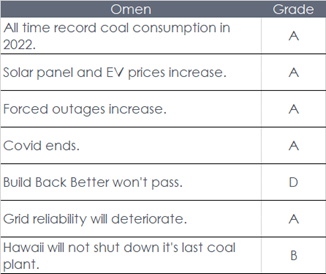

This post features the results of my Lucky 7 predictions I made a year ago, a grade for each omen, and a little sass here and there.

Coal Record

Prediction: Annual worldwide coal consumption will pass the all-time high set in 2014.

Result: The Internation Energy Agency, on 16 December, reported, “Global coal use is set to rise by 1.2% in 2022, surpassing 8 billion tonnes in a single year for the first time and eclipsing the previous record set in 2013(sic)[1], according to Coal 2022, the IEA’s latest annual market report on the sector.” This is remarkable, considering “For the first time in recorded history, China’s carbon emissions will be lower this year than the previous year[2].“

Grade: A

Many factors make predicting coal consumption in 2023 difficult. First, the Ukraine war is driving Europe back into brown coal (the dirtiest and least energy dense). Second, the economy is sliding, and since coal is a marginal fuel, the sliding economy would put pressure on coal consumption.

Solar Panels and EV Prices Rise Due to Material Shortages

Prediction: No meaningful access to rare earth materials will be granted in the U.S. in 2022. Solar panel and EV prices will rise.

Result: The Wall Street Journal reports, “Sticker prices for electric vehicles have also jumped this year because of the rising cost of battery materials, limiting the pool of buyers who can afford one,” and “Auto makers mark up electric vehicles to offset rising battery-material costs.” In the second link immediately above, Toyota is not buying the 100% EV hype. Also, a utility insider informed me that utilities are taking most of the lithium battery market, which will accelerate under the 30% tax credit passed this year.

Utility Dive reports, “Extreme market conditions in 2021 and the early months of 2022 may have added some 13-15% in costs to solar prices beyond what long-term trends would have predicted, according to NREL,” and “We’ve had such an unusual year in terms of inflation and raw material price volatility that it has required the industry to question how we approach pricing and cost analysis.”

Victory is declared.

Grade: A

Forced Outages

Prediction: Operators and executives of the regional transmission organization, ISO New England, will develop ulcers and heart conditions as its grid is starved of energy.

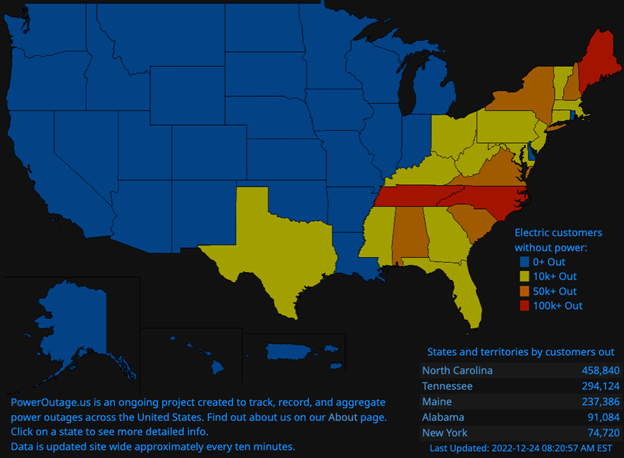

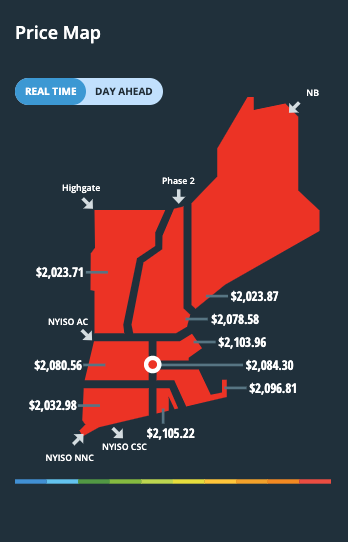

Result: Christmas Eve, Zerohedge reported forced outages and rolling blackouts along the east coast, and electricity prices at $2 per kWh, at least 10X higher in Maine. Lovin that heat pump now? I have repeatedly warned of this problem when electrification scales, and that really hasn’t even started yet.

