First, A Branding Whetter.

Two weeks ago, I peppered the Big Three Automakers, Ford, General Motors, and the company formerly known as Chrysler, for forgetting their cash-cow customer base, which loves large gas-guzzling sport utility vehicles and big honkin’ pickup trucks. Last week, Cracker Barrel laid a more epic duck-up right in the grill of their core customer and fan base.

In full disclosure, I’ve never been to a Cracker Barrel (ticker: CRBL). But even before that, The Wall Street Journal reported in June that CRBL is “decluttering” its stores. The clutter included farm tools, butter churns, and other folksy stuff, which I like. In fact, last week I toured my old High School, which was closed and turned into a mix of a fitness center, with excellent equipment from the athletics department, a meeting center for weddings, anniversaries, and reunions, and a museum of cool old stuff, like pig catchers and fence makers, which I had never seen or even heard of before. Surprisingly, the curator didn’t have a chicken catcher. You know what happens after the chicken catcher is used, right? Running around like a chicken with its head cut off? Except they don’t run. They flop around randomly for about a minute of “free range” brutality.

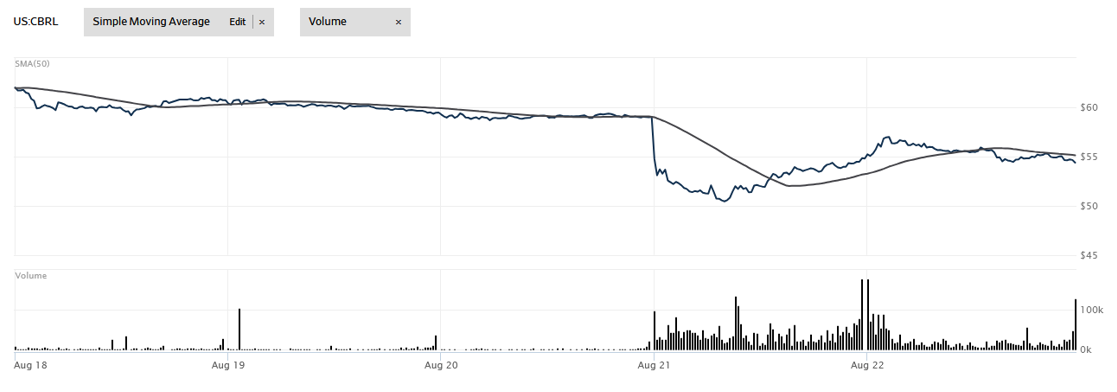

Last week, Cracker Barrel launched a new logo, ditching the old man in bib overalls and the barrel. Reactions by customers, mainstream media, social media, and the equity markets have been catastrophic, with merciless pounding on all fronts. Figure 1 shows CRBL’s stock price over the five days ending Friday, 22AUG25. Guess when the logo dropped.

Figure 1 Cracker Barrel Stock Price

We’ll have a branding expert autopsy this boondoggle in a couple of weeks with a guest post. I’ve said for years that it’s too bad there’s no money in stopping a stupid idea. For example, how can I make a fortune on Rivian’s guaranteed bankruptcy?

We’ll have a branding expert autopsy this boondoggle in a couple of weeks with a guest post. I’ve said for years that it’s too bad there’s no money in stopping a stupid idea. For example, how can I make a fortune on Rivian’s guaranteed bankruptcy?

Headliner, Soaring Electricity Prices

Shifting gears, I couldn’t leave Heatmap’s headliner, How Electricity Got So Expensive alone, particularly when they picked a fight with President Trump, who blamed soaring costs on renewables.

The Associated Press wrote, “President Donald Trump has lashed out at renewable energy sources such as wind and solar power, blaming them for skyrocketing energy costs.“ Further, they quoted Trump’s Truth Social posts, calling wind and solar, “THE SCAM OF THE CENTURY!“ and “The days of stupidity are over in the USA!!!“

I missed this one from the campaign trail via Newsweek in October 2024. Trump was quoted as saying, “We will cut energy and electricity prices in half within 12 months—not just for businesses but for all Americans and their families, and we will quickly double our electricity capacity.“ ???????? As Bugs Bunny would say, what a maroon.

