I like to stay ahead of the curve here at the Rant, but I would have needed to call play-by-play like Kirk Herbstreit on a college football game to keep up with the Cracker Barrel makeover fiasco. The CBRL fiasco played out faster than a college football game, which now averages two days, four hours, and twenty-three minutes.

Cracker Barrel executives and their ad agencies seem clueless about their clientele. Executives need to understand and keep the pulse on their customer base. Steve Jobs was famous for this, but less known for it are Susan Morris, CEO of Albertson’s Supermarkets, and Wesley Batista Filho, CEO of JBS-U.S., which produces one-fifth of the beef and pork consumed in the United States.

Ms. Morris was featured in The Wall Street Journal. Starting nearly four decades ago at the customer service desk, the article says she walks the aisles of her stores and can tell how long an apple has been on the shelf. She is fiercely competitive.

Mr. Filho obsesses over the lawn and landscaping at his slaughtering plants and whether workers are engaged and smiling as they enter the facility (no kidding). “It shows that people take care of the plant,” he said in an interview in New York this past week. “It’s a big deal.” Yes, it is!

Cracker Barrel CEO Julie Masino’s 30-year career track includes stints with Godiva, Coach, J. Crew, Macy’s, Starbucks, Mattel, and Taco Bell. Assessment: Schwanky, modern, fast-paced, and hip—not exactly the Cracker Barrel core profile. The Board of Directors needs to look in the mirror.

We’ll finish with an expert assessment by Liz Haworth next week.

The Latest on Rising Electricity Prices

Last week, Barron’s reported that residential electricity prices have increased 30% since 2021, about half as much as a burger at a restaurant in my experience. As I noted, this is a problem for the Trump administration, which declared it would cut electricity prices in half in one year. Prices are 5.5% higher than a year ago. The Energy Information Administration projects electricity prices will increase by 6% in 2026. Well, we can put a fork in the electrify-everything movement. It’s well done.

Barron’s notes utilities and merchant generators like NextEra, Vistra, and Duke Energy could get dinged by the rising prices as they benefited from growing loads, driven mainly by data centers and the explosion of artificial intelligence. “Someone has to pay for all that new infrastructure to serve those plants – and some of those costs are already hitting consumers.”

Price Caps, Shortages, and Rising Long-Term Prices

Ironically, last week I presented 13 reasons or impacts that affect electricity prices. I’ll add one more that involves data centers, but it’s not the explanation readers and the mainstream media have in mind.

That is the simpleton’s assessment, which is maybe only 30% of the reason. But first, a worthwhile diversion. As I’ve seen elsewhere, Mid-Atlantic (PJM) states are advocating price caps on payments to power plant operators. That is an idiotic move and another reason we have shortages and soaring prices. If you want to run out of something, put a price cap on it, and it will do precisely the opposite of what is needed – an increase in supply.

Environmentalists (Sierra Club) blame price increases on the DOE’s order to keep coal plants open and the lights on. Calculating the cost of operating a plant in a vacuum is easy, but what does that mean for the overall market? Increased supply can avoid the most costly peaker plants on the supply curve.

The Regulatory Bureaucracy

As usual, the answer is more complex, and there is plenty of blame to spread around like creamy Skippy.

I attended last week’s second annual Data Center Frontiers Trends Summit in the heart of the AI beast, Reston, Virginia. At last year’s inaugural conference, I pondered how independent power producers would cost-effectively provide electricity behind the meter without expensive backup power and standby charges offered by the grid—silly me. The industry has figured it out, leaving the utility industry and its excessively slow-moving regulatory bureaucracy holding the bag with the most expensive services, which will drive up the cost of service for all ratepayers.

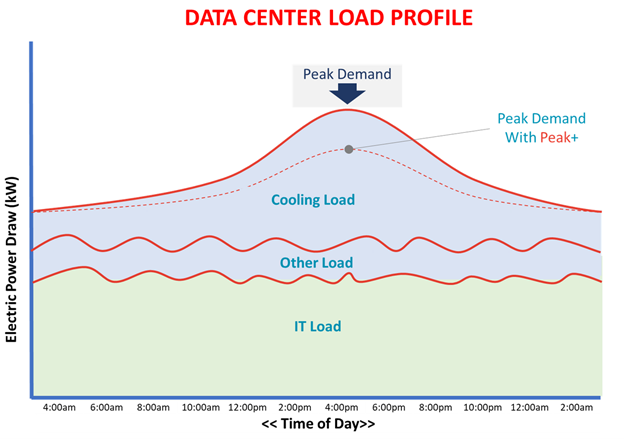

Data centers with their humongous base load have high load factors, averaging about 85%[1]. Figure 1, courtesy of Peak+, is a representative electric load profile cartoon for a large data center. The cooling loads are a bit exaggerated for demonstration purposes.

Figure 1 Data Center Load Profile

Due to the utility and regulatory tectonic-speed bureaucracy, merchant power generators are swooping in to take the base load for data centers, and they are doing it with resilient, redundant, and reliable systems featuring internal combustion engines driving on-site power generation with four or five nines of reliability.

