Market Prices

Continuing from last week, how do we cost-effectively decarbonize the grid at a continental scale? Start with baseload nuclear power and, from there, load management. To achieve optimal load management to keep electricity costs low for customers, customers must see market prices in short-term forecasts, like weekly, day-ahead, or even near-real-time pricing.

Tariffs, or rates today, are relics of the analog days when utilities deployed armies of people in pickup trucks to run around and manually read meters. When I was a kid, my dad tasked me with reading meters on building sites away from the home site.

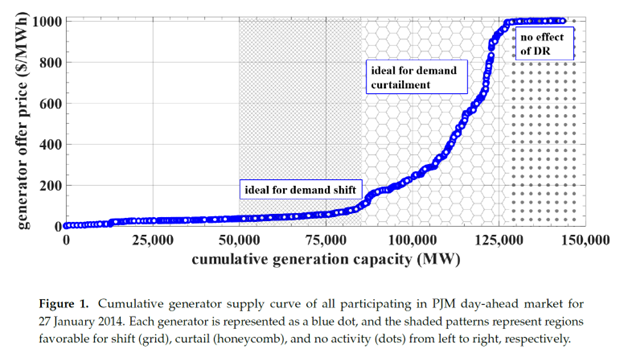

The following figure represents a typical day-ahead stack of power generator bids for a wholesale market, in this case, PJM. The price for energy (vertical axis) changes with total grid demand (horizontal axis). The problem is that customers don’t see the market price like they are too weak to handle it, or the technology to provide information and bill customers per real-time price doesn’t exist.

