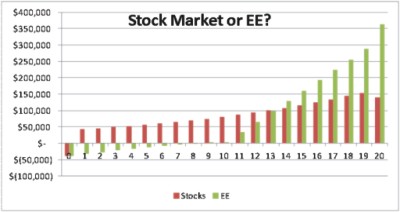

I’m not a casino gambler because I know who wins. I learned long ago that a stock is worth what the next guy will pay for it – nothing more and nothing less. Bad news is good news, and good news is bad. It’s entirely unpredictable. For example: Bureau of Labor Statistics: “Two hundred thousand jobs were added last month, well short of the 500,000 expected increase.” CNBC: “That was a horrible jobs report today!” Stock Market: “Hurray! The Fed won’t raise interest rates,” and the market climbs two percentage points. Commodities have more intrinsic value than securities, and therefore,…

Read More