I’ll lead with the conclusion: decarbonization will continue if it costs less than conventional sources, with caveats. The caveats are externalities. Thermal sources of electricity, including coal, natural gas, and nuclear, are associated with externalities of carbon dioxide emissions, coal ash (which is rich in exotic rare earth minerals, aka, coproducts), and radioactive waste. At least radioactive waste is contained in tiny secure containment vessels, the cost of which is not socialized over all humans and the broader environment.

Renewable sources of electricity and batteries also have externalities that no one wants to discuss. The big ones include production and investment tax credits, ecosystem destruction, and child labor. When I read about climate change impacting people of color in the inner city, it’s clearer to me that much of the energy transition is more precisely impacting impoverished people of color in places like the Democratic Republic of Congo, Indonesia, and Southeast Asia.

Permanent Tax Credit Externalities

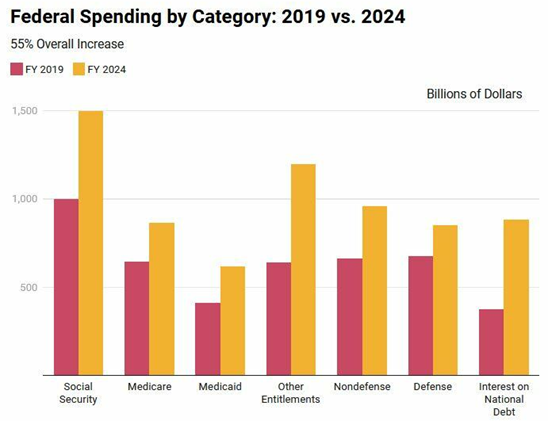

Well, tax credits don’t really cost anything, right? The cost of the national debt and deficits will become more visible as the cost of servicing the debt rises compared to spending. For instance, the cost of financing the debt is already more than we spend on defense – about $1 trillion. It won’t be long, and it will cost more than all discretionary spending. At that point, you’ll need the shopping cart to carry the cash required to swap for food in the weekly trip to the supermarket.

Rest assured, everything I’m reading in the development of the “Big Beautiful Bill” is doing nothing to cut anything. And Trump is well-known for bankruptcies and giving up nothing so, it’s looking grim per Figure 1 and Figure 2.

Figure 1 Spending by Category

Figure 2 Federal Revenue vs. Debt

Figure 2 Federal Revenue vs. Debt

Last Friday, May 16, 2025, Moody’s stripped the U.S. of its “last top credit rating.” What does that do? It increases interest rates for higher risk. What does that do? It grows the debt more, and so on.

Last Friday, May 16, 2025, Moody’s stripped the U.S. of its “last top credit rating.” What does that do? It increases interest rates for higher risk. What does that do? It grows the debt more, and so on.

The point is tax credits aren’t free, and unlike carbon dioxide emissions, a cost can easily be applied to anything that drives deficits, which for now is small, but it won’t stay that way on this reckless trajectory. Disruption comes out of left field, to everyone’s surprise. Rant readers shouldn’t be surprised.

The message is that when you step back and consider everything, there is no purely “clean” energy – only tradeoffs of one externality or cost shift. Did I mention the massive amounts of carbon-intensive concrete required for wind farms?

Liars?

When I read headlines like The Utilities Are Spreading Lies About Rooftop Solar, I think of fish in a barrel. Rant readers may recall a year ago when I reported (Solar Wars) that California’s rooftop solar owners received $6.5 billion per year from other ratepayers who could not have solar: multifamily dwellers, low-income folks, the elderly, etc. That was the preliminary report. A later report from the same source, The California Public Advocates office, revised the number to $8.5 billion transferred from the have-nots to the haves. The Solar Rights Alliance, purveyors of the pants-on-fire article, claim rooftop solar saved ratepayers $1.5 billion – a $10 billion swing.

Pants On Fire doesn’t understand the regulated utility market and that you can’t layer competition over a regulated monopoly model and expect a good outcome. I’ll write slowly so Pants on Fire can follow along.

Regulated Revenue Requirements

Regulated utilities, including water, electricity, and natural gas, operate on a cost-of-service model. The cost of service includes the bulk transmission (whether owned directly or provided by others), distribution, maintenance, metering, and commodity costs, like fuel, including natural gas, coal, syngas, or uranium. Other costs include debt service and return on equity to attract capital. Sum all those costs, and that equals the revenue requirement.

Net Metering Erodes Revenue Covering Fixed Costs

Element two is misguided net-metering policy that allows the haves only to pay the net energy they purchase from the grid. The revenue requirement stays the same for all practical purposes, especially as the peak load doesn’t change under the weight of the mantle curve. The cost of delivering electricity is driven by the cost of doing it under peak load, and that’s not changing. In California, peak net load would be when the sun sets on a hot September day.

Element three is simple math. The net-metered haves pay less. The revenue requirement stays the same, so everyone else must pay more through rate increases to meet the requirement. It’s simple math. The haves need the grid as much as everyone else when the sun goes down, but they’re not paying their “fair share” of the grid cost because of net metering.

Negative Electricity Prices and Inefficiency

Exacerbating factors include negative electricity prices and spinning reserves. As of December 2024, California solar producers curtailed three million megawatt hours of production because there was nowhere for it to go, even at negative prices. Three million megawatt hours is roughly 40% of a large nuclear power plant’s annual production. Merchant electricity generators can sell electricity at a loss and make money because of the production tax credit. So, not only do the have-nots have to pay more to cover the revenue requirement, but they must pay others, say, the good folks in Arizona, to take the excess generation!

Lastly, heavy doses of renewables require lots of hot spinning reserves to pick up the load when the sun sets, suddenly stops shining, or the wind unexpectedly stops blowing. The recent blackout in Spain shows what happens when standby spinning reserve isn’t there to pick up the dropped solar supply. The frequency dropped by two Hertz and boom, the Iberian Peninsula went dark.

Batteries may carry the load for a short period, but for longer stretches of significant “loss of load” (generation), gigawatts of hot spinning reserve are required to quickly take the load as the sun sets and net load ramps at incredible rates of 20 GW per hour. The spinning reserve includes gas and steam turbines that consume energy and produce almost no electricity. Think of diesel tractor-trailers parked at the truck stop idling to keep the cabin warm for sleeping. It doesn’t get less efficient than that.

I could go on for pages, but the conclusion is that spin and half-truths are easy in the world of the regulated monopoly with “competitors” trying to crash the party.