I lambasted net zero many times, one time calling it an unserious weapon against climate change. Why is that? We’re going to see in this post. What is net zero? Simply, it is a building or property that produces as much renewable energy on-site as it consumes, typically over a year. Some utilities claim their net zero trophies for producing as much renewable energy as their customers buy.

Why is Net Zero a Con?

To answer this question in one word; exports. When a property or utility generates more electricity than it consumes, it must be exported to someone else. Well, if everybody did that, there would be no place to export it because all neighbors have the same plight. Net zero cannot be scaled to more than, oh, let’s say, 30% of generation. Beyond that, there is no place to export it.

At the Peak Load Management Alliance conference last week, an executive vice president from Arizona Public Service used California as an example of net zero after he roasted California (to which I’d respond, look out, you are headed in that direction). He said California increasingly and more frequently pays Arizona to take their excess power. That is net zero – it’s worse than dumping at zero cost. It’s like paying a tipping fee to have Waste Management haul the trash away. This is 180 degrees opposite of Michaels’ core purpose to minimize waste and maximize value – dumping electricity and paying to do so!

A Western Energy Imbalance Market has been established to facilitate transactions between winners and net-zero losers. It has elements of a Regional Transmission Organization, except takers, like Arizona, would be wise not to share a wholesale market with the likes of California.

Why Sell at a Loss Rather than Dump Excessive Renewable Electricity?

Production Tax Credit

I can think of two answers to this question, which can both be consolidated up the chain as duped policy. The first answer is the production tax credit for wind generation here in the Midwest. Wind generators make money by taking the tax credit and making the difference between that and the grid’s zero or negative locational marginal price.

