Last week as I began writing the second DRIPE post, I started down an electric-utility-pricing rabbit hole. I pulled back and saved it for this week – rabbit hole, botfly larvae, and all[1].

Now is a good time to play a card dealt to me a few weeks ago. An article in the Ohio Capital Journal described the latest efficiency bill that unanimously passed a House committee and included a precious quote from the Ohio Consumers’ Counsel: “The free market can create the efficiency effects of the legislation, without handing over millions to utility companies along the way.”

Wrong, for several reasons, the greatest of which is utilities are monopolies with pricing structures based on 50-year-old technologies. Customers are charged for consumption with modest pricing variations for summer, winter, day type (business day or other), and time of day. Large users get demand charges for slightly more equity[2], but that is also archaic.

Two-way communicating smart meters, part of the advanced metering infrastructure, and sophisticated wholesale bulk electricity markets have been developed to serve most of the country, but few customers (almost none) get the price signals from the wholesale market. And therefore, Ohio Consumers’ Counsel, your claim is weak.

Pricing systems do not adequately reward customers for reducing energy consumption during peak periods that set revenue requirements for the entire year. In this case, “peak periods” means the four-hour periods that occur about three times a year. Those peak periods set the transmission and generation capacity requirements – a very large part of the cost of service.

Not Common Sense

People understand how businesses make money. They buy some equipment, lease a building, start hiring people, in some cases purchase raw materials, and then they sell goods or services, hopefully at a profit – buy low or spend less, and sell high and charge more. There is a continuous drive for process efficiency, productivity increases, and product improvement to achieve pricing power, all of which can produce more profit. It isn’t easy, and it wouldn’t be any fun if it weren’t.

Utilities? Not so much. It’s still in a 100-year-old business model developed with the assumption of continuous 5-10% load growth, revenue requirements, and predetermined weighted cost of capital on some mix of debt and equity. Why the old business model? Lack of impetus, too many competing stakeholders, and all the things that come with the bureaucratic monopoly-management industry.

Let’s dig in.

Lilliputian Price Signals

Electricity prices for most customers are set by the time of day, day type, and season. Whether it’s 70°F and cloudy or 105°F sunny, calm, and humid, the retail price is the same on a weekday in July, even though the wholesale price may be radically different, per the supply curves we reviewed in the past couple of weeks.

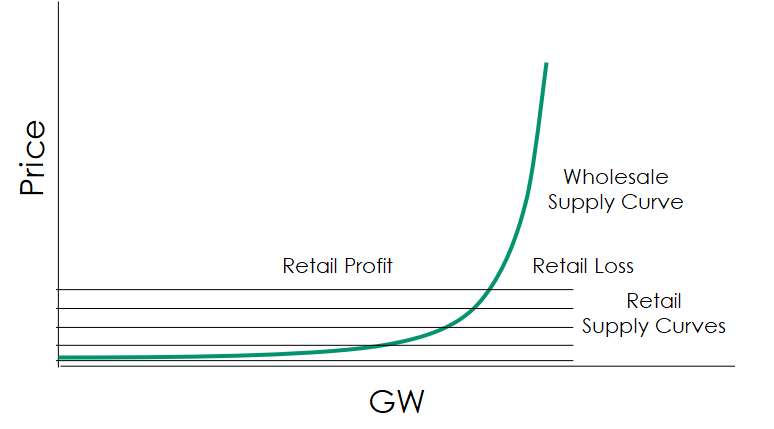

The retail supply curves below, from low to high, might be for the following customer types and circumstances:

- Large general service (e.g., huge industrial) winter off-peak (night or weekend)

- General service (e.g., medium commercial) winter off-peak

- General service winter on peak

- Residential winter, all hours

- Residential summer, all hours

Customers on large general service rates would have a hefty demand charge set during the highest 15-minute average demand, which can make up most of the bill depending on the utility and market. Also, there might be dozens of horizontal price curves for rates such as peak, super peak, and critical peak for any given utility for many different rate classes. It’s a grand mess.

Crudely, here in the Midwest and many other places, the archaic business model has an annual revenue requirement. The sum of all sales is greater than the sum of all expenses, including wildly fluctuating wholesale energy purchases throughout the year. The chart above shows utilities sell electricity at a “profit” on the left and above the supply curve, and they sell at a “loss” when below and to the right of the supply curve.

Crudely, here in the Midwest and many other places, the archaic business model has an annual revenue requirement. The sum of all sales is greater than the sum of all expenses, including wildly fluctuating wholesale energy purchases throughout the year. The chart above shows utilities sell electricity at a “profit” on the left and above the supply curve, and they sell at a “loss” when below and to the right of the supply curve.

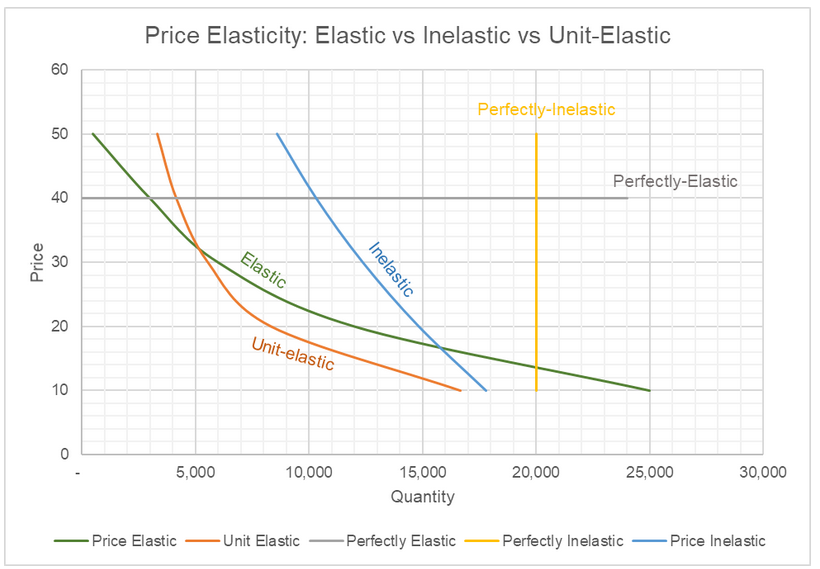

I’m not an economist, and anyone can tell me if I’m wrong. We have near-perfect elastic demand (horizontal) curves at any given time. In fact, most folks use more high-priced electricity in summer than they use in low-price winter. Consumption increases with price. What is that called? A different market with different needs, I guess.

Without pricing feedback, customers use energy almost at an all-you-can-eat rate. The next kW or kWh costs the same as the last one – not an efficient setup.

Rates of the Future

To work efficiently and minimize cost, the grid of the future requires wholesale price signals to flow through to customers. Customers should also pay for their appropriate portion of transmission and generation capacity.

We should have dashboards on our utility account login pages and device apps that show tomorrow’s forecast wholesale costs and pay accordingly. We should be notified for those three days per year when our “peak load contributions[3]” will be determined so we can minimize those costs as well.

This seems doable to me. The RTOs running wholesale power markets operate the most sophisticated pricing model I can imagine. Surely, making this information available to everyone and paying market rates every hour, every day, can’t be that hard.

[1] I saw these coming out of a rabbit one time and it was the most disgusting thing ever. I dare you to look for images on the innertube.

[2] Paying more in line with what it costs to serve them.

[3] Here is an overview to see how that works: https://supplier.bge.com/electric/load/plcs.asp