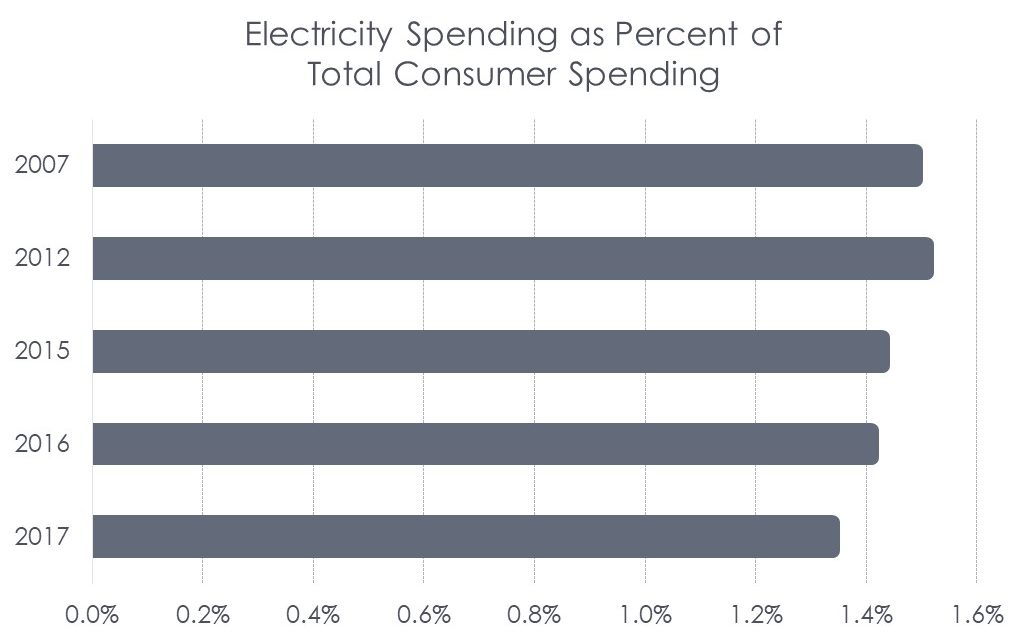

On the subject of electricity generation sources and price, I’ve been reading numerous articles from various bona fide sources and started connecting dots. Public Utilities Fortnightly (PUF) has written about historically low electricity prices, as a percent of GDP or household spending, numerous times in the past year. Electricity price escalation has not kept pace with the consumer price index. As of last August, Steve Mitnick, of PUF shared data, which I plotted on the chart below.

A year ago, I wrote about this topic as well in Low Electricity Prices – For How Long?. In that post, I explained how electricity prices are linked to the cost of the last kWh put onto the grid, and that last kWh is provided mainly by natural gas. What happens when natural gas prices start to follow a worldwide, rather than continental US, market price, via liquefied natural gas shipments?

Low Price Drivers

Drivers behind low average electricity prices include, in no particular order:

- A flood of subsidized renewable energy onto the grid

- A moribund world economy with slow economic growth

- Low natural gas prices as a result of hydraulic fracturing

- Intellectual property theft for solar technology[1][2]

Recently I’ve learned there is another major contributor to low energy prices that no one explicitly claims.

