As I get older, I’m more interested in old stuff, especially how our ancestors lived, the challenges they faced, and the technologies they used. As I mentioned last week, our ancestors needed to be more creative than we are today. They had to use their brains or work tirelessly to serve customers to be successful (some of this is still required today).

Today, we simply make an algorithm to grind numbers to optimize processes. Compare the toil and ingenuity required to launch and build Facebook compared to Boeing, Ford, IBM, McDonald’s or Hilton. The efforts and ingenuity required to build those companies was vastly different, from one to the next. That is interesting to me. It is much easier to build a multibillion dollar company today but it’s also much harder to stay on top. (Uber v Lyft) The harder it is to build, the more resiliency it has, but more blocking and tackling (customer service, quality assurance, etc.) is required to maintain it. (Ford v GM)

The View, from 1985

On those notes, I recently discovered a 1985 article by Amory Lovins, published in Public Utilities Fortnightly. The title: Saving Gigabucks with Negawatts. Wow! Now this is perfect! It was published right at the time Michaels Energy was launched. Let us see what was going on in 1985 and how things progressed from then.

Four years ago in this post, I explained that consumers and small business want “clean, low cost, always on, invisible, safe, varmint-friendly, avian-safe, zero-emission power.” But mostly, they want reliability and low cost. None of that other stuff matters to the rank and file if the price goes up.

Lovins, in his 1985 article, similarly writes, “people want, seek, and will eventually find the amount, type, and source of energy that will deliver each desired energy service (such as comfort, light, shaft power, and electrolysis) in the cheapest possible way consistent with reliability and convenience.” Congratulations, Amory. Nothing has changed to this day.

Lovins went on to say the market was highly imperfect, but it was starting to resemble a free market in 1985. Here are some of his points:

- Efficiency could quadruple at a cost of 2 cents per kWh delivered (1985 dollars). Amory, you were way wrong. Per EIA data, the levelized cost of efficiency delivered was 0.9 cent per kWh among seven major Midwest states: MN, IA, WI, IL, IN, OH, MI. I’m not even going to bother looking what that would be in 1985 dollars. Probably 0.5 cent.

- While we have wind today, with a negative marginal cost to deliver, Lovins says it would be cheaper to implement efficiency and simply write off capital costs for plants that burn fuel – coal, natural gas, nuclear, oil. You are correct sir.

- (Again with the exception of wind) Fuel generated electricity cannot compete with efficiency. Touché

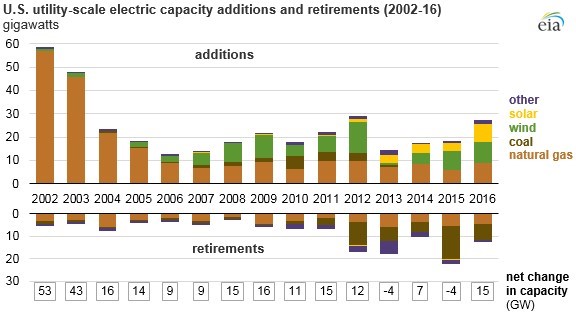

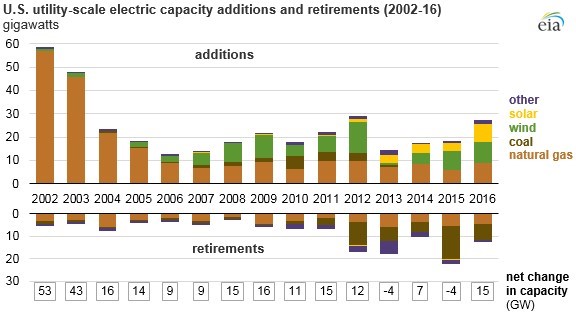

- He writes, “[the] industry is continuing to liquidate itself to build hundreds of plants it cannot afford, will not need, and will not be able to pay for.” See the chart below. One cannot argue Lovins was wrong. That is for sure. Generation was vastly overbuilt with coal plants being shut down willy nilly in recent years. And for that, you cannot blame renewable sources since they are not dispatchable resources. In fact, they require dispatchable parallel resources in the form of natural gas plants, as shown. How backward is that?!

- His last point, “how long it will actually take the customers to discover least-cost options[?] [It] depends on customers’ access to information, capital, and freedom of choice. It is a variable to be influenced according to policy goals. Utility experience now shows that implementation of efficiency is or can be made faster and more reliable than building plants.”

About that Access to Information…

His last bullet is an emphatic, spot on, bullseye, sixty yard field goal right down the middle. It is easy to spin efficiency as a hidden tax with wealth transfer among customers. It is also easy to explain the utility model is a massive wealth transfer business on the supply side too, to anyone who will stop for a moment and think just a little.

It is hard to explain that the large energy user paying hundreds of thousands of dollars to acquire resources for other customers 100 miles away, to avoid transmission, distribution, and power plants hundreds of miles away, that are paid for by you, big customer, cost less for you, big customer.

That is a complex statement to read and follow. Let me use a graphic in attempt to clarify:

0.9¢ efficiency < 9.0¢ supply[1]

Ask the controller. 0.9 cents or 9.0 cents? You can pay for the cheapest resource for other customers or you can pay 10x for other customers.

Hey regulators: let’s provide the same markup on the cost of energy saved versus the cost energy supplied! I think I read this before.

Thank you, Soothsayer Lovins. You nailed it.

[1] EIA data: https://www.eia.gov/electricity/data/eia861/