Our theme the last few weeks has covered technological change, consumer emotions, and irrational ways of thinking. The regulated monopoly and its cost-of-service model will not last forever. Someday it will be replaced. What might that look like?

Right after last week’s post, From Crazy to Rational went up, I read Why Electric Utilities Should Replace Electric Rate Base in Fortnightly. Wow. How fortuitous!

Cost-of-Service

The cost-of-service model (COS) described in last week’s post, and verified by the Fortnightly article, motivates utilities to provide slightly more business efficiency than government. The COS model sets revenue requirements for utilities by capitalizing it’s rate base (poles, wires, transformers, substations, and power plants) through debt (bonds) and equity (common stock), and passes through all operating costs.

The services sector, which comprises about 80% of the economy, could never survive on such a model. Imagine living off the cost of capital for chairs, tables, bar stools, fryers, griddles, and the water heater in a restaurant. The owner would need to charge a weighted cost of capital of about 4,000% to survive off that.

Losing Revenue

The Fortnightly author confirms utilities are losing revenue to actions taken beyond their control, which is to say, on the customer side of the meter. For residences, the customer side of the meter is the breaker panel and wires running through the house. The same thing goes for businesses, except for some really large ones, which may have their own substation or transformer bank on their side of the meter.

Behind the meter activity, of course, includes self-generation with solar and in some cases, wind and combined heat and power. It also includes efficiency and nascent storage. Since the vast majority of customers pay their electric bills through energy purchases, their home, which uses 30% less energy than 20 years ago, doesn’t use enough to cover utility fixed costs. Utilities need to raise prices on energy consumption or increase their fixed charges of service.

Unsavory Choices

Raising energy prices hyper-drives customer-meter-side investments making the case worse – resulting in the ballyhooed death spiral. It’s like a pyramid scheme in reverse where the last few customers with chairs pay it all.

Raising fixed charges throws renewable energy advocates, and efficiency advocates for that matter, into a tizz. The right way to go in these situations is to switch to a demand rate, which is a far more equitable way to cover fixed charges while paying an appropriate, non-ballooning energy charge. The demand rate argument will be saved for another day.

Profit on Goods and Services

The Fortnightly author writes that new large energy users often seek to secure their own electricity provider. This would be much like the mega-casinos in Nevada chose to do. To do so requires unbundling of utility services, so only interconnection charges customers to use the grid for backup and marginal power needs.

The solution to shrinking rate base, distributed energy resources, and demand management, he writes, is to provide a reasonable markup on the cost of goods and services. The utility becomes an energy facilitator rather than only a builder of things to be capitalized for 30 or more years.

It is nice to imagine such a world: utilities wouldn’t care if consumers wanted to build their own power generating resources. Excess power produced by those resources and absorbed by the grid would be served with a markup and sold to other customers. Similarly, demand management could be acquired and marked up whether it is dispatchable (demand response) or undispatchable (energy efficiency).

Leveling the Field

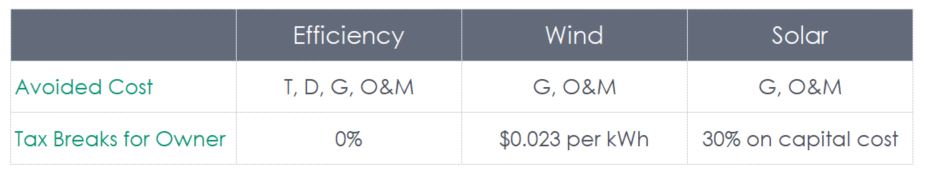

Perhaps this is a way to level the playing field with renewable power supplies. Consider how energy efficiency gets the shaft compared to renewable resources. Renewable supply-side resources still required half the cost of delivered energy, which is, the grid. Efficiency requires nothing. Efficiency displaces everything from the coal mine to the meter. To get a tax break for efficiency, you have to build a new building, and it has to consume 50% less than a code-compliant building – and for this four-minute-mile equivalent, you get a dime, which when I was a kid, you could buy a Sunrise strawberry soda in a returnable glass bottle[1].

T = Transmission

D = Distribution

G = Generation

O&M = Operations, maintenance, fuel

Still another alternative to the outdated cost-of-service model is to capitalize services such as demand management. Rather than providing zero incentive for utilities to do efficiency, services provided to displace supply-side resources can be rolled into the rate base. Illinois is one example where utilities are allowed to do this.

Alternatives Will be Challenging

Unbundling utility services will pose a fair challenge for consumers and businesses, not unlike unbundling cable and internet. There are many alternatives to cable TV these days.

Cable companies provide TV and internet over the same wire. The incremental cost to add television programming to an internet connection is cost competitive with internet only and buying some other TV programming alternative. I choose to not mess with that, but I thank the millions of people who do because it lowers my programming costs through competition. Will this come to utilities anytime soon? Could be.

[1] Only slight facetiousness. The four-minute-mile was a long-time barrier in track and field.

Join the discussion One Comment