- Lost jobs

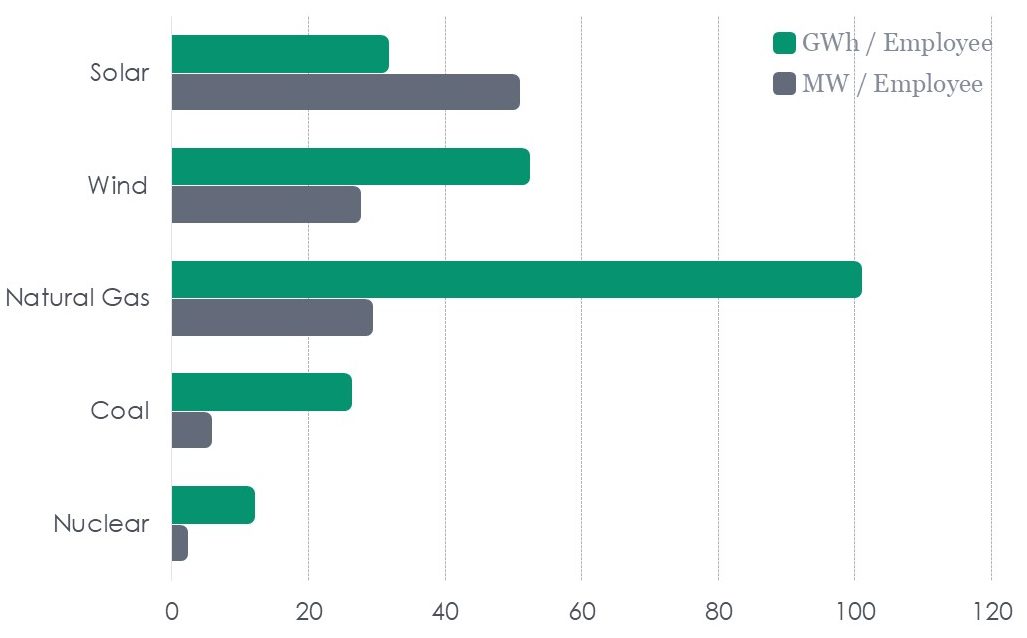

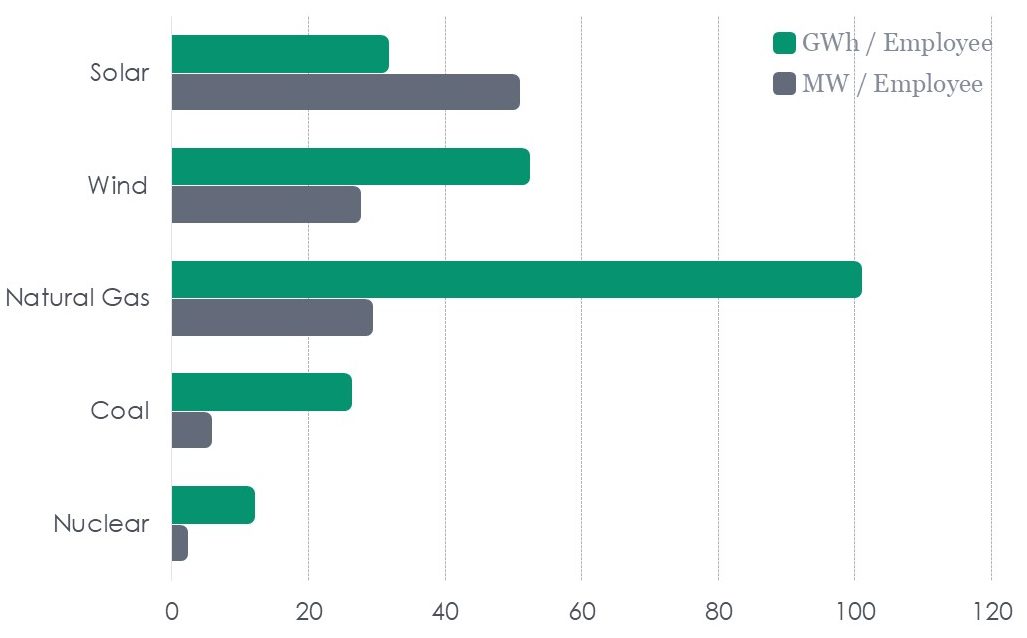

Why didn’t I think of this? The Wall Street Journal recently analyzed declining jobs in the utility sector. Using data they provide, I developed the following metrics for power generating capacity (MW) and electricity production per utility employee[3].

The labor required for coal and nuclear is a big factor in the price of these sources. For coal, it’s labor for handling fuel and fly ash and maintaining the associated equipment to handle it. For nuclear, the big labor component is security. Conversely, once built, natural gas is delivered straight to the burner with no utility labor required. There is no waste product to handle or dispose. Wind and solar require very little labor and no fuel cost. Wind turbine manufacturers are now designing generator units that require far less maintenance – and workers.

The Real War on Coal and Power Supply Jobs

As you will see below, the war on coal is bipartisan. Fuel cost, government subsidies, and the drive to reduce labor cost has moved power production to cleaner sources.

Secondary employment for supporting industries has also taken a big whack in the move to natural gas and renewable resources. In the last couple years, Siemens AG announced layoffs of 7,800, 4,500, 2,500, and 6,900 jobs, almost all in their power-generation divisions. Last month, General Electric’s power division announced layoffs totaling 12,000 souls. Not mentioned are vastly reduced coal mining and related transportation jobs.

Our industry needs to remember, as it cheers the growth in cleaner energy, that there are real jobs and people being hurt on the other side of this. It isn’t their fault. They are good people.

Dispensing with the Political BS

Why do clean energy subsidies persist when the economics are dominantly on its side for low/no fuel cost and far less labor? Politics, as described in Connecting on Climate Change. Virtually no one in Washington stands on principles across the board. They are for or against economic philosophy everywhere, except their home turf where all pork is welcome.

Efficiency Redistribution?

But what about efficiency wealth redistribution? Efficiency and demand response are part of the resource mix like wind, natural gas, and nuclear. However, efficiency does not get a 2.3 cent per kWh tax credit for five years. Furthermore, efficiency and demand response costs and benefits reside within a utility’s socialized customer base. Efficiency funding does not move across state lines or monopoly service territories.

