The New Scientist published an article by an economist saying that now is the perfect time to implement “long-overdue environmental regulations requiring US power plants to reduce emissions of mercury, arsenic and other toxic metals”. And the added cost will be a boon to the economy. That’s what the textbooks say, so it must be right!

As the article states in one place, yes, retrofitting power plants will create jobs somewhere, and the higher cost will be passed on to consumers. Do they equally offset on a macroeconomic level? I severely doubt it but no one can prove that.

In another theory, he claims added regulation is neutral because the Federal Reserve will juice the economy with low interest rates. We’ve had negative real interest rates for years. Capital is practically free. Mortgages are about 3.5% – zero in real terms as inflation is almost this high. What are home prices doing? Still falling. How’s that juice working for you? It’s doing well with increasing gasoline prices valued worldwide by the sinking U.S. dollar – sinking because of negative interest rates! House payment savings are going in the gas tank and grocery bag.

Regulation is likely to create jobs, the article says, for three reasons. First, capital is not scarce but opportunities for investment are. It is clear the author has never run a company. Recessions offer precisely the opposite. They produce shakeouts. Overleveraged, poorly managed companies go out of business or their stock prices fall, making them targets for acquisition – friendly or hostile. Normally, recessions provide opportunity for well-run companies to emerge with greater margins and market share.

Second, the article says increased energy costs are unlikely to be passed on to consumers (directly opposite of what it says above) because companies have no pricing power. With profit margins at 45 year highs, companies can easily absorb the price increases with reduced profits. OMG! What a ridiculous statement. The author has clearly never had to answer to a board of directors and shareholders. Yes. We will voluntarily not raise prices just because we can. You’re fired.

The third reason is Alan Greenspanesque in its gibberishness, so it is simply copied and pasted: “the boost to employment provided by new investments accompanied by muted price responses will not be neutralized by the Federal Reserve, at least not in the next few years, as it has committed to holding interest rates low until unemployment returns to more normal levels.” Sounds good. Translation: jobs created from this investment[1] will not be offset by higher interest rates as the Fed Chairman, Ben Bernanke, will keep interest rates low until full employment returns.

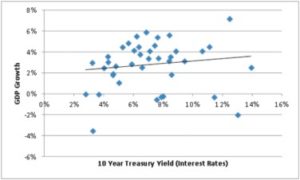

19 Year Treasury Yield

Ever heard the terms stagflation or misery index? Stagflation is a crappy economy with soaring inflation. The misery index is simply the unemployment rate added to inflation. These peaked in the late 1970s and are rising to painful levels again. The theory that low interest rates juice the economy is totally bogus, but yet we follow the ignoramuses like the Ben Bernanke who don’t look at history and instead follow the holy textbook. The chart nearby clearly shows low interest rates are associated with poor economies. Precisely the opposite of what the article implies. Data are from each of the most recent 40 years.

Yeah, but Jeff, you rube, the low interest rates move us to the dots in the middle where higher growth is present. Not so fast. I’ve got that clearly covered too.

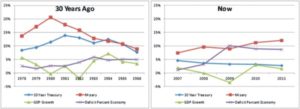

The next two charts are what the president, congress, and the Federal Reserve would learn something from if they opened their minds and dropped the mud for a while.[2] Thirty years ago interest rates were more than double what they are today and growth averaged 5% over four years of the recovery. We haven’t had 5% growth since 1999 and that lasted one year. The deficit, however, in the past three years is three to four times the average over the previous 37 years when it held pretty much flat. It hasn’t mattered but it does now.

Are spending and low interest rates working per the holy textbook? Uncertainty in a wide range of business – critical issues including taxes and energy-related regulation that we can control – is also a major brake on the economy.

Will emission controls ruin the economy? No, but stop with irrationalizing that it will help as described. While we are at it, let’s learn something from history rather than buying what the economics textbook is shoveling.

[1] Investment: Money that is invested with expectation of profit. I don’t think scrubbers produce profit for anyone.

[2] Sources: Bureau of Labor Statistics, Federal Reserve, World Bank.