I think the bots troll the Rant because as soon as I report something, here comes a related article. The latest occurrence featured Energy Central, which republished an article from The Washington Times, which referenced an article from The New York Times (talk about strange bedfellows) that stated customers in states with “competitive” wholesale markets pay an average of $40 more per month for electricity. Therefore, they conclude to readers that wholesale markets are a rip-off for the following reasons PER The New York Times and NOT me:

- Utilities are spending more on transmission in deregulated states because they can

- In deregulated states, generators take profits on electricity (egad!) [in addition to delivery (utility) profits]

The paper of record states, “New transmission lines in deregulated markets often get limited review by state or federal officials, which means they are less likely to be rejected on the grounds that they are too expensive or that a less costly alternative, like a local power plant, could be substituted.”

First, I don’t believe transmission approvals are easier in deregulated states. Second, what would “a local power plant” be? Coal, which is not allowed anywhere, or new natural gas plants, which are not allowed in at least half the deregulated states. Is there a difference between unsubstantiated conjecture, misinformation, misrepresentation, stupid, and free speech? No. Readers must discern everything.

On that note, I don’t believe anything the mainstream media says, including stories on balloons, war, and train wrecks. So, I fact-checked the Times article regarding the $40 claim noted in the first paragraph. Broken clocks are indeed correct twice a day. The average retail cost of residential electricity in deregulated states is $0.1469. The average in regulated states is $0.1180. Typical homes use roughly 1,000 kWh per month, so the article from The New York Times estimate is reasonable.

Shocked To Reality

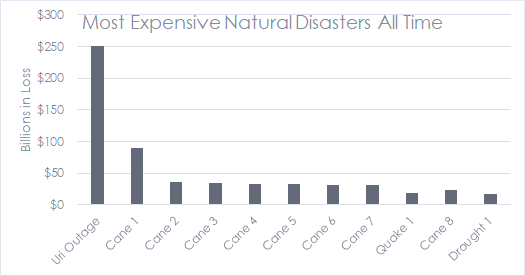

Guess what is more costly – an outage in cold weather or massive hurricanes that we are led to believe never happened before the industrial revolution. The Texas Tribune reported that winter storm Uri, in February 2021, caused $250 billion[2] in property damages. The most destructive hurricane on record caused less than a measly $100 billion per Newsweek’s five most expensive natural disasters of all time. They forgot Uri, the damages of which were largely due to deregulation, and I backed that up here.

We can see why Jeff frequently bashes past, present, and forward-looking electricity policy. It’s because the lack of electricity in extreme weather is devastating to life and property. It’s why I have a portable generator and a gas boiler wired to plug into it when, not if, we have an outage for hours or days that would freeze and break every pipe in my home.

We can see why Jeff frequently bashes past, present, and forward-looking electricity policy. It’s because the lack of electricity in extreme weather is devastating to life and property. It’s why I have a portable generator and a gas boiler wired to plug into it when, not if, we have an outage for hours or days that would freeze and break every pipe in my home.

Wildfires

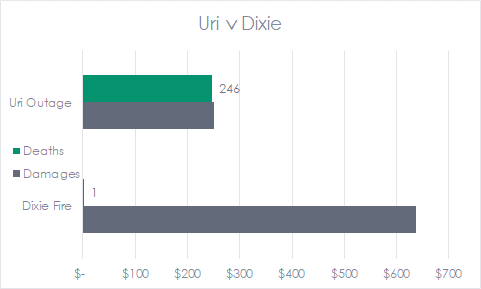

You might be thinking, what about the fires caused by climate change? Me too. The two most damaging fires noted by Statista were Dixie ($637B) and Beckwourth ($542B) caused by powerlines and lightning, respectively. The third most expensive wildfire is statistically the same as Uri.

Let’s compare Dixie to Uri per the following chart[3][4]. Power outages in cold weather are deadly, get it, lawmaker?

Far and away, the most expensive disasters are in deregulated states of Texas and California. At least Texas has competitive prices compared to the rest of the country. California has the most expensive electricity in the lower 48, and Texas has the 15th least expensive electricity in the U.S.

Far and away, the most expensive disasters are in deregulated states of Texas and California. At least Texas has competitive prices compared to the rest of the country. California has the most expensive electricity in the lower 48, and Texas has the 15th least expensive electricity in the U.S.

Generator Gouging?

The NYT article claims that deregulated states have higher electricity prices because of price gouging by generators. That is laughably and demonstrably wrong.

First, when states deregulated, investors only wanted the regulated poles and wires companies (utilities, aka, local distribution companies and transmission companies). TXU, the former vertically integrated utility serving Dallas, spun off their distribution company, Oncor, which everyone wanted, and their power plants, which no one wanted. TXU[5] filed for bankruptcy in 2014, the 8th largest bankruptcy of all time when it occurred.

Second, as described last week, generators bid in reverse auctions. A reverse auction is just like it sounds – the seller agrees to sell at a minimum price. This is the reverse of a standard auction, where the buyer agrees to buy at the highest price.

What is the market clearing price in a reverse auction? It is close to the marginal cost of energy: fuel, operations, maintenance, and the avoided costs of shutting down and restarting. The clearing price is a money loser for the marginal bidders that put the last kW on the grid. The bid does not include capital costs, which must eventually be recovered through higher prices or go bankrupt. You can spend a billion dollars on a 500 MW natural gas power plant, and it may benefit from selling electricity and losing less money than not selling. This may be the greatest reason competitive markets are destined to fail.

Transition

There is still plenty to write about.

A Rant reader once told me that state legislators and public service commissions should read this stuff. Yes, they should. I’m in the genuine intelligence business, not the artificial happy talk business. This is serious stuff, as proven herein.

[1] https://www.eia.gov/electricity/sales_revenue_price/

[2] Average of low and high estimates: https://www.perrymangroup.com/media/uploads/brief/perryman-preliminary-estimates-of-economic-costs-of-the-february-2021-texas-winter-storm-02-25-21.pdf

[3] https://en.wikipedia.org/wiki/Dixie_Fire

[4] https://www.cbs19.tv/article/news/local/texas-winter-storm-report-246-people-died-statewide-18-of-those-were-from-east-texas/501-8a1a0907-5293-40f0-a176-4aa6f50b27db

[5] TXU was renamed Energy Future Holdings.