Grade: A

Covid

Prediction: Covid will be nearly gone by the end of the year, despite guidance from the experts.

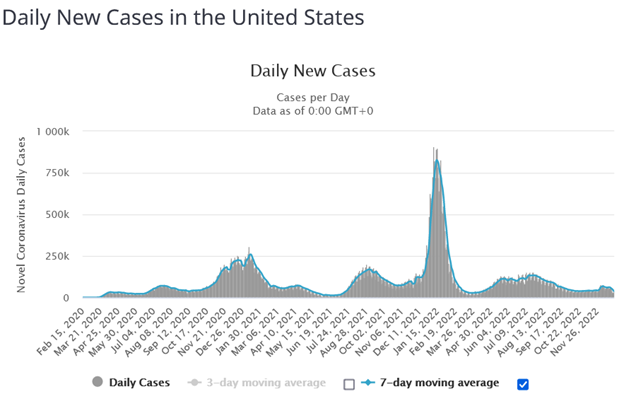

Result: In January 2022, people were still terrified of Covid, and now the fear is minuscule. Under the leadership of Jen Szaro, AESP plowed ahead with the annual conference in Nashville, as that peak shown below in February had just passed. Attendees LOVED it!

Source: Worldometer

Source: Worldometer

My mother, who is 88, contracted Covid in the nursing home. Lucky me, I was with her the three days leading up to her diagnosis, and I got it too. Her doctor seemed more concerned about returning home safely from his shift than mom’s risk from Covid at the time. (you get the point) It’s not totally gone, but then will it ever be? The fact is, people have lost the fear, even in nursing homes.

When I made the prediction, new daily cases were 624,000. Today new daily cases are 36,000, or 94% lower.

Grade: A

Build Back Better

Prediction: Build Back Better would not pass because Joe Mansion’s constituents disapprove.

Result: Joe, who apparently plans to resign from the senate before his term ends in 2025, struck a deal with Chuck Schumer and signed on to $369 billion in climate spending through the absurdly named “Inflation Reduction Act.” Joe probably got the naming rights on the bill because he talked like an inflation hawk for months leading up to his collapse. That and a promise of easing restrictions on fossil fuel production and pipeline permitting got him a bag of spent coffee grounds at Starbucks and an early retirement. Congratulations, Joe.

I think the initial BBB plan was on the order of $6 trillion, but it was down to a measly $555 billion as of prediction time. With two-thirds of the $555B passed, I’ll give myself a D.

Grade: D

Grid Reliability

Prediction: The North American Electric Reliability Corporation, NERC, is doing the math and coming to my conclusion: “a reserve margin shortfall on the Midcontinent Independent System Operator’s (MISO) grid will occur sooner than previously expected due to generation retirements.”

Result: Per Utility Dive, “John Moura, NERC’s director of reliability assessment and system performance analysis, said in a call with media to discuss the report. ‘The system hasn’t been stressed in this manner in the past, and probably more importantly, it hasn’t been as widespread.’”

Grade: A

This situation will continue to deteriorate until law and policymakers face the music. When the east coast went dark on Christmas, as noted above, here in the Midwest, we had the good fortune of wind, and relatively mild temperatures, like minus 13°F. January can easily produce temperatures 10 degrees colder than December. The wind may not blow, and the grease in the turbines may gel, so get ready, MISO people.

Hawaiian Coal

Prediction: Hawaiian lawmakers declared the state doesn’t need coal as of September 1, 2022. I wrote that they would either suspend or rescind that law.

Result: They switched to fuel oil. Wa waaa! Result – 29% decrease in carbon emissions[3] for 11% of Hawaii’s electricity with an added cost of $15 per month (7%) per customer because fuel oil is expensive.

Grade: B

Summary and Next Up

Conservatively, I scored a 3.43 GPA. I will renew my Lucky 7 predictions for 2023.

[1] The IEA reported the peak was 2014, and now they say 2013.

[1] The IEA reported the peak was 2014, and now they say 2013.

[2] https://www.energysociety.org/tes2022.html

[3] eGrid data and my arithmetic.