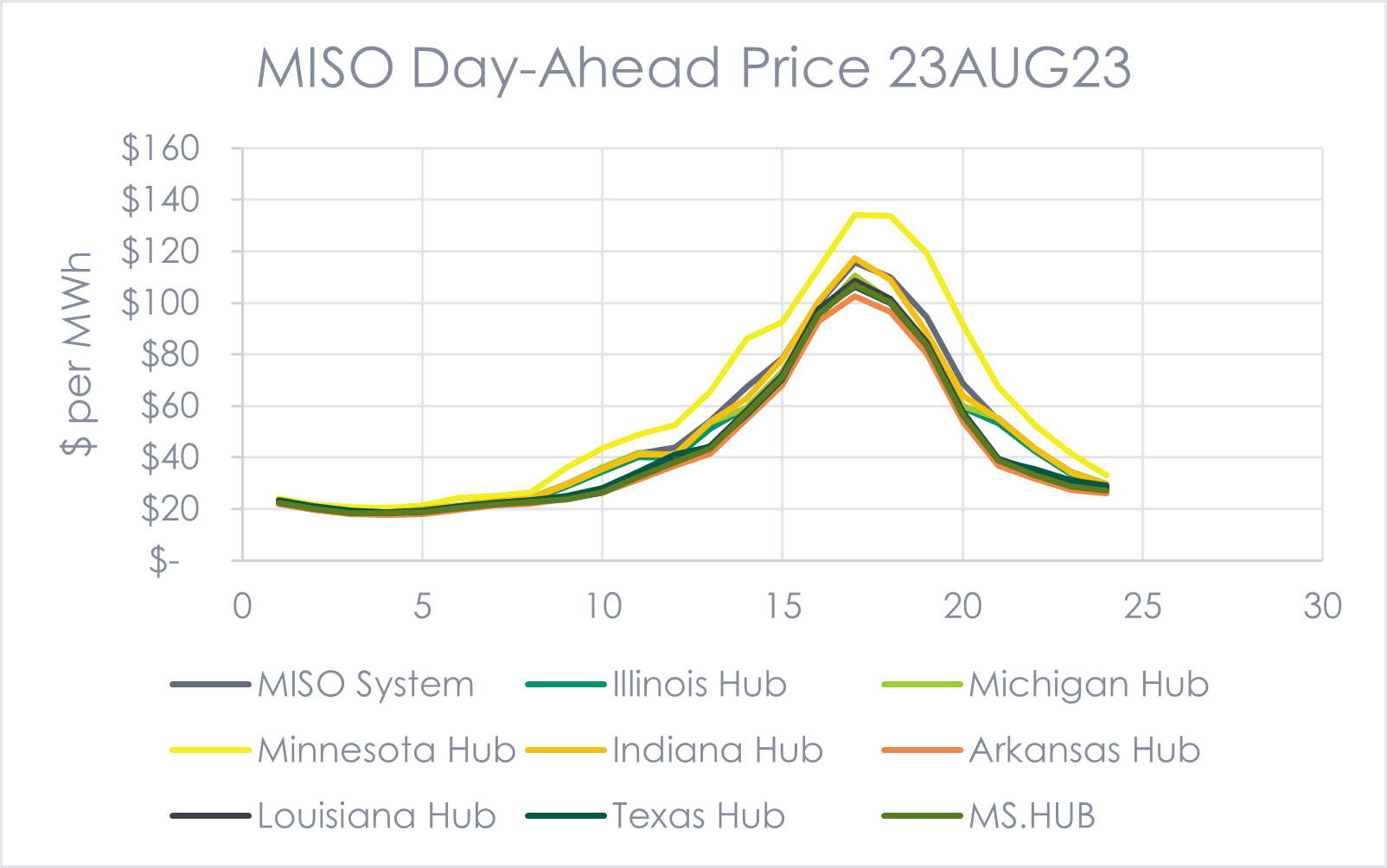

There is no time component to the above chart. The chart below shows prices by hour on a hot August day in the region of the Midcontinent Independent System Operator, or MISO. See how the ratio of maximum to minimum price is six to one?

There is no time component to the above chart. The chart below shows prices by hour on a hot August day in the region of the Midcontinent Independent System Operator, or MISO. See how the ratio of maximum to minimum price is six to one?

Analog Rates

Analog Rates

In my electric service territory, to my surprise, there is an option to purchase time-of-use electricity with a ratio of on-peak to off-peak of four to one (4 cents off-peak and about 16 cents on-peak). There are two not-surprises. First, eligibility starts with a minimum consumption of 60,000 kWh per year. In case you are not aware, that would be something closer to a Mar a Lago electric bill than mine. My consumption is a measly 3,600 kWh per year. I’d need to use 17x more electricity to be eligible. Second, the on-peak period for billing purposes is 12 hours, while peak prices on the market last only six hours. Why?

2000 California Energy Crises v. Analog Rates

California’s first deregulation attempt was an economic disaster for the investor-owned utilities (IOUs). The market was established to have deregulated wholesale markets, while the IOUs were not allowed to pass the full cost through to customers – i.e., the retail market was regulated while the wholesale market was not. The IOUs were forced to buy high and sell low for catastrophic losses. Bankruptcies were quick and brutal.

California’s established market was a disaster, but the thing it had in common with today’s electricity tariffs (rates) from sea to shining sea was a complete absence of market price signals to customers. There is zero customer-price elasticity in the electricity market; thus, there is zero incentive to manage electric loads. With no price signal to curtail usage when prices are high, all that high-priced electricity is blended into the flat rates everyone pays across the board – not good.

No Incentive to Decarbonize

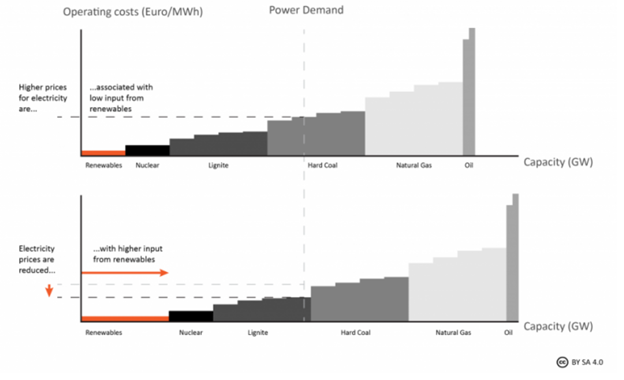

What electricity sources have the most carbon emissions? The expensive sources. Below is a chart from Europe, where natural gas is expensive. In North America, where we have lots of natural gas, combined cycle natural gas would be in front of coal.

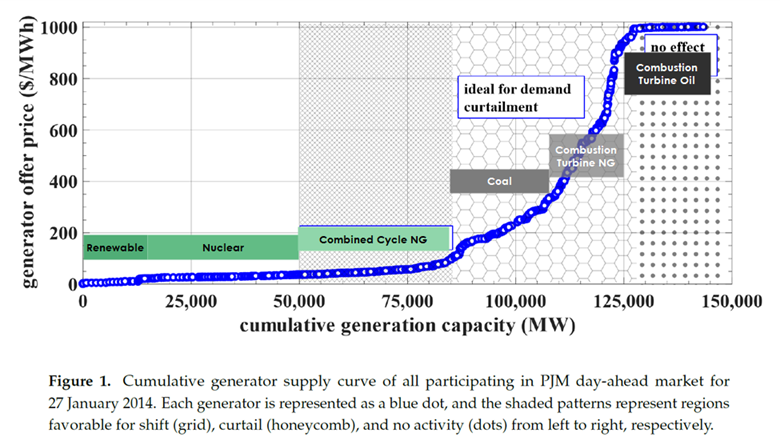

Depending on the region, the generation stack in North America might look like the following, where NG represents natural gas:

Depending on the region, the generation stack in North America might look like the following, where NG represents natural gas:

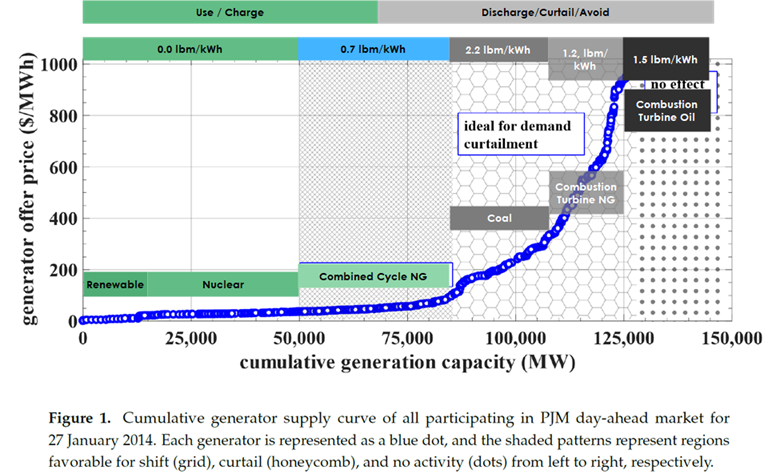

I add it all together in the following brilliant chart showing cost, carbon content, and the impacts of passing price information through to customers to keep prices low, reliability high, and depress CO2 emissions. Who doesn’t want this? Archaic retail analog prices are the problem. Dynamic pricing is the solution.

I add it all together in the following brilliant chart showing cost, carbon content, and the impacts of passing price information through to customers to keep prices low, reliability high, and depress CO2 emissions. Who doesn’t want this? Archaic retail analog prices are the problem. Dynamic pricing is the solution.

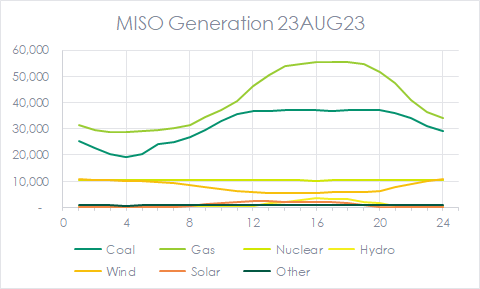

The chart below shows the generation supplied on the same day prices are posted in the MISO plot above. MISO does not disaggregate inefficient combustion turbine NG (peaker plants) from efficient combined cycle NG. The last eight MW of generation over the six peak hours must come from pricey combustion turbines. Coal plant production remains flat over the eight hours. The previous chart is not unrealistic, although coal and combined cycle bid windows probably overlap. I kept them separate for demonstration.

The chart below shows the generation supplied on the same day prices are posted in the MISO plot above. MISO does not disaggregate inefficient combustion turbine NG (peaker plants) from efficient combined cycle NG. The last eight MW of generation over the six peak hours must come from pricey combustion turbines. Coal plant production remains flat over the eight hours. The previous chart is not unrealistic, although coal and combined cycle bid windows probably overlap. I kept them separate for demonstration.

I will return to add more next week.

I will return to add more next week.

Holiday Bonus: Global Update

The Energy Rant is the no-pander zone, but I’m not as critical as the news streaming in from the mainstream media, or MSM, as I call it. Here is a sampling of brutal headlines from a single email update I get from The MSM on Climate and Energy. I follow with a one-sentence crux, including quoted sentences or phrases from each article.

The Path to Green Energy Is Getting Messier

Crux: “Offshore wind projects are being scrapped, renewable-energy companies’ share prices are tanking, and automakers are reining in electric-vehicle plans as demand falters while the oil and gas industry is embarking on a round of megadeals enabled by soaring profits.”

Green Investors Were Crushed. Now It’s Time to Make Money

Crux: “This year has been almost universally bad for clean investments, including solar and wind manufacturers and developers, and EV companies I need to squeeze in an EV update soon.

World Climate Plans ‘Severely Off Track’ To Cut Emissions: UN

Crux: “Combined commitments from 200 nations would see 2030 carbon emissions fall just two percent below 2019 levels, far short of the 43 percent needed per the IPCC climate panel to avert a 1.5-degree Celsius rise in global temperatures.”

China’s Spending on Green Energy Is Causing a Global Glut

Crux: “China’s economy spent nearly $80 billion on clean-energy manufacturing last year, around 90% of all such investment worldwide,” making the world’s “clean-energy” supply chain even more reliant on the brutal regime.

Nuclear Project Failure Is a Blow to Industry’s Future

Crux: “NuScale is scrapping plans to build a first-of-its-kind modular nuclear reactor plant in Idaho,” and with it goes Illinois’ intentions to reinvigorate nuclear power.

A Costly Lesson: How Koch’s Green Push Ended in the Red

Crux: Fossil billionaire Charles Koch lost 58% on a portfolio of 14 clean energy startups and pulled the plug after two years of investing in such special-purpose acquisition companies.

Happy Holidays!

Analog Rates

Analog Rates