Last week, Trump also declared himself to be a turf-care expert. He also “know[s] more about drones“ than anybody.” It’s easy to understand how his detractors can’t stand the man. But then, what politician doesn’t claim to have cut taxes 46 million times, or that when that happens, women, children, and seniors will starve, and hospitals, schools, food pantries, and grocery stores will close when those tax cuts are enacted?

Unlike the President, I have an extensive library of posts in the Energy Rant explaining electricity price drivers, going back 10 years. See Table 1 and read up on the linked Rant posts as evidence. Renewables are mentioned thrice, but I also discuss the bogus levelized cost of electricity, comparing production costs, when generation is available, for renewables versus dispatchable power plants. That misleading factor may drive sub-expert politicians to go all-in on renewables.

The last of the baker’s dozen price drivers in Table 1 summarizes the current driver that is acutely affecting prices: dispatchable thermal power plants are closing faster than they are being built, and load is increasing at the same time.

Table 1 Energy Rant Electricity Price Drivers Library

Factor | Description | Relevant Rant Post | Link |

Fuel Costs (Gas, Coal, Hydro, Nuclear) | Traditionally the biggest driver; natural gas often sets marginal prices, though electricity is increasingly decoupling from fuels. | Electricity’s Decoupling From Fuel Costs | |

Renewable Penetration and Variability | Wind/solar lower prices when abundant but require costly backup capacity and grid balancing. | Electricity’s Decoupling From Fuel Costs | |

Capacity Market Structures vs. Energy-Only Markets | Capacity markets provide reliability payments; energy-only markets depend on scarcity pricing, leading to volatility. | Capacity Market v Energy Market – What’s the Diff? | |

Transmission and Congestion Constraints | Bottlenecks and constraints raise locational marginal prices (LMPs), especially in policy-heavy regions like NY. | Derisking Load Growth and Cost Overruns | |

Market Manipulation and Gaming | Withholding, bidding strategies, and exploiting caps increase prices and emergencies. | Electricity Market Manipulation – Higher Costs, More Emergencies | |

Regulation vs. Deregulation (Policy Environment) | Regulated states show more stability; deregulated markets show volatility depending on design. | Regulation v Deregulation in True Color | |

Environmental and Renewable Portfolio Standards (RPS, Cap-and-Trade, Carbon Policies) | Mandates for renewables and carbon policy raise retail prices, especially in CA and Northeast. | Electricity Price Drivers | |

Load Growth and Electrification | New demand from EVs, data centers, and electrification raises capacity and marginal costs. | Derisking Load Growth and Cost Overruns | |

Demand Response and Energy Efficiency | Efficiency and DR reduce peak demand, lowering costs compared to new capacity investments. | Electricity Shortages and What to Do About It | |

Reliability and Backup Requirements (The LCOE Problem) | LCOE is misleading—ignores firming, storage, and reliability costs; FCOE better reflects true costs. | Planes, Bikes, Automobiles, and the Deceptive LCOE | |

Geography and Resource Mix | Resource access (hydro, coal, gas) keeps some states cheaper; others face imports and higher renewables costs. | Electricity Rates and Reliability – Access and Policy | |

Auction Outcomes and Market Clearing Prices | Capacity auction results (e.g., PJM) directly drive retail costs when clearing prices spike. | Two Questions for Electric Utility Stakeholders | |

Supply and Demand (Plant Closures vs. Replacement) | Power plants are retiring faster than they are being replaced, tightening supply relative to demand and driving prices upward. | All Aboard the Less for More Train |

Utilities in primarily vertical markets, like MidAmerican Energy, which I wrote about a couple of times recently, have kept their legacy thermal (coal) plants online to serve as backup for their wind generation. According to CEO, Kelcey Brown, MidAmerican struck a deal with the Iowa Utilities Commission such that once it meets its revenue requirement, the rest goes to pay down rate base (e.g., wind farms). Perhaps their strategy is to have the wind farms paid off by the time the coal plants are at the end of their life, just in time to build efficient combined cycle natural gas plants to replace the coal plants. That would be brilliant, and Energy Rant approved.

In summary, per Table 1, electricity pricing trends are complex and involve dozens of factors. The acute challenge is the rapid retirement of dispatchable generation and load growth that hasn’t been experienced since the 1970s. Policymakers must price up load management, storage, and energy efficiency behind the meter, FAST, while the power generation industry increases manufacturing and construction capacity.