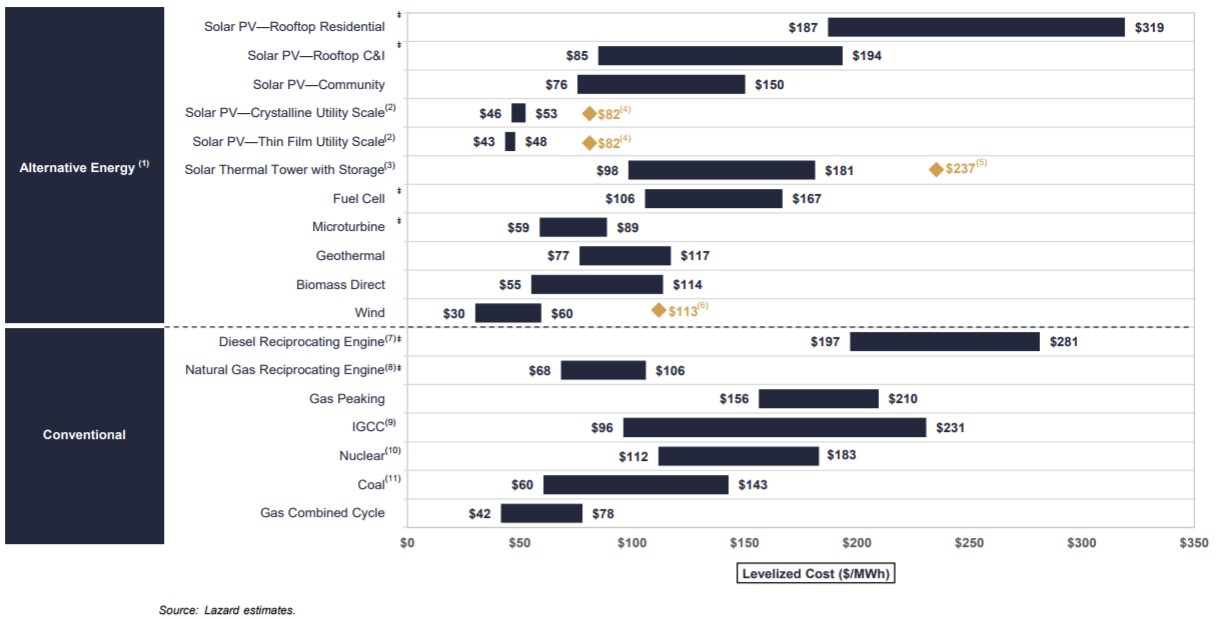

Lazard publishes an annual report for levelized cost of energy production. November 2017 data are shown in the chart below.

How would NFL and college football fans feel if the New England Patriots or the Alabama Elephants[4] were spotted 17 points in the playoff or championship game? Packer fans would pull for the Vikings in a Patriot-Viking Super Bowl, played on Minnesota’s home field. What does that tell you about the love for the Patriots outside of Massachusetts?

Wind = Patriots.

Aside from efficiency, wind is the low-cost resource, yet Washington spots wind with a 50% cost subsidy to boot.

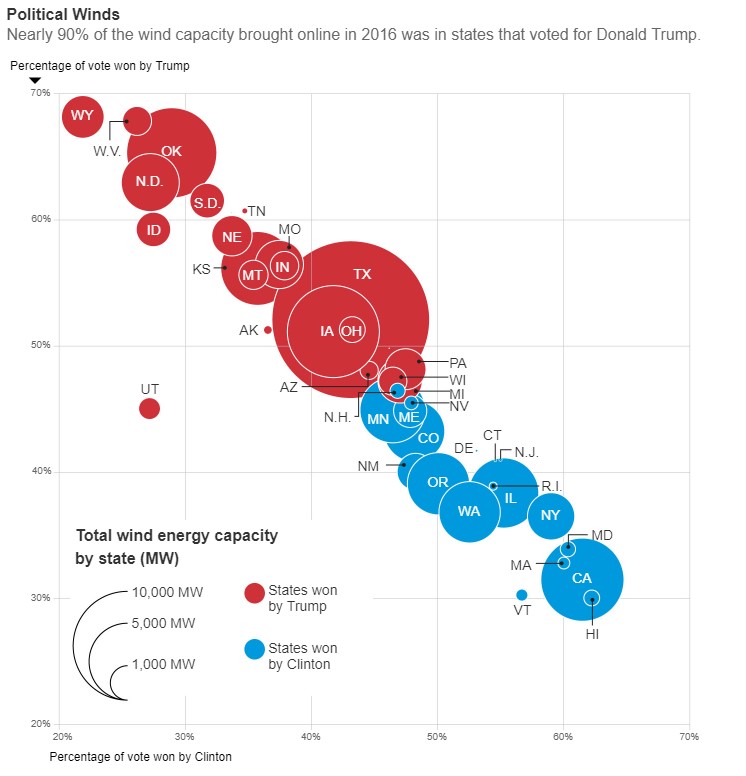

The subsidies persist because it is the red state south against everyone else. They are hugely outgunned by red-state central and mountain states, plus all the blue states. That, my friends, is why renewable subsidies roll tide.

The chart nearby, produced by The Wall Street Journal, is a bit confusing. The upper left to lower right trend means nothing.

The clean energy jobs we are seeing are akin to the manufacturing and installation of airport kiosks and ATMs. It’s great for short-term jobs, but in the medium and long runs, the name of the game is labor cost reduction. There’s nothing wrong with this per se, but let us consider Washington continues to heavily subsidize this no-brainer.

Energy efficiency jobs will not be immune – of this you can be sure.

[3] Capacity factors for nuclear, coal, and natural gas estimated to be 90%, 60%, and 40%, respectively. Capacity factors for wind and solar are 22% and 7%, respectively. Source: eGrid 2014, the most recent data available.

[4] Crimson Tide, with an elephant mascot.