Due to the utility and regulatory tectonic-speed bureaucracy, merchant power generators are swooping in to take the base load for data centers, and they are doing it with resilient, redundant, and reliable systems featuring internal combustion engines driving on-site power generation with four or five nines of reliability.

On-site merchant power producers can compete with utility electricity on price because they have no transmission, distribution, or bureaucracy costs. They have redundancy and fanatical maintenance, providing baseload power like a nuclear power plant.

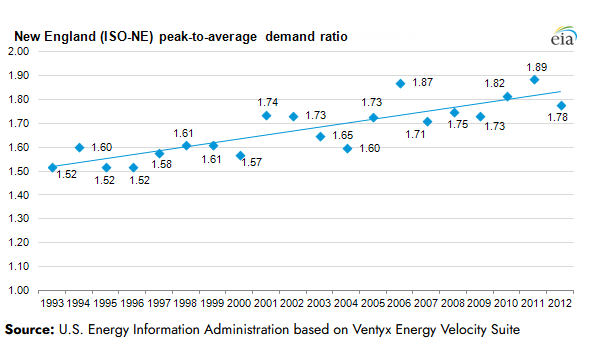

The result is that utilities are losing massive baseload sales, which is eroding their load factors compared to what they could be. Peak-to-average demand ratios have been increasing for thirty years, as shown in Figure 2. This increases electricity prices because more generation, transmission, and distribution are required for a given volume of energy sales.

Figure 2 Peak-to-Average Utility Loads

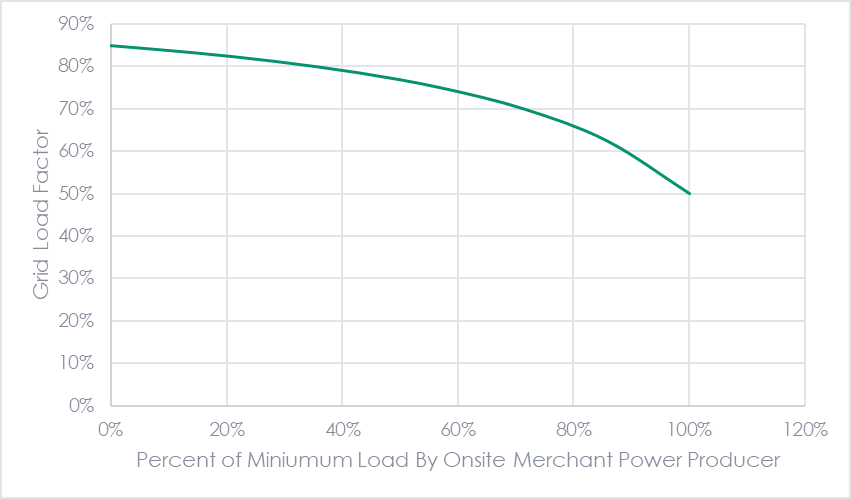

The inverse of peak-to-average load is the net load factor. A peak-to-average ratio of 1.9 is equal to a load factor of 0.53. Hyperscale data centers with huge loads of very high load factors of 0.85-0.90 could start to bend the peak-to-average curve down, except the utility industry and ruling bureaucracy are too slow. Per my analysis (simple math), a merchant power generator that takes all the baseload (100% capacity factor) on a data center with a load factor of 0.85, will decrease the utility’s share to only 50%, right where the grid is today.

The inverse of peak-to-average load is the net load factor. A peak-to-average ratio of 1.9 is equal to a load factor of 0.53. Hyperscale data centers with huge loads of very high load factors of 0.85-0.90 could start to bend the peak-to-average curve down, except the utility industry and ruling bureaucracy are too slow. Per my analysis (simple math), a merchant power generator that takes all the baseload (100% capacity factor) on a data center with a load factor of 0.85, will decrease the utility’s share to only 50%, right where the grid is today.

Figure 3 Hyperscale Data Center Load Factor Impacted by On-Site Baseload Generation

Bottom line: on-site generators are leaving the expensive, peaky scraps for utilities to cover. This will continue to cause electricity prices to soar, waste lots of natural gas, and increase carbon emissions, because on-site generation with internal combustion engines is about 40% less efficient than a utility-scale, combined-cycle power plant.

Bottom line: on-site generators are leaving the expensive, peaky scraps for utilities to cover. This will continue to cause electricity prices to soar, waste lots of natural gas, and increase carbon emissions, because on-site generation with internal combustion engines is about 40% less efficient than a utility-scale, combined-cycle power plant.

This isn’t theory. It’s already happening. Despite the regulated utility boat anchor, data center developers and owners are finding a way. They gotta do what they gotta do.

[1] I. Riu, D. Smiley, S. Bessasparis, K. Patel, “Load Growth Is Here to Stay, but Are Data Centers?:

Strategically Managing the Challenges and Opportunities of Load Growth,” Energy and

Environmental Economics, Inc., July 2024. Available at: https://www.ethree.com/