of sounding like a broken record, I have to mention that data centers, crypto mining, and artificial intelligence are forcing issues with utilities, regulators, policymakers, and underinformed lawmakers. In the pre-crisis phases of today, utilities are socializing the need for thermal and baseload powerplants to meet the load. As a result, utility stocks are hot. Standard and Poor’s Depository Receipts, known as SPDRs (spiders), for utilities, soared 15% in the last three months compared to a measly 3% for the S&P 500.

Barron’s reports, “Duke Energy announced last week that it is teaming up with Microsoft, Amazon, Alphabet, and Nucor on a new tariff structure for its service area aimed at lowering the long-term costs of developing clean energy, like new nuclear and long-term storage.”

Did he say nuke-u-lar?

Nuclear power is an excellent match for data centers with high load factors, meaning they operate with a constant load. I must say that data center load profiles are guarded with the security of nuclear launch codes, but we have been able to reverse engineer load data to verify.

Even our local generation and transmission cooperative, Dairyland Power, is socializing the need for nuclear baseload power generation. President Brent Ridge: “…we need to be prepared for when we move into, really the new nuclear renaissance. We need to be on the leading edge of that.” Dairyland and Alliant Energy each shut down and dismantled smaller (less than 500 MW) coal plants just south of La Crosse in the last couple of years.

The Barron’s article states the total data center load in the U.S. will double to 50 GW between 2023 and 2030. The total peak load has been around 740 GW, so these are major additions. Many new-build data centers become utilities’ largest customers overnight. Such is the case with the recently announced Google facility that will be built in Southwest Cedar Rapids, Iowa. I’m sure that will help load the Marshalltown combined cycle plant noted above. But that may be a peanut compared to Google’s construction in WEC Energy territory where its load will hit 1,000 MW, the capacity of a large nuclear power plant. These are staggering loads.

How does WEC Energy – aka Wisconsin Electric Power Company, aka WEPCO, aka We Energies – plan to meet these loads? Two billion dollars of natural gas generation with a pipeline expansion and LNG storage (storage: good idea). Critics say the plants will be obsolete by mid-century. They won’t be. WEC Energy says it needs the plants for three reasons: 1) The EPA makes continued operation of its coal plants unaffordable, 2) MISO gives its renewables fleet less credit toward its capacity obligations, and 3) growing load.

Why do I keep writing about this stuff? Because these are fascinating times I haven’t experienced in my career, and something must give. There is room for a lot of innovation in power generation, storage, load management, and energy efficiency. As importantly, the loads are coming much faster than the planning, approval, and construction of grid assets, pushing solutions toward load management and efficiency!

Soaring Loads

Soaring Loads