PSA

I thought of making some wisecracks about the trial balloon that the Chinese Communist Party drifted over the United States. Whatever the intent, it’s no good. The thing that gave me a chill is that these balloons are a top ‘delivery platform’ for a nuclear EMP (electromagnetic pulse) attack. These balloons “can fly up to 200,000 feet, evade detection, and carry a small nuclear bomb that, if exploded in the atmosphere, would shut down the grid and wipe out electronics in a many-state-wide area.” I mentioned this last week and wrote an entire post on this threat five years ago. Pray or whatever you do, chicken bones and batt wings, etc., that we don’t experience one of those.

Wholesale Electricity Markets

I’ve studied wholesale electricity markets for several years, especially in recent months. The purpose is to find mitigation strategies for the growing chasm between half-random, half-cyclical renewable electricity generation, growing peak demand, and spikey load profiles.

Renewable supply and electrification of many energy needs are the issues. Load management is the solution; that is where we (Michaels) live.

Will wholesale electricity markets deliver? I have long postulated that competition in electricity markets will not work for two reasons. First, electricity cannot be stored in meaningful ways like gasoline, corn, or pork bellies. Second, we can skip bacon for weeks or months or not consume it at all. This provides elasticity for the market to work. Such elasticity and choice are impossible in electricity markets, making them entirely different than any other competitive market.

Capacity Markets v Energy Markets

There are two types of wholesale markets, as I explained a year ago in capacity markets versus energy markets, which is the hottest Rant post of all time. To recap, a capacity market pays generation owners to have the capacity to generate power in the future, plus electricity payments via power purchase agreements, day-ahead, and real-time electricity markets.

Stakeholders in energy-only markets believe capacity payments waste money because customers may pay for generating assets that are never used. The point of capacity markets is to reduce financial risk for investors so grid operators[1] can ensure sufficient capacity is available to meet electric loads, i.e., “keep the lights on.” Generators (companies) in energy-only markets get their “capacity” rewards during periods of scarcity with very high prices, like $9 per kWh, roughly 200 times average prices, but for a few hours per year.

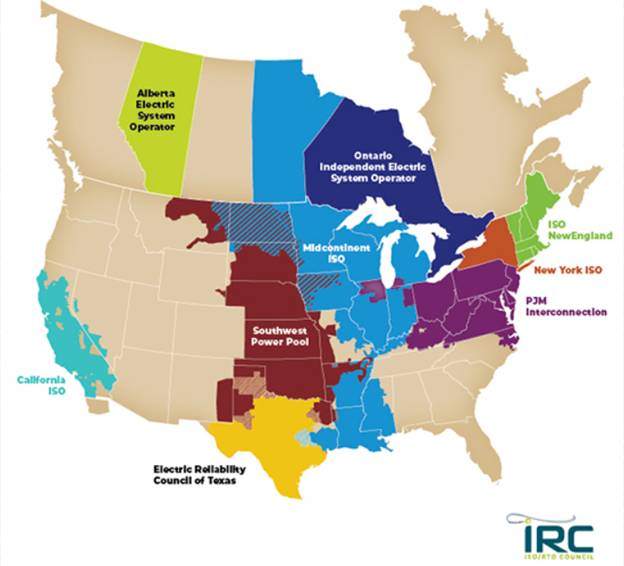

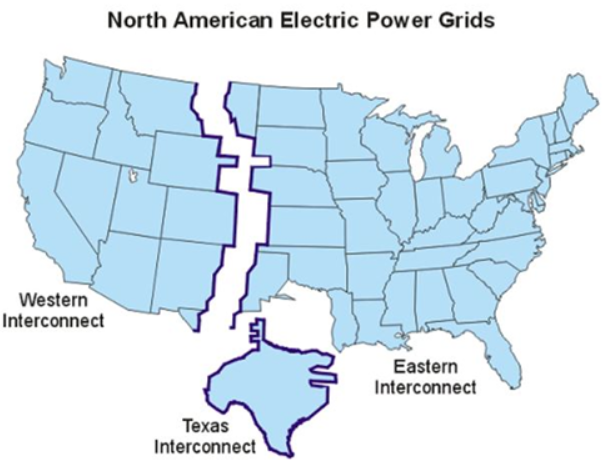

California, Texas, Southwest Power Pool[2], and Alberta do not have capacity markets. Ontario is working toward a capacity market, and the other RTO/ISOs shown in the map below operate capacity markets.

The following image shows how the wholesale markets fit within the three power grids in the U.S. These grids share very little power and operate out of phase. Only a small amount of direct current power traverses the grids.

