The race is on to decarbonize the grid, and those states that are forcing it too quickly are seeing soaring electricity prices. This is fabulous for our industry because energy efficiency and load management have become much more cost-effective. But are higher prices good for customers, industry, and local economies? Probably not.

Last week, I attended the Peak Load Management Alliance’s 50th Conference in Brooklyn. In sessions on decarbonization and electrification, practitioners described how the cost-effectiveness of heating with cold-climate heat pumps is already a challenge. Not only are there no savings, but electricity costs are increasing rapidly and are already more expensive than natural gas for space heating.

To examine reasons for soaring electricity costs, let’s consider a recent opinion piece in The Wall Street Journal, How Florida Keeps Electricity Plentiful and Rates Low. The author, Mario Loyola, blames rising prices on “renewable portfolio standards, net-zero carbon-emission mandates, and regional cap-and-trade schemes.” As a fellow from the conservative Heritage Foundation, he holds Florida as the model for policy and grid planning. Let us investigate.

Florida Truths

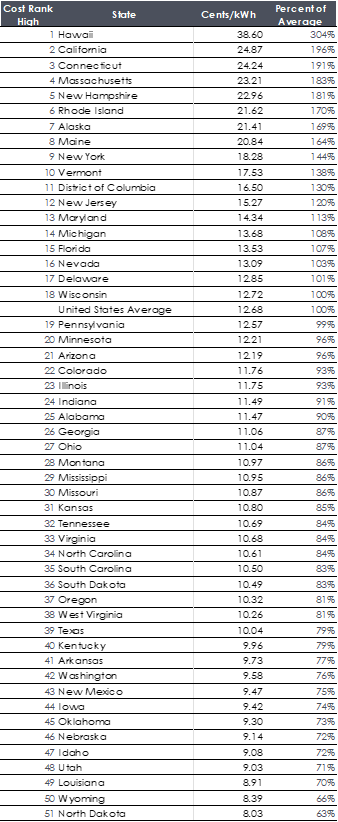

First, Florida has little to brag about regarding electricity prices. It ranks number 15 on the state list of most expensive retail electricity and is seven percent more expensive than the national average. The conservative Institute for Energy Research states Florida ranks 37th in residential retail rates for July 2024. Data in Table 1 includes all customer segments, residential, commercial, and industrial, and the entire year of 2023. And sometimes, I am accused of cherry-picking!

Table 1. State Average Retail Electricity Prices 2023

Solar on the Way to Florida

Solar on the Way to Florida

Mr. Loyola writes that Florida has prioritized natural gas, which provides 75% of Florida’s electricity, over renewable energy. He should read the news like I do. RechargeNews.com reports, “Utility Florida Power and Light (FPL) wants to add 25GW of grid-scale solar PV and related battery storage capacity through 2033, more than the next eight largest US owners of those technologies have installed over the past decade.” Wow! That will take 195 square miles [1] of the Sunshine State – about 3.5 times the landmass of Miami [2].

NextEra, the parent company of FPL, is far and away the nation’s largest owner of renewable generating assets, with 67 GW of renewable capacity. That is more than double second place and six times as much renewable generation as third-place Xcel Energy.

Manipulating Markets

As noted in Rant Revelations, companies seek decarbonization and, in some cases, market manipulation to pad their bottom lines. Altruism sits in the back of the bus. NextEra has been fighting a transmission line to pipe inexpensive Canadian hydropower to New England—seven of the ten most expensive states in the union, including Vermont and New York. In the six-year battle, NextEra partnered with a PR firm that fights on behalf of big coal. Isn’t that interesting? “[NextEra] operates Seabrook Station, a massive nuclear power plant in New Hampshire; an oil-fired power plant in Maine; and renewable facilities across the region.” Read the Politico article and get mad.

On Sunday, RTO Insider published a timely article, Avangrid Sues NextEra Over ‘Scorched-Earth Scheme’ to Stop NECEC (New England Clean Energy Connect). “’NextEra has committed anticompetitive, unfair and deceptive business practices to foreclose competition for the supply of wholesale electricity on the ISO New England marketplaces,’ Avangrid told the U.S. District Court for Massachusetts. ‘NextEra has reaped hundreds of millions of dollars from these illegal practices.’”

Boom.

Clean Energy Policies

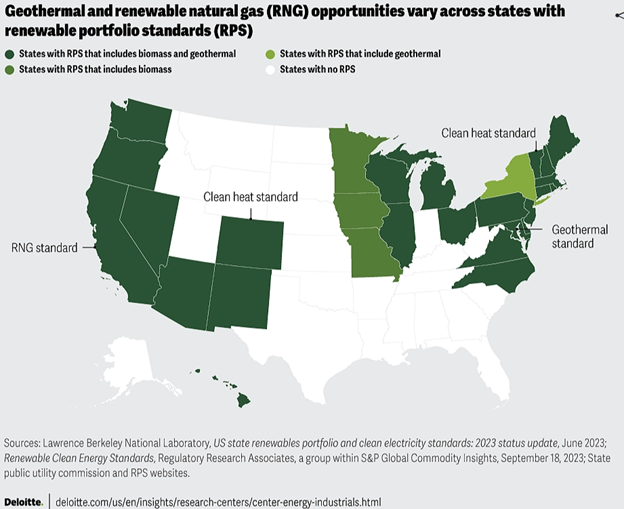

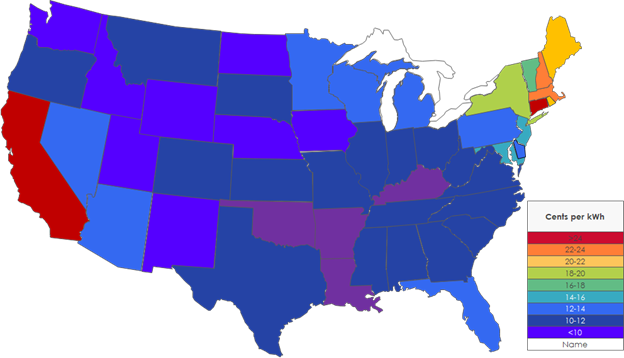

Returning to the Heritage article, are renewable portfolio standards (RPSs), which set minimum renewable power generation requirements, a cause for high electricity prices? Figure 1 shows Deloitte’s map of states with RPSs. Figure 2 shows average retail electricity prices by state. There is some alignment in RPSs and high prices, particularly in the Northeast and California. Northwestern states have low-cost, paid-for hydro generation.