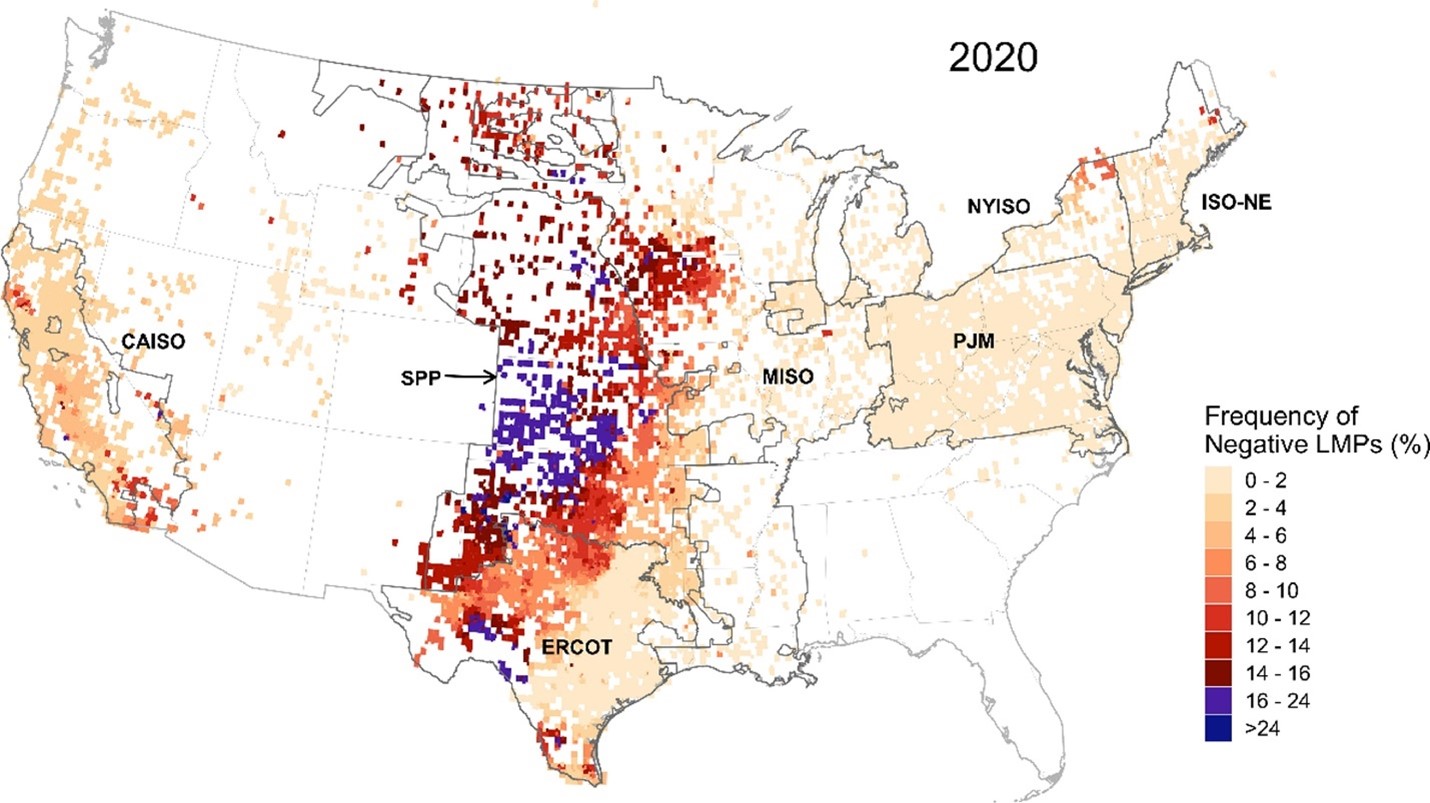

I recently came across a chart showing the penetration of negative pricing on the grid, as shown below. An uninformed person may think, wow, this is fantastic! Free electricity!

Operating at a Loss Saves Money?

Wrong. First, let’s consider why prices are negative. I already gave part one – production tax credits. Part two is that the continuous duty, thermal power generating units – coal, nuclear, and natural gas – cannot start and stop like a golf cart. It is often less expensive for the generating company to run at a loss than shut down and restart for whatever reasons. These resources were never designed for frequent start-stops and, therefore, doing so would shorten their lifetimes.

Instability

Instability

This is an unstable situation with a negative feedback loop. As more renewables flood the market with low, no, or negative-price electricity, the stabilizing thermal power plants lose more money, causing them to go out of business and destabilizing the grid more. Thundering herds of unicorns are not coming to bail us out.

What is happening as a result? Grid operators, regional transmission organizations, and independent system operators say, “uh ah, coal plant. You’re staying connected to the grid because we need you to keep the alternating current frequency at 60 Hz and the voltage within specified tolerances.” There went the “free market.” You can now see why there is an “unprecedented” risk of widespread outages this winter. There already isn’t enough spinning reserve left on the grid. Could this also be why grid operators are punting on additional renewable resource interconnections?

Mechanics of Price Increases

Now, what about negative prices helping customers? How are these continuous-duty thermal generators that were losing money and going out of business going to be compensated going forward? A subsidy paid by electricity customers! This is a fiasco because lawmakers mandate things on the world’s most complex system that they do not understand whatsoever.

Another Price Increase Model

Negative prices in California derive from a different misbegotten policy called net metering. First, net metering transfers $12 billion of wealth from non-participants (customers without solar), who tend to have lower incomes, to participants. Customers with solar reduce their bills to almost nothing, renting the grid for free, and thus subsidized by non-participants. As a result of paying next to nothing and shifting costs to others, solar customers increased energy consumption by about 20%. What a win, win, win!

I must pause here to laugh and scoff at lawmakers’ ignorance from a few years ago as we fought to save energy efficiency in Iowa. Some claimed wind energy is “free,” and wealth transfers for efficiency programs must die! Pffft! They have no earthly idea how the electricity market works or how the policies they pass impact price and reliability. These fabulous policies have swung Iowa from a 10% electricity price advantage against Illinois to a 15% disadvantage in ten years! How can this happen with “free” energy, Senator?

Pushing Back with Demand Response

We must stop subsidizing technologies that result in higher aggregate prices and start pushing back to match demand with supply. How is this done? Thirty-one flavors of demand response, which will be featured next week.