President Trump plans to remake the world economy, and he’s not going to flinch on the tariffs he leveled on “liberation day,” April 2, 2025. The man is resolute, noting for 40 years that the United States has been “ripped off” by nations around the globe. Here are links to his appearances on Larry King Live in 1987 and the Oprah in 1988, illustrating he hasn’t changed his mind.

How do the tariffs work? According to Axios, it’s simple – each country’s trade deficit is divided by exports to the United States, divided by two, with a minimum of 10%. Therefore, tariffs range between an absolute maximum of 50% and 10%. Trump’s chart is shown in Figure 1, courtesy of Bloomberg.

Figure 1 Trump’s Reciprocal Tariffs

The Wall Street Journal editorial board has thrown daily tantrums for obvious reasons. They are 1,000% in favor of annual $1 trillion trade deficits. If you are in your 20s or 30s and can’t believe soaring rent and home prices, it’s because there are too many dollars chasing too few assets – as I described to a colleague recently. Farmland has become like gold, divorced from its capacity to produce. The average selling price per acre in Iowa is around $12,000. A decent corn yield of 200 bushels per acre at the current price of $4.60 produces $1,000 per acre in revenue annually (rounding up). That will never pencil, and I believe it’s a result of zillions of dollars floating worldwide.

The Wall Street Journal editorial board has thrown daily tantrums for obvious reasons. They are 1,000% in favor of annual $1 trillion trade deficits. If you are in your 20s or 30s and can’t believe soaring rent and home prices, it’s because there are too many dollars chasing too few assets – as I described to a colleague recently. Farmland has become like gold, divorced from its capacity to produce. The average selling price per acre in Iowa is around $12,000. A decent corn yield of 200 bushels per acre at the current price of $4.60 produces $1,000 per acre in revenue annually (rounding up). That will never pencil, and I believe it’s a result of zillions of dollars floating worldwide.

Not since Paul Volcker and Ronald Reagan broke the back of crippling inflation has the economy undergone a projectile extraction without anesthesia to stop the bleeding. Will it work? We’re going to find out. Victor Davis Hanson of Stanford’s Hoover Institute recently noted that if punitive tariffs leveled by China, India, Vietnam, Mexico, and the EU are so bad, why have they not collapsed, let alone transitioned from third-world countries to developing juggernauts? The answer is beyond my expertise, but I can read inputs and outputs.

Manufacturing Resurgence

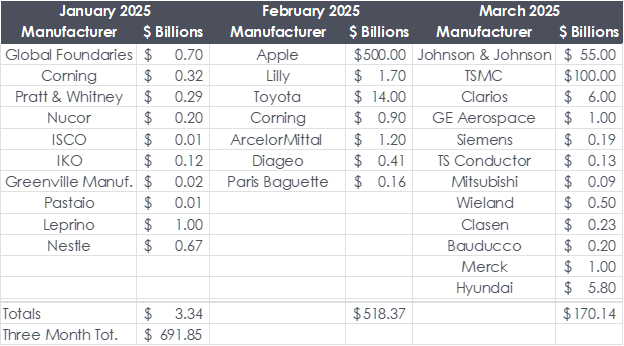

Table 1 shows a list of manufacturing facility construction announced by month according to Industry Select, a 110-year-old “#1 most trusted sales platform.” I can corroborate many of these announcements from other news sources and also posted on the Whitehouse.gov site.

Table 1 2025 Manufacturing Expansion Announcements

Table 1 includes only projects with estimated construction costs reported by Industry Select. Other projects without dollar values and smaller projects will likely bring the total to $1 trillion invested.

Table 1 includes only projects with estimated construction costs reported by Industry Select. Other projects without dollar values and smaller projects will likely bring the total to $1 trillion invested.

And the AI Race

That’s only manufacturing. As noted last month, a consortium of developers known as Stargate committed $500 billion to the artificial intelligence race in the U.S. Late last month, Meta announced plans for a $10 billion, four million square foot data center on a strip of Louisiana land that is larger than the campus of Louisiana State University in Baton Rouge. The AI boom has data center developers “hunting” for access to massive electric transmission or natural gas pipelines to fuel power generation and reliably power their operations for many years. The Wall Street Journal reports Entergy is filing to build three natural gas power plants with a price tag of $3.2 billion to power the facility and maybe add a little extra for others on the grid. The Meta site is already crisscrossed with transmission and gas pipelines.

One thing is certain: manufacturing growth and artificial intelligence investments in the United States will stress the grid like no one reading this spiel has ever seen. Eleven years ago, while energy efficiency cheerleaders were taking credit for flat load growth, I had another take: we weren’t building anything, and manufacturing was declining. I was more right than wrong.

Bridge Out Ahead

Readers may remember, “We’re not going to build our way out of this.” Here is the evidence and some specifics – gas-turbine suppliers can’t meet demand. With backlogs stretching to 2029, merchant generators and utilities are canceling orders. What about transformers that boost turbine power voltage up to transmission line voltage for the electricity superhighway? It takes a presidential term (four years) from order to delivery of transmission-scale transformers. Good grief! President Trump – whaddya say we onshore some turbine and transformer manufacturing? How hard can it be?

All In

The spark for this Rant post was a call last week among a consortium of thermal energy storage (TES) providers, including Michaels Energy. The purpose is simple – to preserve the tax incentives for TES to reach market acceptance and scale to jump the chasm.

I’ve had the good fortune of getting to know one of the executives participating in the consortium. He recently met with Interior Secretary Burgum, who pointed out that winning the AI race is a priority for the administration. Well, there you are! We need energy storage, fast. Thermal energy storage:

- Is readily available with inexpensive materials – plastic, water, salt, glycol, and steel – to name a few, depending on the use case.

- Materials are readily available and manufactured in the United States, tariff-free.

- Materials and manufacturing don’t flow through China, unlike electric batteries.

- Is scalable and can handle nearly a tenth of the nation’s peak load for eight or more hours.

- Is about one-fifth the cost of electric batteries and less expensive than gas turbines and transmission lines.

- Is cost-effective regardless of the type of generation: coal, natural gas, solar, or wind.

What does “we’re not going to build our way out of this” mean? It means bridge out ahead! Delivery times for gas turbines are seven to eight years, and turbine suppliers are playing it safe and not expanding willy nilly because of recent market crashes. In seven or eight years, the AI race may be decided, and manufacturers may look elsewhere for competitively priced, reliable electricity.