The following image shows how the wholesale markets fit within the three power grids in the U.S. These grids share very little power and operate out of phase. Only a small amount of direct current power traverses the grids.

Energy-Only Markets

Energy-Only Markets

Do energy-only markets ensure adequate generating capacity? It is easy to argue no because Texas and California have had infamous blackouts and continue to be at high risk.

Moreover, Texas regulators threw in the towel last month and implemented a de facto capacity market last month called a performance credit mechanism.

Capacity Markets

Grid operators, public service commissions, and utilities in capacity markets have no ground to stand and belly laugh at energy-only territories. Christmas 2022 gave us blackouts in the Southeast, where there is no wholesale market. However, ISO-New England and PJM utilities needed to beg customers to curtail and scrape by to keep the power on. Generators couldn’t get enough fuel because of the reversely diversified reliance on natural gas and pipeline constraints. New England got 40% of its energy from fuel oil during the Christmas stress test.

As a result of the Christmas stress test, PJM issued $2 billion in penalties for non-performing generators, many of which were due to a lack of the fuel known as natural gas. Seventy percent of the unplanned outages were from natural gas plants. For reference, the PJM capacity auction revenue is about $2 billion. The beatings will continue until the natural gas miraculously flows.

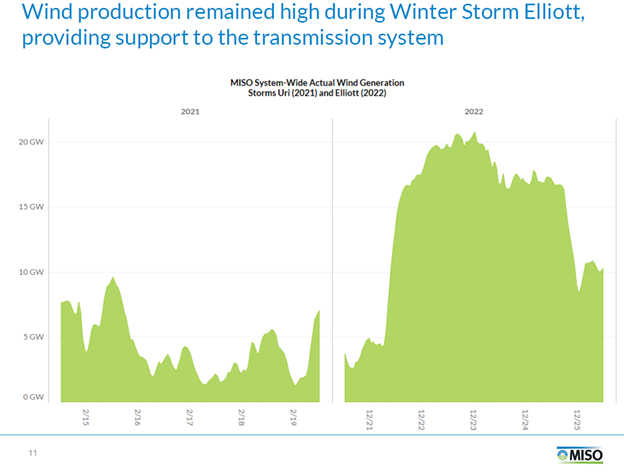

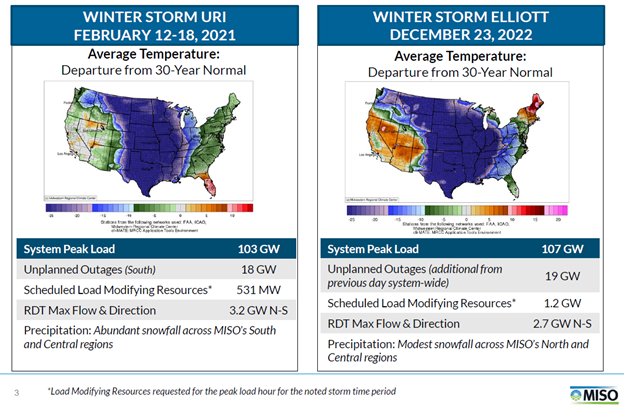

Meanwhile, at the time, I commented that the MISO got lucky because it was windy up here with blizzard conditions. Interstate highways were closed, and thus the MISO averted outages by luck as reported by MISO. See below in one chart, December’s Elliot versus February 2021’s Uri.

This winter’s load was 4 GW higher than in February 2021, so we can see how 10 GW of luck saved MISO members.

This winter’s load was 4 GW higher than in February 2021, so we can see how 10 GW of luck saved MISO members.

One Market Failure

One Market Failure

The American Public Power Association states wholesale grid operators cap prices at $1 to $2 per kWh, roughly 20-40X average prices. Especially in energy-only markets, that screams to potential investors in generation to go away by increasing risk for those investors. Furthermore, by some bizarre reasoning, ERCOT decreased its price cap from $9 to $5 per kWh and mandated weatherization of generating assets. Message: mandated increased cost and reduced financial reward. I’ll take two, please. Good grief!

Problem with Capacity Markets

Energy-only markets, which are demonstrably less reliable, say customers in capacity markets may pay for generating assets that are not used. However, a labyrinth of push-pull rules (regulation) exists to manipulate the market toward “competition.” I’ll get into that and other issues in wholesale markets next week.

[1] Regional transmission organizations (RTOs) and Independent System Operators (ISOs) are non-profit companies that dispatch energy resources and operate the markets, among other things.

[2] https://www.publicpower.org/policy/wholesale-electricity-markets-and-regional-transmission-organizations-0

One Market Failure

One Market Failure