Figure 1. Deloitte Renewable Portfolio Standard States

Figure 2. Average Retail Electricity Price 2023

Figure 2. Average Retail Electricity Price 2023

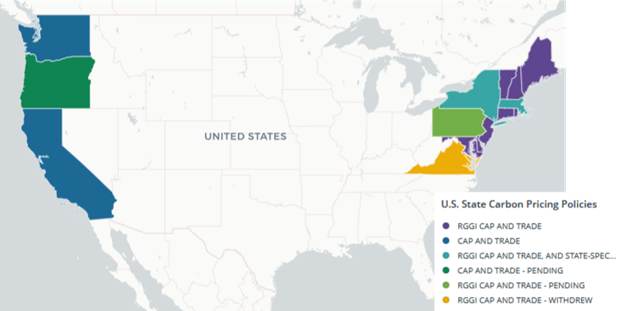

Figure 3’s map of cap-and-trade states comes from The Center for Climate and Energy Solutions. Again, except for the hydro-rich Northwest, there is alignment with the electricity price map of Figure 2. Wouldn’t it be grand for New Englanders to have more supply from Quebec Hydro?

Figure 3’s map of cap-and-trade states comes from The Center for Climate and Energy Solutions. Again, except for the hydro-rich Northwest, there is alignment with the electricity price map of Figure 2. Wouldn’t it be grand for New Englanders to have more supply from Quebec Hydro?

Figure 3. Cap and Trade States

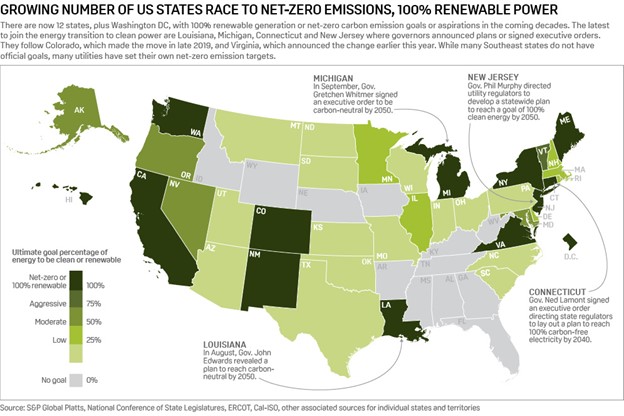

Figure 4’s net-zero and GHG map shows less alignment with high prices. Two states stick out like sore thumbs: 1) Iowa, which may have the highest percentage of renewable electricity production, has no GHG/net-zero goals (way to go!), and 2) Louisiana, oil and natural gas central aligns with California and New York. What? [3]

Figure 4’s net-zero and GHG map shows less alignment with high prices. Two states stick out like sore thumbs: 1) Iowa, which may have the highest percentage of renewable electricity production, has no GHG/net-zero goals (way to go!), and 2) Louisiana, oil and natural gas central aligns with California and New York. What? [3]

Figure 4. GHG and Net-Zero States

Mr. Loyola writes, “Democrats think solar power is coming to the rescue, but that is a fantasy.” Uh, see NextEra’s plans for Florida, dominated by Republicans. One reason renewables have thrived in Iowa is their development has been pitched as an economic boon to the state. The numbers (prices) will speak for themselves. In Iowa, capacity factors [4] for wind generation are well into the 40 percent range and even 50 percent, while capacity factors for solar in Florida are only around 20-25 percent. [5]

Mr. Loyola writes, “Democrats think solar power is coming to the rescue, but that is a fantasy.” Uh, see NextEra’s plans for Florida, dominated by Republicans. One reason renewables have thrived in Iowa is their development has been pitched as an economic boon to the state. The numbers (prices) will speak for themselves. In Iowa, capacity factors [4] for wind generation are well into the 40 percent range and even 50 percent, while capacity factors for solar in Florida are only around 20-25 percent. [5]

Regional Transmission Organizations

The last thing I’ll mention from Mr. Loyola is that he states renewable subsidies “have proved particularly toxic in states governed by regional transmission organizations, or RTOs, where utilities can’t easily pass capital and operating costs on to consumers.” Mmmm, I won’t agree or disagree with that in a vacuum. However, I will reiterate that wholesale markets, e.g., RTOs, are headed for trouble because “free” markets and real-time electricity delivery don’t work to drive down prices. For a deeper explanation, see how ants are welcome at the picnic.

I will say the block of Southeastern states, from Tennessee and North Carolina south, have shunned RTO formation and hold low electricity prices in high regard to economic growth, particularly for manufacturing. Is it working? Pretty well, except Florida.

[1] https://www.powertechenergy.com.au/a/how-much-land-do-i-need-to-build-a-5-mw-solar-farm

[2] https://www.newworldencyclopedia.org/entry/Miami,_Florida

[3] As of November 20th, 2024, Virginia’s participation was upheld by the courts. The governor’s action to withdrew was ruled illegal. Virginia is still legally participating.

[4] Average electricity generation rate as a percent of nameplate power.